Many Filipinos are earning a more stable living thanks to their online jobs.

However, in today’s economy, it’s not enough to rely on one salary alone.

You need to make money work for you as well.

Thus, investing your money wisely can help you grow your wealth and secure your financial future well into retirement.

Here are some general guidelines for personal investing in 2025 you can refer to:

Setting Financial Goals: Building a Solid Foundation

Most Filipinos don’t have clear financial planning, which makes it harder to achieve financial stability and independence.

A strong foundation starts with concrete financial goals. Use this remote worker’s guide in 2025 to help you get started.

Emergency Funds and Budgeting for Freelancers

Most freelancers often grapple with unstable, unpredictable income and irregular work, making them especially vulnerable to financial emergencies.

An emergency fund and a solid budget gives you a safety net and some semblance of financial stability during lean times.

Budgeting involves tracking income and expenses so that you allocate funds for essential needs, discretionary spending, and savings. It can help you make better informed financial decisions so you can manage your work from home finances.

You can check this link for an example of how to establish a budget for your personal investing in 2025.

On the other hand, an emergency fund is a savings account set aside specifically for emergencies. This is money that you will only use for medical bills, car repairs, or in the event of job loss.

It serves as a safety net that allows individuals to survive most major emergencies like the ones outlined above without going into debt, providing peace of mind and financial stability.

Here are some tips to build an emergency fund as a freelancer or remote worker for your personal investing in 2025.

Establishing Short- and Long-Term Goals

Next, set specific short- and long-term financial goals.

They don’t necessarily have to be huge or extravagant, like “make my parents retire” or “buy a mansion” (but feel free to include those if it’s important to you).

What’s important is that these goals should be especially meaningful to you.

For example, you might have a short-term goal of buying a bag you’ve always wanted or taking a well-deserved vacation. Long-term goals could include saving for a home, building a retirement fund, or investing in your child’s education.

By identifying what matters most to you, you can create a plan that keeps you motivated and focused on your financial future.

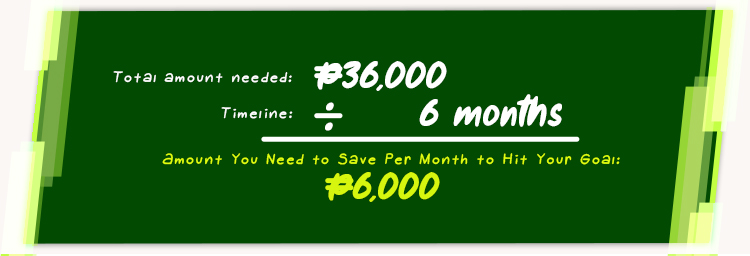

Calculating Your Goals

The next step is to calculate how much money you should be saving each month to achieve those goals.

Take into account your salary, earnings, timeline, and target amount.

Let’s say you have a short-term goal of saving ₱36,000 for a vacation you plan to have in six months.

To calculate how much you need to save each month, divide the total amount by the number of months:

Afterwards, assess your current earning capacity to determine if the resulting goals are doable.

Do you need more income to be able to put aside the required amount each month? Do you need to tighten your spending and/or extend the timeline?

You can also refer to this article to help you draw up SMART goals that are realistic and achievable for your personal investing in 2025.

Investing in Tax-Advantaged Accounts

These can help you grow your money while minimizing tax liability.

Most of these accounts are medium to long-term investments, with a holding period designed to maximize benefits over several years.

Here are some investment strategies in 2025 you can follow.

Retirement Savings Options for Remote Workers

Remote workers have several options for building their retirement funds, even without employer-sponsored plans that typically accompany more traditional forms of employment.

The current benchmark is ten times your annual salary saved in a retirement fund earning 5% after taxes.

Luckily, there are a lot of options today that offer this rate for your remote work investing.

These include investing in tax-free options like the PAG-IBIG MP2, SSS Peso Fund or setting up Personal Equity and Retirement Accounts (PERA) in the Philippines.

For more information, check out these tips to build your retirement savings as a remote worker for your personal investing in 2025.

