Remote working has opened a lot of doors for Filipinos. Now, you can earn a decent income online with more time flexibility and location independence.

You also won’t need to spend as much on transportation, clothing, and food.

But with freelancing, income can be unstable.

Sometimes, it can feel like a feast when you have a lot of ongoing projects. But it can also feel like a famine, especially if your services are seasonal.

So what will you do if sudden emergencies happen? How will you pay for your expenses?

This is where an emergency fund comes in.

What’s an Emergency Fund?

Basically, an emergency fund is a financial safety net for unexpected expenses. It can be for a medical emergency. Or in cases where appliances (like your aircon) break down.

If you don’t have money set aside for these, you might end up having to dip into your investments, incurring pre-termination fees. Or worse, fall into debt because you don’t have enough cash onhand.

An emergency fund takes care of these unforeseen expenses.

It also provides peace of mind so that you won’t be caught off-guard when something unexpected happens.

How Much Should You Set Aside for Your Emergency Fund?

On average, it’s recommended to have 3 to 6 months’ worth of expenses stashed in an easily accessible bank account.

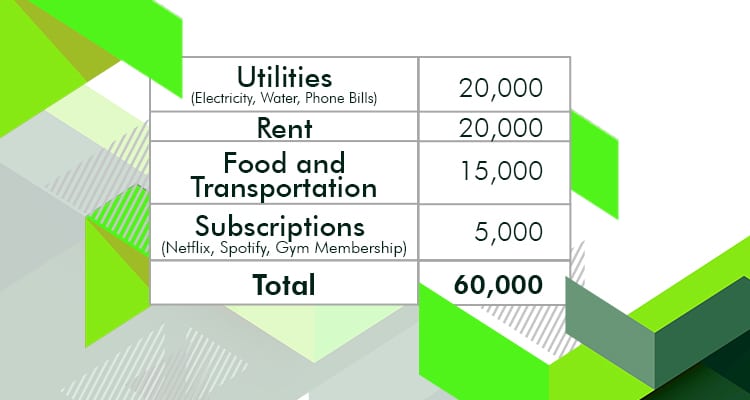

So how do you compute? Let’s start with listing all your expenses.

(Some of your expenses might fluctuate, so just use the average figure to come up with an estimate.)

For example:

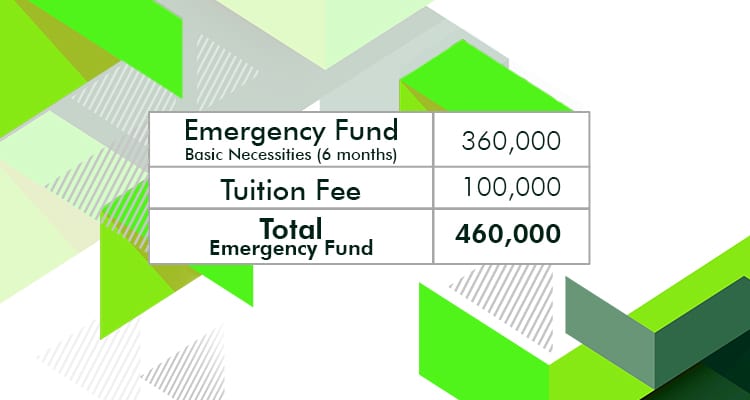

After arriving at the total, just multiply it by 3 to 6 months. This should be the amount you’ll target for your emergency fund.

Take note, this is just the standard amount. So if you want more peace of mind, you can target a higher amount. For example, you can include your child’s yearly tuition fee.

If it gives you more peace of mind, you can save as much as you want so you can include other personal costs in your emergency fund.

But how do you build up such a hefty sum from an irregular freelancing income? Here are some tips.

Follow a Budget and Allocate a Percentage to Your Emergency Fund

If you don’t follow a budget, it’s hard to allocate money for your emergency funds.

There are plenty of budgeting methods. The 6 jars financial management method is one of the most effective and flexible ones for freelancers.

Basically, you allocate a percentage of your income to these “money jars.”

One money jar can be for your emergency fund. Let’s say, about 5% of your income.

If you earn Php 50,000 this month, you deposit Php 2,500 into your emergency fund. If it’s just Php 15,000, then Php 750 goes to that account

Because it’s percentage-based, you can contribute to your emergency fund regardless of your income every month.

Cut Some of Your Expenses

Remember your list of expenses? If you can, you might want to cut down on some.

For example, if you rarely watch movies, you can cancel your Netflix subscription.

You can also find cheaper alternatives for your current expenses. For example, trade in your car for a more gas-efficient vehicle. Or relocate to a more affordable area since you’re working remotely anyway.

You can then allocate the freed-up cash towards your emergency fund.

Allocate Part of Your Windfalls towards Your Emergency Fund

Received a bonus from your clients? Got extra cash from selling some of your unused items?

Try to funnel some of your unexpected income towards your emergency fund. No matter how little, every peso counts.

Find Other Sources of Income

Lastly, you can try to find other sources of income. Maybe, you want to add more clients to fill up your extra time.

You can also try to start a side business that doesn’t require too much capital. Think affiliate marketing, content creation, dropshipping, etc.

With more income, you can build your emergency fund faster.

You can also worry less about having an irregular income when you have multiple sources.

But if you want a more stable online career, you can sign-up through Remote Staff for the best online jobs for Filipinos.

Remote Staff offers long-term remote working contracts in different fields. And should your client terminate your contract, Remote Staff will find you another one.

This way, you can be more stable financially while building your emergency fund.

Sign up today!