Almost everyone wants to earn more money. An article by Time magazine entitled “A Crypto Game Promised to Lift Filipinos Out of Poverty. Here’s What Happened Instead,” showed the dream. Back then, I was a believer. But now, believing in that dream through Axie is parked on the side for the meantime. Here’s my story.

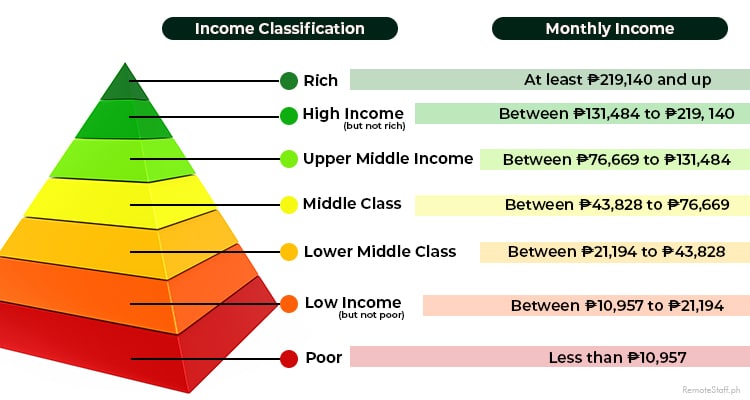

In the Philippines, earning opportunities are quite slim. Based on a study by the Philippine Institute for Development Studies (PIDS), the level of income per Filipino is classified into the following categories.

There’s a great divide in the income opportunities. The average salary of a Filipino is roughly 13,000 PHP a month. In fact, the latest Family Income and Expenditure Survey of the PSA show that 58.4% are in the low-income class. And the remaining 40% falls on the middle class. Only 1.4% are part of the high-income class.

There’s a great divide in the income opportunities. The average salary of a Filipino is roughly 13,000 PHP a month. In fact, the latest Family Income and Expenditure Survey of the PSA show that 58.4% are in the low-income class. And the remaining 40% falls on the middle class. Only 1.4% are part of the high-income class.

And this might even worsen as layoffs happen during the pandemic. Another source of income might be the answer. Undoubtedly, it’s welcomed by most Filipino families. That’s when I tried earning cryptocurrency from play-to-earn games.

What is Play-to-Earn?

I’m not new to playing games. Ever since I was a teenager, I played online games and earned a bit of money from them. If you remember, Ragnarok was a popular MMORPG in the heyday. I would sell some in-game currency called “zeny” in exchange for some pesos. That was quite a black market way to earn some money back then.

So when I learned about Axie Infinity, I was interested because people are buying the in-game currency called “Smooth Love Potion (SLP),” a non-fungible (NFT) token in exchange for fiat currencies. In a nutshell, NFT has value because it carries a unique code stored in a blockchain.

And they can use that on in-game functions like breeding. Or, like Bitcoin, you can keep it as a store of value because of its rareness similar to Gold.

Finally, I’m earning from something you enjoy playing. It was the dream.

The Rise of Axie Infinity

August 2021 was my birthday month. And I thought to myself, why not enter Axie Infinity? At that time, the SLP was pegged around 13 PHP. Down from an all-time high of 20 PHP just the last month.

At that time, Axies were priced at 25,000 PHP – 30,000 PHP each. And you need 3 to play. Not everyone can afford an Axie team. That’s where you can be a scholar under a manager. And split some earnings. I jumped in.

At first, learning the game was hard. There are a lot of mind games and card combinations you need to think about. These cute Axies are not something you just click and earn. I tell you; it’s quite competitive. It’s hard work.

But as a gamer back then, it only took some time before I learned how to play. Lo and behold, I was earning quite a bit of money.

The Axie Economy

There’s a flaw though in the Axie Economy. As more people play the game, more SLP is minted. But it can only be burned by one function, breeding. There came a point where the amount of SLP farmed every day is around 3 times it was burned.

If demand can’t catch up with supply, the price will inevitably go down. Every 15 days, SLP went down. An extra 6000 PHP from playing 2 hours a day isn’t that bad. 2 to 3 months down the road, it was still a liveable amount. So I continued playing.

In this economy, it’s nice to have extra sources when your job can’t afford to give you a raise.

Crypto Bust

The devs tried to fix the economy by limiting the issuance of SLP. They tried halving SLP you can earn from the adventure mode. Events were made to boost the burning mechanisms. They also reduced how much you can get for every battle.

At one point, they took out the default SLP issuance from the adventure mode altogether. Still, it didn’t solve the SLP’s declining prices. It still went down week after week.

With the next events, the Axie team wouldn’t have predicted what was about to happen.

In January 2022, the US announced a rate hike that started the decline of the major cryptocurrencies namely Bitcoin and Ethereum. Investors are selling-off high-risk investments like crypto and stocks. And it caused sharp declines in its prices.

What you have to understand in crypto is that if the major cryptocurrencies suffer price loss, the lower ones will come next. So the sharp decline in Bitcoin caused SLP to follow suit.

No changes in game mechanics and fixes can outprice a total economic downturn. From an all-time high of 20 PHP last 2021, SLP was brought down to its knees at a blistering 0.22 PHP price.

Not to mention, they were hacked with over half a billion dollars worth of assets by the North Korean Group Lazarus.

Despite these turmoils happening, Axie Infinity is one of the strongest crypto games still surviving. But the others have closed down because of the current economic climate.

And it’s still punished because of the economic implications of the war between Russia and Ukraine. The bull is gone. It’s not the year for cryptocurrency.

For the Long Term

Playing the game is not that profitable for both the manager and the player anymore. A lot have quit already. What was once thought of as a solution to earn money and build wealth became quite a burden.

For the players, it’s not even worth their time. 0.22 PHP per SLP is around 300 PHP a month! And for the managers, some of them lost their money or are even in debt. It’s quite a problematic circumstance.

And for those who are still holding these NFTs, if you don’t need the money, might as well just let them stay for a while. Hopefully, there will be a rise again in the coming years.

What You Should Do Instead

So do I regret playing? Not really. It showed me the taste of a possible better future. And the potential is there. But not in today’s economic climate. Maybe in the future years to come.

So what do you do to earn money? First of all, NFTs are high-risk assets. You earn big from them when the market is rising. And its volatility can bring you big losses as well when left unchecked.

So you should not put all your money on it. And it’s even better to have safeguards before investing.

It’s not wrong to invest in volatile assets. But make sure that you have your financial foundations in check. An emergency fund, some savings, and investments in low-risk assets like these simple investment options.

In this way, you won’t be affected that much by their downturns. And you can take greater risks in other high-risk assets moving forward.

And it’s best to have a secure source of income like an online job. When you have multiple income streams, one of them failing won’t cripple your life. You can check out the following remote careers.

Cryptocurrency and play-to-earn is here to stay. But do you risk all your cards to bring you financial freedom? I don’t think so. Better diversify and build a financial foundation first.