Filipinos have more remote working opportunities than ever before. Now, you can work without leaving the comforts of your home and still earn a decent income.

Some Filipinos use this flexibility to work from anywhere instead as digital nomads.

With just a laptop and reliable internet, digital nomads can travel and work anywhere.

Some of you might start your digital nomad lifestyle in our country, with its pristine beaches and jaw-dropping naturescapes.

Furthermore, it’s relatively cheaper to work in provinces or towns outside the central business district.

Some might be curious what is nomadic living like, but they fail to consider a crucial aspect— digital nomad tax.

Understanding digital nomad tax can enhance your compliance and, with the right knowledge, enable you to reduce your taxes – the legal way.

Let’s simplify it for you with the digital nomad’s guide to taxation in the Philippines.

Disclaimer: This article is for informational purposes only and not a substitute for professional advice. Furthermore, some of the information here could become outdated if new digital nomad tax laws and regulations are introduced. Please be guided accordingly and consult a tax professional as needed.

The Philippines’ Tax System Overview

The Philippines’ tax system is composed of several key components, each serving a specific purpose in generating revenue for the government. These components include income tax, value-added tax (VAT), and various other levies and fees.

Before we delve into the nitty gritty of taxation, let’s discuss some taxation concepts.

Residents vs Non-resident Citizens

If you have a Philippine passport, you’re considered a Filipino citizen. Now, the taxes you will pay depend on whether you’re a resident or non-resident.

You’re a resident if you meet any of the following criteria.

- You have been physically present in the Philippines for 183 days or more.

- You have a permanent residence in the country.

- You intend to stay in the Philippines permanently.

If you’re a resident, your entire income is subject to tax, regardless of where it’s generated. On the other hand, non-residents are only taxed on income earned in the Philippines.

For example, let’s say you’re earning the following income through your remote working jobs:

Residents pay taxes on the total income (Php 75,000), while non-residents pay only for the income from their PH client (Php 20,000).

Can Digital Nomads Become Non-residents?

Based on section 22 of the amended NATIONAL INTERNAL REVENUE CODE OF 1997, here are 2 relevant definitions of the term ‘nonresident citizen’ for digital nomads:

(2) A citizen of the Philippines who leaves the Philippines during the taxable year to reside abroad, either as an immigrant or for employment on a permanent basis.

(3) A citizen of the Philippines who works and derives income from abroad and whose employment thereat requires him to be physically present abroad most of the time during the taxable year.

If you travel the world for over 183 days and have a foreign client, you can claim that your income is generated abroad and not in the Philippines.

However, the law isn’t explicit about how digital nomads can be non-residents. For now, it’s best to consult a taxation expert if this is your concern.

Taxable Income Sources in the Philippines

In the Philippines, income from certain sources can be subject to relevant digital nomad tax, such as:

Gross Income

Gross Income is a general term for all the money earned before subtracting operational expenses.

This encompasses compensation for services, income from a business or a job, gains from property dealings, interest, rents, royalties, dividends, annuities, prizes, and winnings.

In the Philippines, business taxes such as percentage taxes are levied on your gross income to monitor your total sales when you submit your ITR.

For example, let’s say a client paid you Php 90,000 this quarter. You are required to pay 3% (Php 1,800) so that the BIR can countercheck your total sales for income tax purposes.

Compensation Income

Compensation income is money earned as an employee. It includes salaries, wages, bonuses, and other employee benefits.

If you’re employed and your company allows you to work from anywhere, your income qualifies for this category.

Business and Professional Income

Business and professional income is money earned from business activities, including self-employment, entrepreneurial endeavors, and professional services.

Most digital nomads classify their income in this category.

You also need to pay taxes from digital nomad income from the following sources as well.

- Gains from Sale of Property

- Interest and Dividends

- Rent and Royalties

- Prizes and Winnings

- Inheritance and Gifts

Freelancers and Self-Employed Digital Nomads

Many digital nomads work independently, often serving multiple clients in the Philippines and overseas.

Due to the nature of their work, most digital nomads are taxed as self-employed individuals. (Although, some companies allow their employees to work from anywhere.)

Freelancers and self-employed digital nomads must thus maintain records of income and expenses for accurate tax reporting.

They are also required to register and secure the following documents for taxation purposes.

Certificate of Business Name Registration (DTI)

First, you must register your practice with the Department of Trade and Industry (DTI) via a certificate of business name registration.

