Most Filipinos need reliable sources of income to support themselves and their family. And most of us got that from freelancing or remote working.

But what happens if your sources of income stopped? Where will you get money when you retire? For self-employed individuals, it might be riskier compared to those in employment. What’s your safety net?

The government can help you ease some of your burden with the Social Security System (SSS).

DISCLAIMER: This article is for informational purposes only. It may be rendered partially or fully obsolete in case any amendments happen to the SSS laws. It’s not intended to be professional advice.

Who Are Eligible

Mandated by Republic Act 8282, the SSS was established to protect Filipinos from disability, sickness, death, and other cases where they are incapable of working anymore.

And it’s not exclusive to private employees only. As a self-employed individual, you can also benefit from SSS. You just have to register voluntarily.

You are eligible if you have the following.

- No employer

- Not over 60 years old

- Derives income at least 2,000 a month

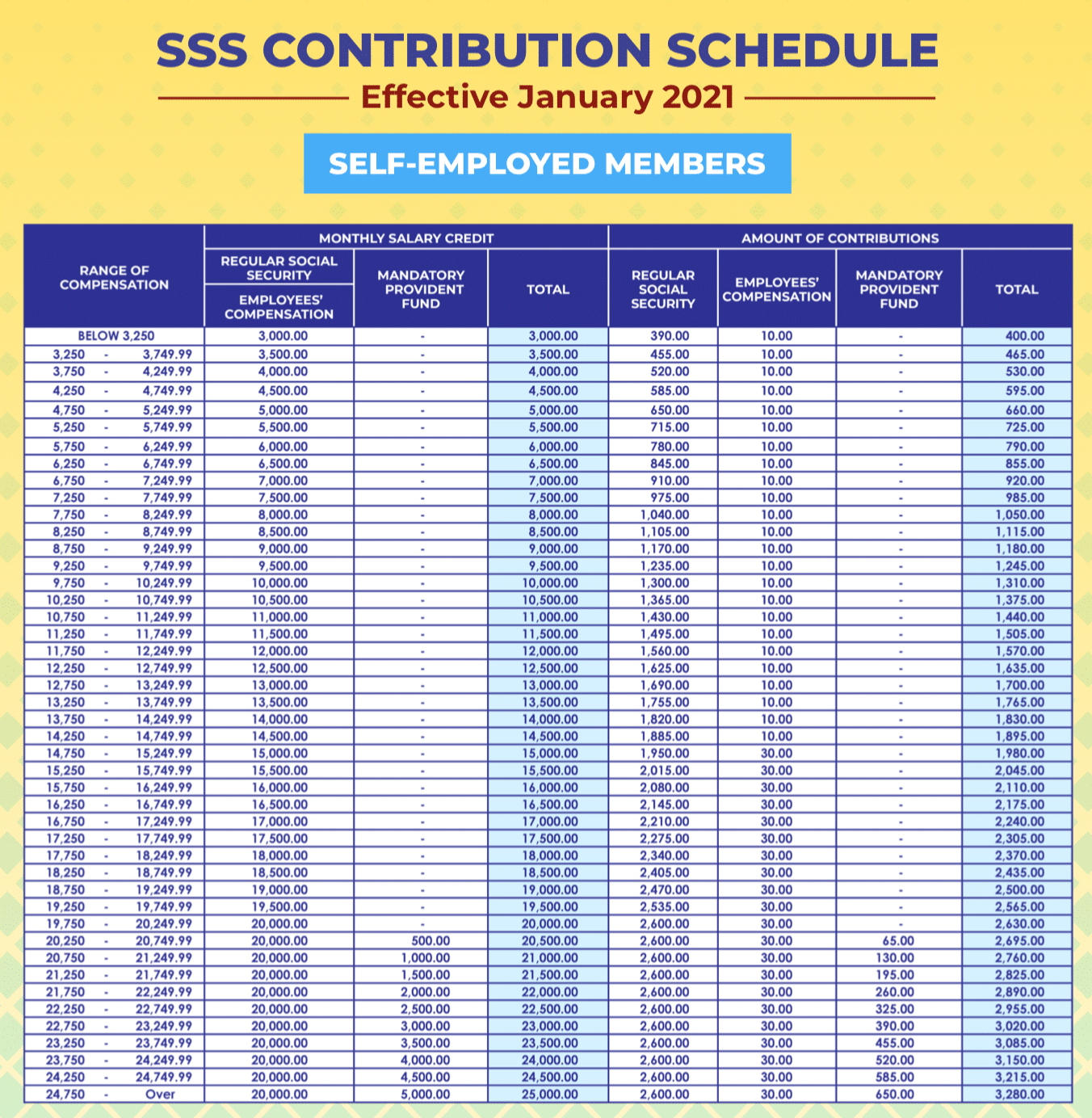

Most of you can get one and start paying right away. Here is the SSS payment table for salary brackets.