Building a Passive Income Stream with Dividend Stocks and ETFs

Another option is to build a passive income stream by investing in dividend stocks and Exchange-Traded Funds (ETFs).

Basically, passive income is money earned with little to no effort.

For example, your savings account usually earns a little interest every month on its own.

Similarly, stocks and ETFs can provide passive income through dividends, which are regular payments made to investors from a company’s profits.

The key difference between stocks and ETFs is that stocks give you ownership in one company, so you benefit from its performance, including dividends. However, you have to monitor these individual investments yourself.

ETFs, on the other hand, are collections of stocks or assets managed by professionals, providing more diversification and less risk. However, the income or dividends from these might be smaller from what you can get if you directly own the stocks.

Once you accumulate enough shares over the years, these dividends can add up to a significant amount – possibly enough to fund your needs throughout your retirement.

So what investments are the best for passive income in 2025? You can consider the following passive income ideas.

Choosing Reliable Dividend Stocks and ETFs

There are hundreds of dividend stocks and ETFs out there, so it’s important to do your research. Select those with a stable financial performance and a consistent track record of paying dividends.

Look for companies or funds that have consistently made profits and with a decent potential for growth, as they are more likely to provide steady passive income and become one of your top investments in 2025.

Also, consider your risk appetite—if you’re comfortable with higher risks (or are younger and can thus afford to wait out inevitable downturns), you may also explore speculative investing focused on capital appreciation, where the potential for growth is higher but without the guaranteed income of dividends.

On the other hand, investing in dividend stocks and ETFs is a more conservative approach that provides consistent income, with less emphasis on price appreciation.

For example, in the Philippines, most blue-chip companies (well-established, financially stable companies) regularly pay dividends.

Platforms for Stocks and ETFs

So where can you invest in stocks or ETFs? Here’s an online investment guide for you.

Local Banks

Many local banks offer investment platforms where you can buy stocks and ETFs:

- BPI Trade

- BDO Nomura

- Metrobank Direct

- Security Bank’s SB Equities

- UnionBank Online

GCash

A popular mobile wallet that allows users to invest in stocks and ETFs through its GInvest feature.

Maya

Another digital wallet that offers easy access to stock and ETF investments for users.

COL Financial

A well-known online brokerage platform offering a wide range of stocks, mutual funds, and ETFs for retail investors.

First Metro Securities

First Metro Securities is a full-service online brokerage platform and subsidiary of Metrobank that allows investors to trade stocks, ETFs, and other investment products on the Philippine Stock Exchange (PSE).

Diversifying with Alternative Investments

Aside from the usual bank deposits, ETFs, and stock investments, you can also explore alternative investments to spread risk and enhance returns:

Real Estate Investment Options for Remote Workers

If you have enough put away, consider investing in real estate, like rental properties or pre-selling condominiums for future resale.

You can earn passive income through rental payments or grow your wealth as property values appreciate over time.

However, real estate comes with high upfront costs, ongoing maintenance, and the risk of delayed returns due to market changes or property vacancies.

For a simpler and less risky option, some people turn to Real Estate Investment Trusts (REITs)—companies that own and manage income-generating properties, allowing investors to earn dividends without the challenges of managing physical assets.

While returns may be smaller, REITs offer a more accessible and stable way to invest in real estate.

PAG-IBIG’s MP2 Program

The PAG-IBIG MP2 Program is a voluntary savings plan that offers higher returns than regular savings accounts.

With a minimum investment of ₱500 per month for 5 years, your savings can earn tax-free gains that are typically higher than bank interest rates. Historically, the fund has earned around 4-8%, and during the pandemic, it even achieved a 6.12% yield while most other investments were struggling.

At the end of the 5 years, you can choose to withdraw your savings and interest accrued or continue investing. It’s a low-risk option to grow your savings with consistent returns.

To discover more about the benefits, check this comprehensive list of all the benefits you can get from PAG-IBIG.

Managing Financial Risks and Insurance

Unexpected events like accidents, illnesses, or natural disasters can happen -and can wipe out your hard-earned savings in one go if you aren’t prepared.

