For remote workers, registering with the BIR is highly beneficial. You legitimize your practice plus it’s easier to get bank loans and apply for visas.

You can have smoother transactions and broader global opportunities because most foreign clients prefer to work with registered talents.

So how do you register? The first step is to get a TIN ID.

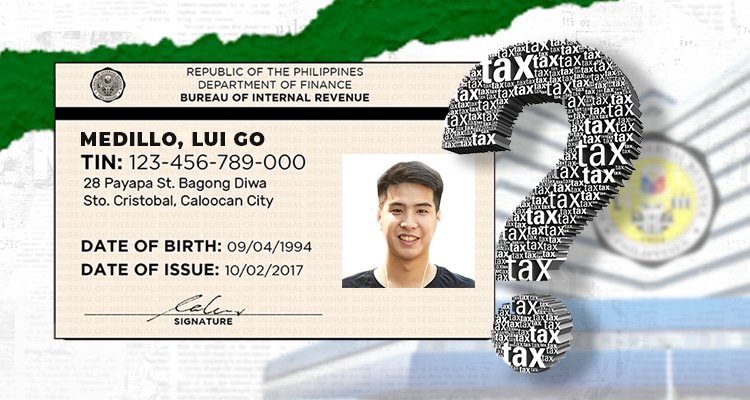

What is a TIN ID?

A Taxpayer Identification Number (TIN) ID is an official card from the Bureau of Internal Revenue (BIR) that is used for tax-related transactions, employment, and other official purposes.

The 9-digit TIN is used by the government to track your tax payments on various income-generating transactions. You can even use it as a valid government ID.

For traditional employees, HR usually registers your TIN ID for you.

Otherwise, here are 4 simple steps to get a TIN ID as a remote worker or freelancer.

Prepare the Following

Before registering, you need to prepare the following requirements.

- Accomplished BIR Form 1904

- 1 Valid ID

- 1 PSA-issued birth certificate

- 1 Community Tax Certificate

- 1 1×1 ID picture

- Marriage contract (for married women)

Note that the TIN ID application is free.

Go to the Your Assigned Revenue District Office

Next, go to the assigned Revenue District Office based on your residence (for the unemployed) or business address. You can only register your TIN ID at the right RDO.

Since remote workers don’t report to a traditional office, they typically register at the RDO nearest to their home address.

You can look up your RDO by calling the customer assistance division hotline at 8538-3200 or emailing contact_us@bir.gov.ph.

Submit the Requirements

The next step is to submit the requirements to the assigned personnel.

You can also ask the officer of the day if you have any questions about the application form or other concerns.

Claim your TIN Card

Usually, you can get your TIN Card on the day of submission.

Once your TIN card is released, you can attach your 1×1 ID picture and laminate it so you can present it as a valid ID.

Take note that this is just the first step of registering your practice. You still need to go through the following steps to register with BIR as a remote worker or freelancer to operate legitimately.

However, before you register, it’s better if you can find an online job first.

Otherwise, you’ll be required to file the tax forms even if you don’t earn any income yet.

However, if you sign up with Remote Staff, we will assist you when you register your remote working practice – on top of the competitive pay and support.

Register today!