Employee Compensation (EC) is the premium you pay for additional benefits from work-related accidents. At the same time, the new Mandatory Provident Fund (MPF) is a portion that will be invested in a managed fund.

Take note that you can change your salary bracket within 1-2 tiers every month.

But what do you actually get from SSS? Here is a comprehensive list of benefits you can get from SSS as a remote worker or freelancer that you didn’t know about.

Short-Term Benefits

Most people know SSS for pension benefits when you retire. But did you know that you can also get a few benefits while you’re still young and paying? Yes! Here are the short-term benefits of SSS.

Sickness Benefits

In our working lives, we will get sick. That’s a fact. But when your budget is tight, you can’t afford to lose that daily income. And even if you can, it’s nice to know that you still earn money regardless. It’s because SSS has a sickness benefit to cover for your income.

The sickness benefit allows you to get a daily cash allowance equivalent to 90% of your Average Daily Salary Credit (ADSC).

Here are the requirements for eligibility.

- At least 4 Days Hospital or House Confinement

- Paid 3 months worth of contribution within the 12-month period immediately preceding the semester of sickness or injury

Documentary Requirements

You can pass a sickness to any SSS branch near you. Here are the requirements:

- Sickness Benefit Application (SBA) Form

- Medical Certificate

- SS ID/UMID card or any valid primary ID cards/documents, as follows:

- Driver’s License

- Passport

- Voter’s ID Card

- National Bureau of Investigation (NBI) Clearance

- Postal Identity Card

- Any other government-issued (secondary) ID cards/documents

- Supporting medical documents for prolonged confinement/sickness, if any:

- Laboratory, X-ray, ECG, and other diagnostic results

- Operating room/clinical record that will support the diagnosis

- Additional documents might be required depending on the sickness.

If the sickness or injury happened abroad, the document should be authenticated by the Philippine consulate/embassy or notarized.

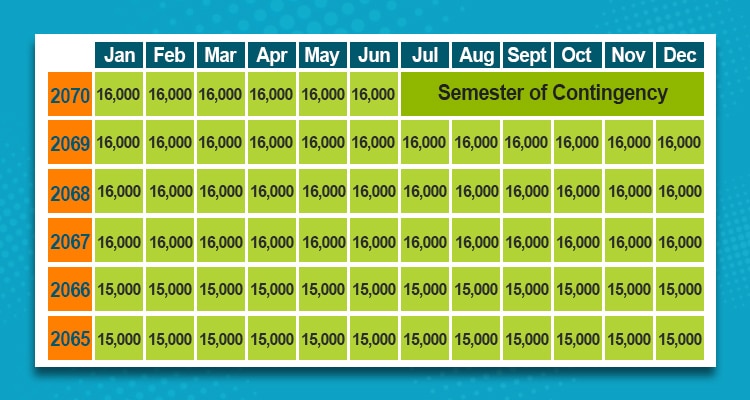

For the contributions, the past payments will also be the basis for your ADSC. It will be the average of the 6 highest contributions, excluding the current semester when you got sick. The excluded semester is called the semester of contingency.

Knowing Your Semester of Contingency

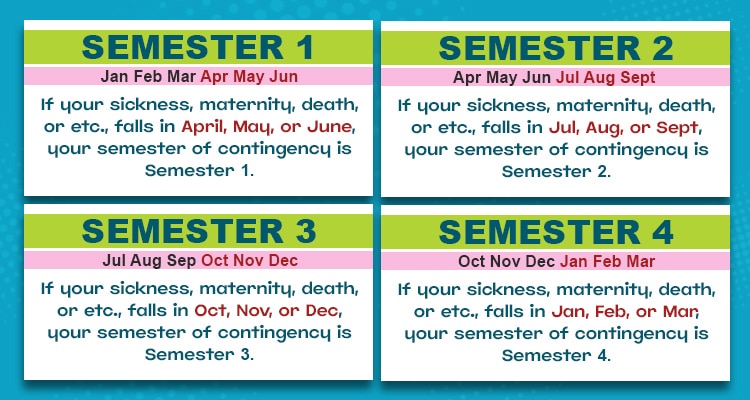

For almost all benefits, you need to know the semester of contingency. A semester of contingency is the quarter something happens (sickness, maternity, etc.) plus the previous quarter.

There are four semesters you may fall into.

Keep this information as it’s used as a basis for your computation for a benefit.