Some digital nomads simply use their full name as their trade name. However, you can choose other trade names as well, provided they’re available.

You can check this guide for how to secure your certificate of business registration.

Occupational Tax Receipt

Next, you should get an occupational tax receipt (OTR).

The OTR is granted by the local government to individuals or businesses conducting a profession, trade, or occupation within their jurisdiction.

This tax is also known as a professional tax, community tax, or residence tax.

You can check this guide for how to acquire your occupational tax receipt.

Certificate of Registration (BIR)

Once you have your business name registration certificate and occupational tax receipt, you can then register your practice with the BIR.

They will issue your certificate of registration, which is required by the government for businesses and individuals engaged in economic activities.

Your COR will also specify the required taxes for your practice. You can refer to this guide on the steps to register on BIR.

Digital Nomad Tax Dues

After registration, what types of digital nomad tax are you expected to pay?

Registration Fee

Self-employed individuals and business owners pay a Php 500 fee to register. Afterwards, you need to pay an annual renewal fee of Php 500 to maintain it.

The deadline for payment is until Jan 31 of the relevant year.

Percentage Tax or Value Added Tax (VAT)

Next, calculate your annual sales, as this will determine whether you’ll pay percentage tax or Value Added Tax (VAT).

You must pay Percentage tax if your annual sales are under Php 3,000,000 (roughly Php 250,000 per month). If your sales exceed this amount, you are required to pay VAT instead.

What’s the difference?

You are classified as a non-VAT taxpayer if your annual sales are below Php 3,000,000.

This exempts you from VAT payments but percentage tax is levied on your gross sales at a flat rate of 3%.

So for example, let’s say you earned around Php 50,000 from a client. You are required to remit Php 1,500 of that (3% of Php 50,000) to the BIR.

On the other hand, if your annual sales exceed Php 3,000,000, you qualify as a VAT taxpayer.

VAT taxpayers are exempted from percentage tax, but are required to remit 12% VAT for every sale.

So using the same example above, you will need to pay Php 6,000 (12% of Php 50,000) for VAT.

So, should you register as a Non-VAT or VAT taxpayer?

You can register based on your estimated annual income. Typically, many start as non-VAT taxpayers and transition to VAT when their sales reach Php 3,000,000.

How to Lower VAT Payments?

As you can see, there’s a significant increase in tax payments when transitioning from non-VAT to VAT.

Is there a way to lower the tax payments? Yes, there is!

First, in the Philippines, it’s common practice to pass this amount on to your clients rather than paying it yourself.

So for the Php 50,000 example above, you can charge roughly Php 56,000 instead.

Next, you can use the input VAT (the VAT you paid from other providers) to lessen your output VAT (VAT from your sales).

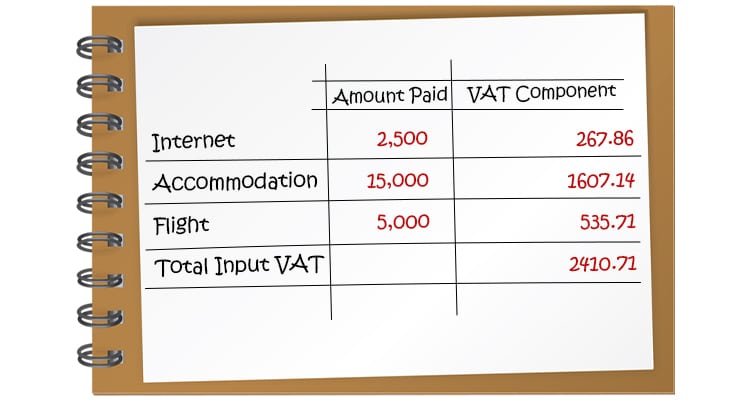

For example, take the incidental expenses (internet, accommodations, etc.) related to your digital nomad online job.

So instead of paying Php 6,000 VAT, you only have to pay Php 3,589.29 (Php 6,000 output VAT minus Php 2,410.71 input VAT).

Make sure you keep the receipts for these transactions to claim the input VAT.

Payments for both Percentage Tax and VAT fall on a quarterly basis around 25 days after the end of each quarter.

Here’s a chart for your convenience.

Income Tax

Filipinos are obliged to pay income tax on their earnings. Digital nomads are no exception.

Citizens and residents are required to pay income tax for earnings from in and outside the country. On the other hand, non-residents only need to declare income earned within the Philippines.

