When it comes to budgeting, you will often come across the words “track your expenses.”

However, what does it mean exactly?

One quick Google search will give you a thousand ideas. It can get overwhelming.

To make this a little easier, we are giving you a rundown on how to use a spreadsheet to track expenses.

Decide How Long You Want to Track Your Expenses

First, determine the length of time you want to track. For example, you may be thinking about tracking your daily, weekly, or monthly expenses.

However, if you are just starting your budgeting journey, it’s best to start small.

Record your daily spending first. By then, you might notice a pattern as to where your money is going. Afterward, you can begin your weekly tracking.

When you finally get the hang of it, you can start tracking your monthly expenses. This way, you will understand your spending habits better.

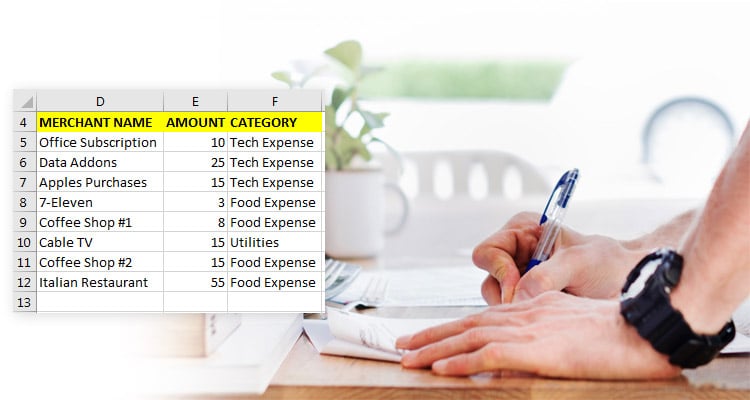

Categorize Your Expenses

You now have a bunch of your expenses listed. What do you do with them?

Answer: put them in categories.

Categorizing your expenses can determine which of those are your needs, wants, and savings. These three classifications are extremely important when you are making a budget.

Assess and Then Revamp Your Spending Habits

When people track their spending, their goal is to usually save money.

As such, now that you have recorded your expenditures, evaluate each one.

Which of your expenses are unnecessary?

Take note of them so you can stop making such a purchase.

Once you form good spending habits, your savings will build over time.

Pro tip: cutting back on “unnecessary” spending often means reducing some of your wants. (That’s why they are called “wants” and not “needs.” They are not essential for survival.)

Finally! How Do You Use a Spreadsheet to Track Expenses?

While there are tons of expense tracker apps on the market, you may be one of those who prefer an old-school approach.

Thus, here is a quick guide on how you can create your personal expense tracker.

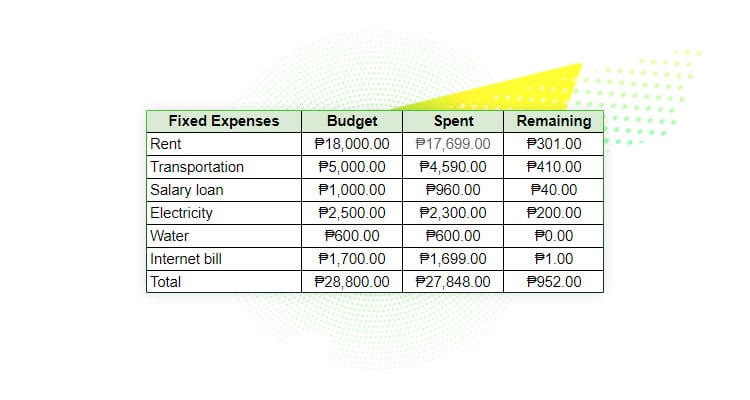

Option 1

On your spreadsheet, start by making one column each for fixed expenses, budget, spent, and remaining.

Some examples of fixed expenses include rent (or mortgage), car maintenance (or transportation), loans, and utilities.

However, for your utilities, it’s best to specify each expense separately, like electricity, water, and the Internet.

It is a fairly straightforward way to track your spending. This option also makes it easy to spot which categories you typically overspend.

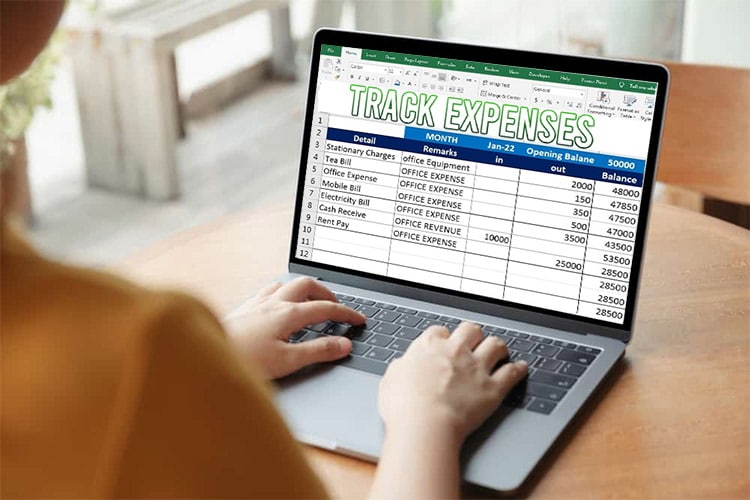

Option 2

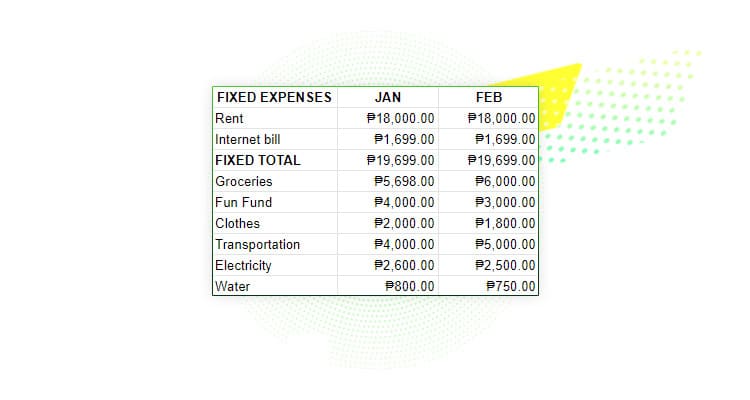

This next option is a bit more elaborate as it will involve a few tabs on your spreadsheet.

Each tab will represent a year. (You can simply copy your formulas into the upcoming year.)

The columns will denote a month.

Start by writing down all your fixed expenses in January, for instance. When you get the total for these categories, you would know this is the minimum amount you need to live.

Start by writing down all your fixed expenses in January, for instance. When you get the total for these categories, you would know this is the minimum amount you need to live.

However, take note that this money does not include your food and utilities just yet.

The next step is to add categories as you see fit:

Once everything is laid out, and you notice that the total expenditures exceed your net income, then is time for you to make a few lifestyle changes.

Tracking Your Expenses Does Not Have to be Stressful.

Seeing numbers pile up can be anxiety-inducing, especially when you keep track of your expenses for the first time.

Still, don’t obsess over it. Over time, tracking your spending will feel like second nature.

And instead of feeling overwhelmed and anxious, you might even feel relieved knowing that everything is in place.

As such, you may be looking to cut down on some of your spendings. Perhaps, you might want to work from home to save on travel expenses. If that’s the case, check out Remote Staff’s job listings.

Remote Staff has been in the industry for 15 years and has provided countless Filipino remote workers with work-from-home opportunities. Want to work from the comforts of your home? Register today!