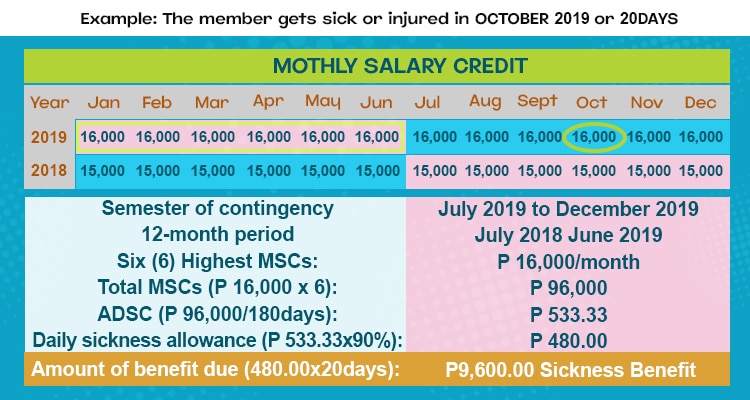

Here’s a sample computation from the SSS website. If you got sick in October 2019, exclude the July to December semester (semester of contingency). And then, look for the highest 6 contributions from July 2018 to June 2019 (the preceding year before the current semester).

You can get a maximum of 120 days cash allowance per year. Take note, though, that you can only be paid up to 240 days on account of the same illness. If the same sickness happens for more than 240 days, it will be considered a disability.

The deadline for filing sickness notification is 5 days after the start of confinement. For hospital confinement, it’s within a year.

But to protect the Filipinos from COVID19, the deadline is extended to 60 days after the end of confinement.

Maternity Benefits

Having a child is a blessing for every family. But then, you need to stop working for a while when you go into labor and to take care of your newborn. How do you earn during those times?

Your livelihood is still protected with the SSS maternity benefits. It grants you a daily cash allowance equivalent to your Average Daily Salary Credit (ADSC) due to childbirth or miscarriage/emergency termination of pregnancy.

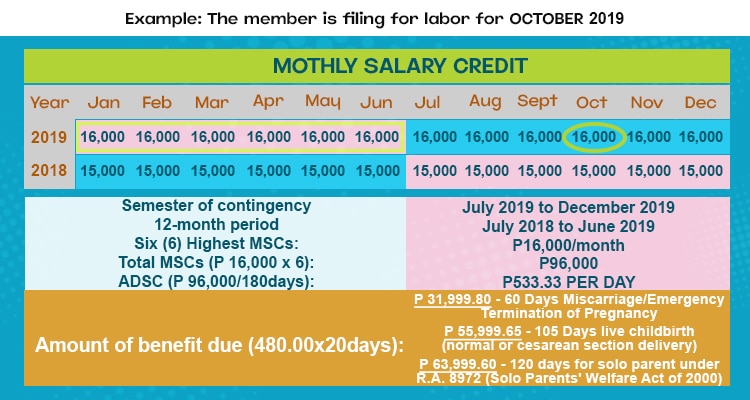

You just need to pay at least three (3) months of contributions within the 12-month period immediately before the semester of her childbirth or miscarriage/emergency termination of pregnancy. Here are the benefits.

- 60 Days Miscarriage/ Emergency Termination of Pregnancy

- 105 Days* live childbirth (normal or cesarean section delivery)

- 120 Days* for solo parents under R.A. 8972 (Solo Parents’ Welfare Act of 2000). This represents 105 Days + 15 Days extra to tend for recovery.

*The 7 days are transferable to the child’s father or alternate caregiver.

If you’re qualified, you need to pass some documents.

- Maternity Notification at least 60 days from date of conception.

- Maternity Reimbursement after pregnancy.

Here’s one example. Let’s say you are filing for labor for October 2019. Exclude the semester of contingency, which is July 2019 to Dec 2019. And then, pick the highest 6 highest contributions within the year preceding the semester of contingency.

You can check the SSS website for further example computations.

Take note. You can’t claim a sickness benefit within the period you are paid with maternity benefit. As a general rule, no member can be entitled to two benefits for the same period.

Salary Loan

Sometimes, we need to borrow money for unexpected expenses. Or maybe, you want to use it to start a business. You can avail of a salary loan from the SSS.

Why do that when there are banks for personal loans? Well, you can avail for a loan payable in 2 years installment for just 10% per annum plus a 1% service fee! That’s just roughly 0.46% per month! That’s pretty low compared to other options.

Here are the eligibility requirements from the SSS website.

- The member-borrower must be updated in the payment of contributions.

- The member-borrower has not been granted the final benefit, i.e., total permanent disability, retirement, and death

- The member-borrower must be under sixty-five (65) years of age at the time of application

- The member-borrower has not been disqualified due to fraud committed against the SSS.

Your salary loan is equivalent to:

- Average of the member-borrower’s latest posted 12 Monthly Salary Credits (MSCs), or amount applied for, whichever is lower.

- You need at least 36 months’ contribution, 6 of which lasted 12 months prior to the month of application.

- Twice the average of the member-borrower’s latest posted 12 MSCs, rounded to the next higher monthly salary credit, or amount applied for, whichever is lower.

- You need at least 72 months’ contribution, 6 of which lasted 12 months prior to the month of application.