One of the best smart money tips in 2025 is to get insurance to provide a safety net during uncertain times.

Here are some types of insurance you should consider.

Health and Disability Insurance for Self-Employed Individuals

Health and disability insurance covers medical expenses and provides a form of income replacement if you’re unable to work due to illness or injury.

It helps ease the financial burden of unexpected health issues, so you can focus on recovery without worrying about medical bills or lost income.

If you have SSS and PhilHealth, they can also help cover some medical expenses and provide disability benefits.

However, for more comprehensive coverage, you may still want to consider private health and disability insurance plans.

You can check out these 4 HMOs to find the right plan that fits your needs and to avail of the coverage necessary for both health and disability protection.

Liability and Professional Insurance for Digital Nomads

One of the best remote work benefits is to travel the world while building a career. However, this lifestyle also comes with risks while abroad.

To safeguard yourself, digital nomads can avail additional travel insurance to cover unexpected events like trip cancellations, lost luggage, or medical emergencies while working abroad.

This protects you from unexpected expenses during your travels, letting you focus on work (or your holiday) without undue stress.

Saving for Retirement as a Digital Nomad

Preparing for retirement can be more challenging for digital nomads due to the lack of employer-sponsored plans, irregular income, and figuring out where to invest on the go.

Here are some practical tips to build a secure retirement plan amidst such challenges:

Choosing the Right Retirement Plan

There’s no single correct way to save for retirement.

For most Filipino digital nomads, the most accessible option would be PH investment accounts with tax-free benefits.

Here are some accounts you can consider in the Philippines for this purpose:

- Personal Equity and Retirement Accounts (PERA) Accounts

- PAG-IBIG MP2

- SSS Peso Fund

Make sure to open an online banking account so you can easily transfer funds from your payroll to these savings accounts.

Meanwhile, if you’re paid through remittances like Moneygram or Western Union, you can redeem the money through digital wallets like GCash and Maya.

The Impact of Foreign Exchange Rates on Long-Term Savings

As a digital nomad, foreign exchange (Forex) rates can affect your savings, especially if you’re earning in one currency and saving/investing in another.

To reduce this risk, you can use a multi-currency account.

For example, if you earn in US dollars but save and invest in Philippine pesos, a multi-currency account lets you hold both currencies and exchange them when the rates are favorable- and not a second too soon.

As of this writing, here are some banks that offer such options:

- BDO

- Metrobank

- UnionBank

- Security Bank

- BPI

FAQS

Let’s go over the most commonly-asked questions when it comes to investments for remote workers.

How can remote workers start investing if they don’t have a lot of savings?

For your personal investing in 2025, start by building an emergency fund first.

Once that’s in place, you can invest small amounts in low-risk options to develop the habit of growing your money, and focus on increasing your earning capacity over time to be able to set aside more for investments.

As you earn more, you can gradually increase your contributions and diversify your portfolio further.

How can I protect my investments from economic downturns as a self-employed worker?

We don’t know what the future holds, but there are ways to minimize the impact of an economic downturn on your personal investing in 2025:

- Diversify: Spread investments across different assets like stocks, bonds, and real estate.

- Build an Emergency Fund: Set aside cash for living expenses to avoid selling investments in tough times.

- Focus on Stable Investments: Invest in reliable assets like dividend-paying stocks issued by reputable companies.

- Invest for the Long-Term: Stay focused on long-term goals and avoid reacting to short-term market changes.

Conclusion: Building a Secure Financial Future as a Remote Worker

Securing your future as a remote worker isn’t impossible, but it requires thoughtful planning, consistent investing, and adapting to change as it happens.

By following the tips above, you can establish a solid financial foundation, protect your wealth, and grow your savings for your personal project financial freedom 2025!

However, if you’re just starting your remote career and are still looking for opportunities to earn a stable income, consider signing up with Remote Staff.

Remote Staff offers remote jobs with competitive compensation packages, giving you the chance to secure a reliable source of income while working from home and building your financial future.

Register today!