Are you prepared for retirement? There will come a point when we’re too old to keep working and will just want to enjoy our remaining years.

So where do we get the money for our living expenses by then? Most of the time, your SSS pension won’t be enough.

Thus, you should put aside money for a retirement fund just in case.

How Much Do I Need to Retire?

Your retirement goals will depend on your projected lifestyle. The benchmark is to have ten times your annual salary invested in a retirement fund earning 5% after taxes.

According to Investopedia, this can last you around 30 years of living expenses – as long as you only withdraw 4% annually and have a similar lifestyle today.

For example, let’s say you’re earning PHP 30,000 per month. That’s PHP 360,000 times 10 or a PHP 3.6 Million target retirement fund.

Using the formula above, you can only spend P144,000 a year or PHP 12,000 a month (3.6M times 4% divided by 12) from this retirement fund to stay afloat.

What if you want a more comfortable lifestyle? Let’s say PHP 50,000 a month.

Just divide 12 times that amount by 4%. This will give you PHP 15,000,000.

(Note: this assumes that you don’t have other sources of income other than the interest and capital gains of your retirement fund.

So this amount can be lower if you have other sources of income like rental properties, business income, affiliate income, etc.)

When Should You Start Saving?

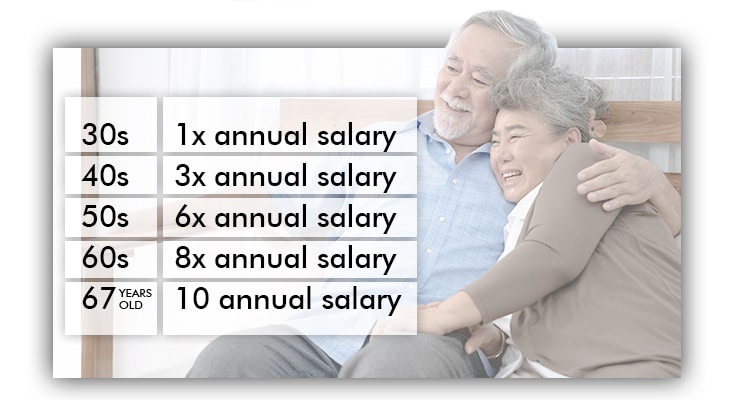

Based on the same article by Investopedia, you can target saving around 15 to 25% of your income to reach the following milestones per decade.

So when’s the best time to start saving for retirement? Unfortunately, it was yesterday.

Today is the second best time.

However, how can you build a retirement fund if you don’t have a steady remote working job?

Worry not! Here are 5 tips to help you build your retirement fund as a remote worker.

Follow a Budget

The first step is to follow a budget. There are a lot of templates available out there.

For most workers with fluctuating monthly incomes, you can try the financial jars method.

This method allocates your income into money jars with different purposes. Here’s a sample allocation:

- 55% Necessities (food, rent, utilities, insurance, debt repayments, etc.)

- 10% Financial Freedom Account (money for investments that you grow and don’t touch)

- 10% Long-term savings for spending (savings for big-ticket items like a car or trip abroad)

- 10% Education (seminars, online classes, etc.)

- 10% Play (budget for leisure or anything you want to spend on)

- 5% Give (charity, gifts to friends, donations, etc.)

You can customize the percentages depending on your needs, and allocate a part of your income to your retirement fund.

This way, you can still budget your income during the lean months.

Open a Separate Savings and Investments Fund for Your Retirement

It’s good practice to separate your retirement money from the rest of your expenses.

This prevents you from accidentally dipping into your nest egg. It’ll also be easier to track how much you’ve accumulated -and how much you still need to save up.

You may also want to consider opening a PERA account for additional investment and tax perks.

Build Your Emergency Funds

Before creating your retirement fund, you should build an emergency fund first.

Most people are just one emergency away from wiping out their savings and investments. Building an emergency fund gives you a cushion for those unfortunate events.

For example, let’s say you have a medical emergency. You use your emergency funds to pay for the ensuing expenses.

This allows you to deal with emergencies without compromising your retirement fund.

Here are some tips to build an emergency fund as a remote worker.

Avail of Life and Health Insurance

Sometimes, your emergency fund can’t cover all urgent and unexpected expenses.

Fortunately, the right life and health insurance can cover significant medical expenses – and could temporarily replace your income when you can’t work.

They also provide peace of mind during grave emergencies and enable you to keep to your retirement savings plan.

Get a Stable Remote Working Job

Some remote working jobs are seasonal or project-based. When you have a lot of projects, it’s easy to budget your money.

On the other hand, where will you get income from if you have no clients?

It’s time to secure a stable remote job by partnering with reputable companies like Remote Staff.

Remote Staff offers long-term online jobs for Filipinos.

Moreover, we’ll match you with a new client just in case your current one abruptly terminates your contract.

Take the first step to a more stable and rewarding remote working career by signing up today!