You will get the net amount of the loan minus any outstanding balances if you have other loans from SSS. This rule is relevant when you want to apply for a loan renewal. You can do this when you have paid 50% of the original amount and 50% of the period has passed.

Again, this is payable within 24 monthly installments starting from the 2nd month following the date of the loan.

Documentary Requirements

- Member Loan Application Form

- SSS digitized ID or E-6 (acknowledgement stub)

- Two valid IDs, one of which with a recent photo. Here’s a list of valid IDs you can use.

Long-term Benefits

Now, let’s discuss the long-term benefits of contributing to your SSS. And there are plenty!

Disability Benefits

Other than pension benefits when you retire, you can get an earlier pension when something happens to you. It protects your livelihood just in case you can’t work anymore because of a disability. Here are the eligibility requirements.

- At least 1 month’s contribution before the semester of disability.

- At least 36 months contribution for monthly disability pension

- If below 36 months, you will receive a lump sum amount.

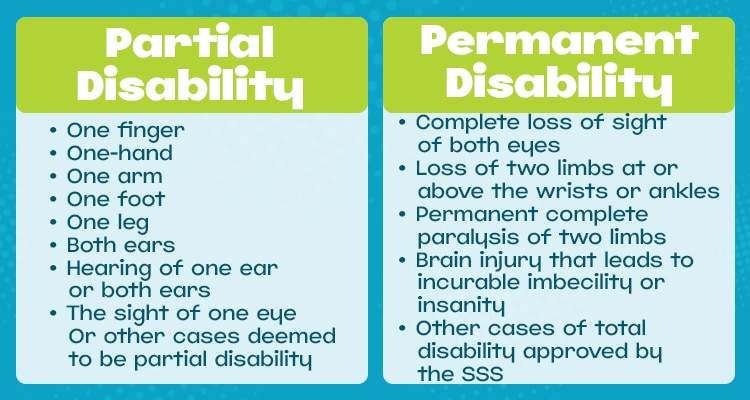

Based on the guidelines, the amount of benefit varies. And it also depends if you’re partially or permanently disabled. Here’s a list of what’s considered a partial or permanent disability.

The general rule is, you can still work when you have a partial disability. With permanent, most can’t anymore.

Partial Disability

- One finger

- One-hand

- One arm

- One foot

- One leg

- Both ears

- Hearing of one ear or both ears

- The sight of one eye

- Or other cases deemed to be a partial disability

Permanent Disability

- Complete loss of sight of both eyes

- Loss of two limbs at or above the wrists or ankles

- Permanent complete paralysis of two limbs

- Brain injury that leads to incurable imbecility or insanity

- Other cases of total disability approved by the SSS

With that, here’s how to compute the disability benefit.

Monthly Pension Benefits

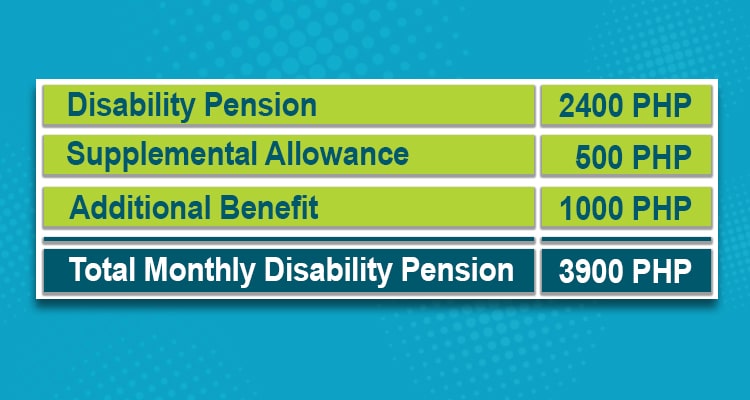

For permanently disabled members with above 36 months contribution, you are entitled to monthly pension benefits.

The member is given a monthly pension depending on the credited years paid plus a 500 PHP monthly supplemental allowance. You also get an additional monthly benefit of 1,000 PHP

The minimum monthly benefit amounts are:

- P1,000 if the member has less than ten (10) credited years of service (CYS);

- P1,200 if with at least ten (10) CYS

- P2,400 if with at least twenty (20) CYS

So, for example, you paid for your SSS for 20 years, and you got into an accident that led to permanent disability. You will get:

But it’s important to note that the pension stops when:

- Recovery from total permanent disability

- Resumption of employment

- Failure to report for the annual physical examination when notified by the SSS

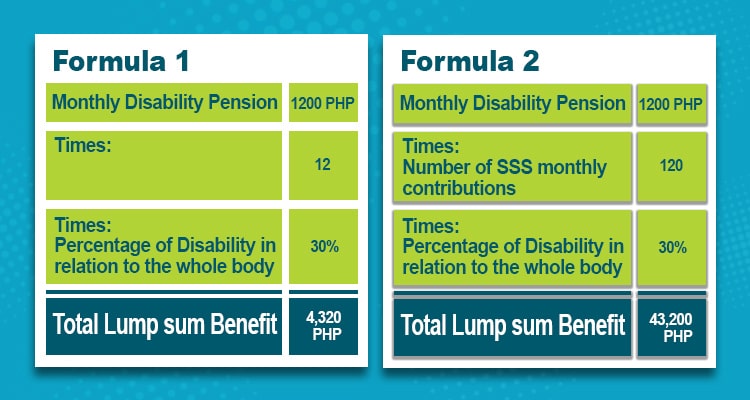

Lump Sum Benefit – Partial Disability

For partial disability or permanent disability with contributions below 36 months, you are still entitled a lump sum benefit, depending on your condition. Here’s what you can get.

For partial disability, there are two formulas to base your benefit on.

- Monthly Disability Pension x number of SSS monthly contributions x percentage of disability in relation to the whole body*

- Monthly Disability Pension x 12 x percentage of disability in relation to the whole body*

*Percentage of disability will be determined by SSS

The minimum monthly benefit amounts are as follows.

- P1,000 if the member has less than ten (10) credited years of service (CYS);

- P1,200 if with at least ten (10) CYS

- P2,400 if with at least twenty (20) CYS

For example, the SSS determined that your partial disability is around 30%. Your CYS is 10 years, and you never missed any payments from then (10 years equals 120 contributions if paid religiously). They will compute the higher of the two formulas.

You will get 43,200 PHP for your lump sum benefit. Take note; even if your contributions surpass the 36 months, you will only be given a lump sum amount since it’s a partial disability.

Only permanent disabilities will be given a monthly pension if monthly contributions are over 36 months.

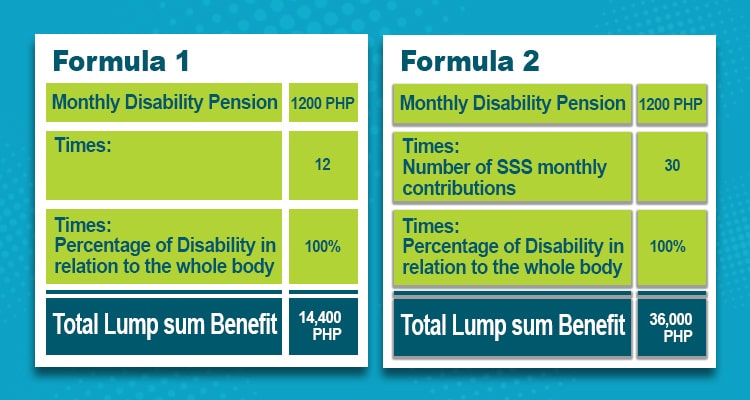

Lump Sum Benefit – Permanent Disability

As for lump sum benefits for the permanently disabled, the computation is pretty similar. The difference is the SSS takes it as 100% disability for computation purposes.

For example, you are permanently disabled with less than 36 months’ payment. Let’s say you missed some payments because of employment transitions. And you only paid around 30 months only. Here’s your computation.

With this, you will be paid 36,000 PHP because it’s the higher of the two.

Disability Pension for Dependents

With the loss of your working income, how can you support your dependents? With SSS, you can have a small cash portion allotted to your family members. You are eligible for pension for up to 5 children below 21 (conceived on or before disability).

The amount you will receive is 10% of your monthly pension or P250 PHP, whichever is higher.

Documentary Requirements for Disability Benefits

- Disability Claim Application

- Medical Certificate

- Either your UMID, SSS biometrics ID card, or two (2) other valid IDs, both with signature and at least one (1) with photo and date of birth.

- Supporting medical documents to support disability claim like:

- Laboratory, X-ray, ECG, and other diagnostic results

- Operating room/clinical record that will support the diagnosis

- Additional documents might be required depending on the sickness.

For Monthly Pension with Dependent Children

- Certified true copy of marriage certificate registered with LCR/NSO

- Certified true copy of the birth certificate of legitimate or legitimated dependent children

- Legal adoption papers for legally adopted children (date of adoption must be prior to the date of the disability)

- Any proof of filiation for illegitimate dependent children

- Claim for Dependent’s Allowance (SS Form BPN-106)

Retirement Benefits

Now, for the best part, SSS offers social security when you retire. It will give you a certain amount for all your efforts. And it might be a good additional income source when you can’t work anymore.

There are two ways to get your retirement benefit, either lump sum or monthly pension. Here are the requirements.

- 60 Years Old and Above

- Minimum 36 Monthly Contributions for Lump Sum

- Minimum 120 Monthly Contribution for Monthly Pension

You can apply for the SSS payment when you reach 60 years old (for optional) or 65 years old (mandatory). But for both, the computation will depend on the number of monthly contributions you made.

Computation for Lump Sum

If, for some reason, you can’t pay the required 120 contributions for a lifetime monthly pension. You can opt for a lump sum amount to be received. This will be equal to all your contributions paid plus interest and earning of your money.

It will be computed by SSS for you. But take note; you can opt to pay after 65 years old to finish the required 120 contributions. In this way, you can receive lifetime contributions instead of just one lump sum.

Computation for Monthly Pension

When you finish the 120 contributions, congratulations! The SSS will give you a lifetime pension upon retirement. You will receive a monthly pension for as long as you live.

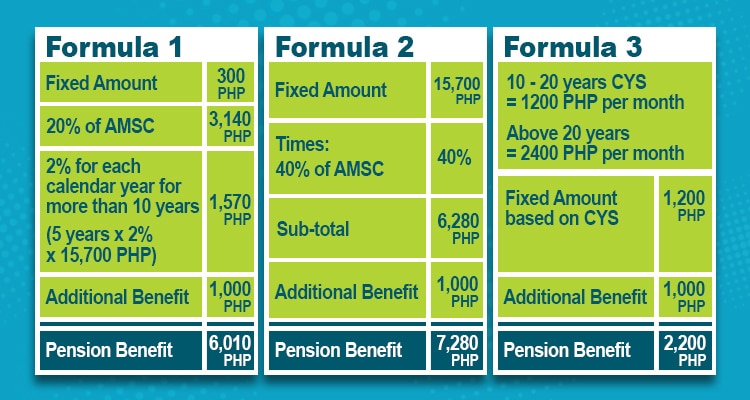

The monthly pension will be computed with the higher of three formulas.

- Formula 1: 300 PHP + 20% AMSC* + 2% of AMSC for each calendar year more than 10 years

- Formula 2: 40% AMSC

- Formula 3: 1200 PHP IF CYS** between 10-20 years; 2400 PHP If CYS more than 20 years

*AMSC = Average Monthly Salary Credit

**CYS = Credited Years of Service

And the pension will be increased by 1,000 PHP.

Computing the Average Monthly Salary Credit

An important figure for the computation is your average monthly salary credit. So what’s the average monthly salary credit?

According to Section 8 of the Social Security Act of 2018, the average monthly salary credit is the sum of the last 60 monthly salary credits immediately preceding the semester of contingency divided by 60.

So if you will retire on October 2070, you will compute it

You will get the sum of your monthly salary credit starting after the semester of contingency. In this case, October 2027 belongs to the July 2070 to December 2070 semester of contingency.

So you will add the 60 payments from June 2070 to July 2065 and then divide it by 60. In this case, it’s 15,700 PHP (P 942,000 / 60).

Computing Your Monthly Pension

Now to compute the monthly pension, let’s use the three formulas above, 15,700 PHP as the AMSC, and 15 years as the years of service you rendered.

Given the result of the three formulas, you will receive 7,280 PHP of pension every month because it’s the highest of the three.

The SSS will compute this for you. If you want an estimate of your possible pension, you can check out this SSS retirement calculator for an estimated amount you will get per month.

Receiving Your Pension

Now that you have your pension, how can you receive it? Right now, you can nominate a bank account for SSS to directly transfer your money. For lump sum, you will get the whole amount for those who didn’t complete the 120 minimum contributions.

As for those above 120 contributions, you will get the following.

- A lump sum of 18 months worth of monthly pension for the 1st payment.

- A monthly pension payment starting the 19th month.

Right now, you can opt to apply online for your retirement benefit for a few simple steps above.

Pension Loan Program

On top of the pension benefit, you can also apply for a pension loan. A pension loan will be equal to up to 6 times your pension with a maximum of 200,000 PHP.

The loan is similar to a salary loan where you are charged a 10% interest payable in 24 months.

Funeral Benefits

A lot of families aren’t prepared for the death of their loved ones. It’s emotionally heartbreaking. And there’s a sudden financial burden. SSS can help you ease your financial needs with your funeral benefit.

With the funeral benefit, your loved ones will be reimbursed for a minimum of 20,000 PHP to a maximum of 40,000 PHP based on the OR. It will be reimbursed to the payee listed on the OR.

For eligibility, you just need a 1 month contribution.

Death Benefit

When you die, your dependents will lose support from you. How can you ease their burden? One way is from your death pension from SSS. Your loved ones will have a cash benefit when something happens to you.

The first order of priority is your primary dependents down to your legal heirs. And depending on your payments and their classification, they can get either a lump sum or monthly pension benefit.

Here is the list of primary and secondary beneficiaries.

- Primary

- Dependent legal spouse

- The legal spouse should remain faithful until the end to maintain the pension. Meaning, if the widow or widower remarries, the pension stops.

- Dependent legal spouse

- By order of priority, five minor children starting from the youngest. They should not be over 21 years old unless they have a mental disability.

- Legitimate children

- Legitimated children or children conceived before marriage, but the parents married afterwards

- Legally adopted

- Illegitimate child

Computation for Monthly Death Pension for Primary Beneficiaries

The computation of the benefit will depend on your credit years of service and your number of contributions. If you paid 36 months worth of contributions above, the computation is as follows.

The amount your dependents would get is pretty similar to what you will get for a disability benefit.

- P1,000 if the member has less than ten (10) credited years of service (CYS);

- P1,200 if with at least ten (10) CYS

- P2,400 if with at least twenty (20) CYS

Plus P1,000 additional benefit, effective January 2017. Every December, your dependents will also receive a 13th-month pension.

For your legal spouse, if they have dependent minor children, they will also be given 10% of the monthly pension or P250, whichever is higher.

Only 5 minor children are entitled to the dependent’s pension beginning from the youngest.

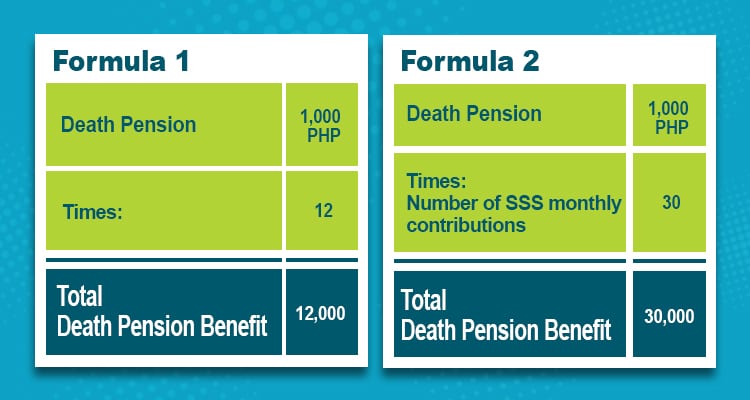

Computation for Lump Sum Death Benefit for Primary Beneficiaries

If you paid below 36 months contribution, you will receive a lump sum amount computed with the highest of the two formulas.

- Monthly pension x Number of contributions

- Monthly pension x 12

For example, let’s say you only paid 30 contributions. Here is the computation.

Based on this scenario, your primary beneficiary will get 30,000 PHP because it’s the higher between the two.

Computation for Lump Sum Death Benefit for Secondary Beneficiaries

If there are no primary beneficiaries, SSS will look for the secondary beneficiaries listed below in order of priority.

- Secondary – parents of the deceased member

- Designated on the member’s registration (E1 or E4)*

- Legal Heirs by virtue of the family code.

*You can register your children on your SSS E1 or E4 so that even if they are above 21 years old, they are still in line for your pension benefit.

Note that the secondary beneficiaries will only get a lump sum amount even if you paid above 36 months’ contributions. The maximum lump sum amount is equal to 36 months worth of contributions.

The computation is the same as the lump sum example for primary beneficiaries.

Additional Benefit for Retiree Pensioners

If you’re a retiree pensioner, you have an additional benefit. Your primary beneficiaries are entitled to 100% of your monthly pension. So your pension would be transferred to them just in case.

What about your secondary beneficiaries if you don’t have primary ones? For retiree pensioners who died within 60 months from the start of the monthly pension, your secondary beneficiaries can get a lump sum amount.

It will be the remaining unclaimed monthly pension for the 5-year guaranteed period.

So, for example, you died and just claimed around 21 months’ worth of pension. You still have 39 months unclaimed from the guarantee because of the 5 year guarantee.

Your secondary beneficiaries will get the 39 months’ worth of pension received on a lump sum basis.

Documentary Requirements

You also need additional documents, depending on your category.

Documents for Primary Beneficiaries:

- Death Certificate of Deceased Member

- Marriage Certificate of Deceased Member

- Birth/Baptismal Certificate of Dependent Children

Documents for Secondary Beneficiaries:

- Marriage Certificate of Parents

- Birth certificate of Deceased Member

- Death Certificate of Deceased Member

- Certificate of No Marriage Record of Deceased Member

Documents for Designated Beneficiaries:

- Birth Certificate of the claimant

- Marriage certificate of the claimant if the claimant is a married female (PSA copy or certified true copy issued by Local Civil Registrar )

- Birth certificate of the deceased member

- Certificate of No Marriage Record of Deceased Member (if single)

- Death Certificate of member’s spouse (if the member is a widow/widower)

- Death Certificate of member’s parents (if single)

Documents for Legal Heirs Beneficiaries:

- Birth Certificate of the claimant

- Marriage certificate of the claimant if the claimant is a married female (PSA copy or certified true copy issued by Local Civil Registrar )

- Birth certificate of the deceased member

- Certificate of No Marriage Record of Deceased Member (if single)

- Death Certificate of member’s spouse (if the member is a widow/widower)

- Death Certificate of member’s parents (if single)

- Death Certificate of other deceased legal heirs (to equally divide benefits to living heirs only)

Monthly Provident Fund

As you can see with the above computations, your monthly pension might not be enough to cover your expenses when you retire, especially with inflation. So if you don’t have other sources of income, you will be forced to lower your lifestyle.

That’s why SSS provided another vehicle to help you in your retirement. It’s called the Monthly Provident Fund (MPF).

The MPF is an investment pool that will be comprised of

- 15% government debt (such as treasury bills and government bonds)

- 20% multilateral institutions and equities

- 25% loans to MPF members

- 40% money market or other approved investments

The management fee will be at 1% per annum, but all investment returns are tax-free.

Upon retirement, it will be part of your monthly pension computed as the account balance divided 180. Meaning, your balance will be payable monthly in 15 years. But upon death, the remaining balance will be given to the designated beneficiaries in lump sum.

Employees Compensation Benefits

On top of all the benefits listed above, you also have a separate benefit for any emergencies, sickness, or disabilities happening because of your work. It’s through the Employees Compensation Benefits or the EC.

You can avail of the EC with your SSS benefits together when both are qualified. So for certain cases (like sickness or funeral), you can have 2 benefits given to you.

By virtue of Board Resolution 19-03-5 (March 6, 2019), the EC will cost the following amount on top of your contributions.

- 10 PHP/month for salaries below 15,000

- 30 PHP/month for salaries above 15,000

Think of it as additional social security for as low as 10 PHP per month. With this, you can avail the following as long as the medical needs are work-related. (e.g., you are injured while in the office.)

Income Benefits

For the income benefits, you will have similar benefits with your SSS, namely:

- Sickness Benefit

- Disability Benefit

- Funeral Benefit

- Death Benefit

EC Sickness Benefit

The EC sickness benefit is pretty similar to the regular sickness benefit. The difference is, it should be work-related sickness. You only need at least 1 contribution to qualify.

The amount you will get is 90% of the average daily salary, but not less than 110 PHP and not more than 480 PHP. Computation is the same with the SSS Sickness benefit above.

EC Disability Benefit

You can also get a disability benefit when your disability is caused by work. Again, this is on top of the claims you can get from the SSS benefit. There are two kinds, total disability and partial disability. Compared to the SSS benefit, you only need one contribution to qualify.

The SSS will compute your disability benefit for you. But for reference, the amount you will get:

- Depends on your contribution for years of membership.

- Plus additional benefit of 1,150 PHP,

- Plus 1,000 PHP supplemental/carer’s allowance, and

- A 13th-month pay

- Dependent pension for up to 5 dependent minor children equivalent to 10% of monthly pension. No substitution.

- The pension should not be lower than 2,000 PHP.

EC Funeral Benefit

You can also get funeral benefits from the EC. You just need 1 contribution to qualify.

The eligibility is similar to the one you get on your SSS benefit. The difference is, you can claim this funeral benefit if the death is work-related.

30,000 PHP will be given to the one who paid for the funeral expenses.

EC Death Benefit

For work-related deaths, your beneficiaries will also get a death pension similar to the ones from SSS. The SSS will compute the exact value. But for your information, here’s what comprises the amount received.

- Monthly Pension plus 15% difference

- Additional Benefit of 1,150 PHP

- Dependent pension for up to 5 dependent minor children equivalent to 10% of monthly pension. No substitution.

- The benefit should not be lower than 2,000 PHP.

Your beneficiaries can file the death benefit from the date of your death.

Medical Services, Appliances, and Supplies

- Reimbursement cost of medicine

- Payment to providers medical care, hospital care, surgical expenses

- Cost of appliances and supplies

- Ward services during confinement

EC Kagabay Rehabilitation Program

On top of the cash benefits and medical assistance, the EC benefits give a chance to occupationally disabled members to still have a livelihood through the EC Kagabay program. The Kagabay program aims to give:

- Physical restoration

- Skills training subject to their capacity

- Entrepreneurial training

With the EC Kagabay program, you have a chance to live a normal life with sustainable income when done right.

Filing of EC Claims

Filing of EC Claims

All EC claims should be filed within 3 years.

For Temporary Disability/Sickness:

- For home confinement, you can file from the start of the sickness or injury.

- For hospital confinement, you can file from:

- Date of hospital discharge

- For multiple confinements, within 3 years from the last date of hospital confinement

But if you have a sickness claim you got from SSS back then, you can still file for the sickness benefit in EC even after 3 years if proven that the sickness from back then is work-related.

For Permanent Total and Partial Disability

- From the Date of Incident/Contingency

For Death Benefit

- From the Date of Death

For the required documents, check this list per benefit.

Conclusion

Paying for your SSS is not just an expense. It’s an investment that can help you with your expenses just in case something happens. Let’s take advantage of these benefits for our social security. Cheers!

Filing of EC Claims

Filing of EC Claims