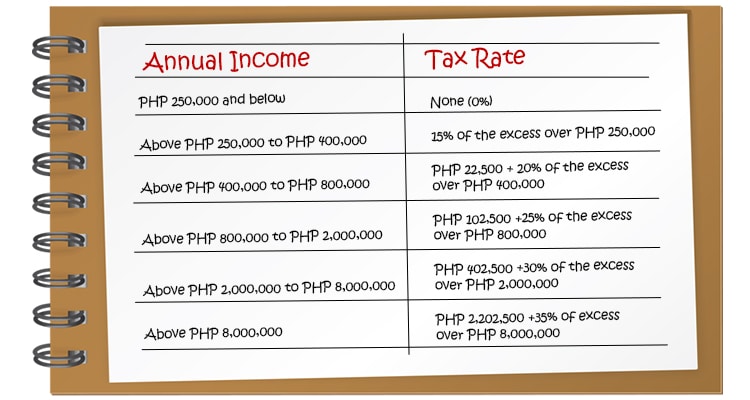

The Philippines’ tax rates are progressively applied, with higher-income individuals paying a higher percentage of their income. The current tax table is as follows:

Understanding Taxable Income

Before computing your income tax liability, you must understand what a taxable income is.

This refers to your gross income less allowable deductions. You can use the following tax deduction schemes to lower your tax due:

Itemized Deductions

Under this scheme, you can reduce your taxes by subtracting allowable itemized deductions from your income.

These deductions are expenses relevant to your digital nomad career.

Examples are internet expenses, electricity, accommodations, flight tickets, etc. Make sure to keep the official receipts.

Optional Standard Deduction

Some digital nomads opt for the optional standard deduction (OSD) if they don’t have receipts for itemized deductions. Those with minimal expenses also opt for this.

Instead of your actual expenses, OSD offers a straightforward 40% standard deduction from your gross income.

For example, let’s say you earned Php 500,000 this year. Your taxable income net of the optional standard deduction will be Php 300,000 (Php 500,000 less 40%- Php200,000).

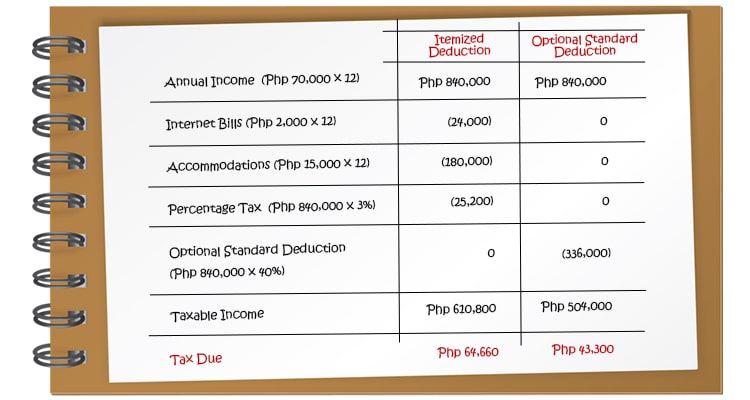

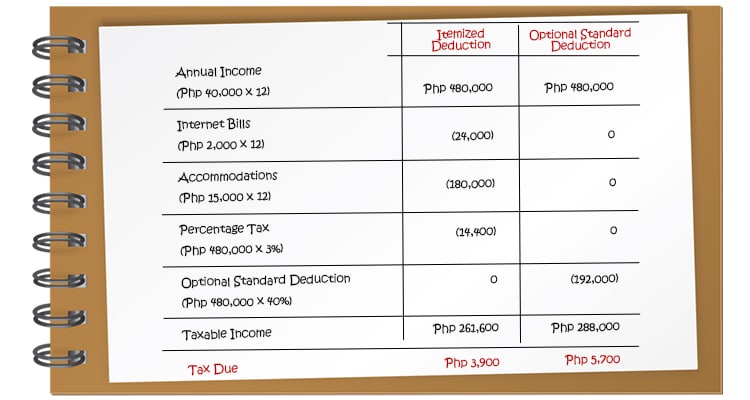

Itemized Deduction vs. Optional Standard Deduction

Should you opt for an itemized deduction or optional standard deduction? Well, that would depend on your income and expenses.

Here’s a simple comparison.

Let’s say you earn roughly Php 70,000 a month and pay around Php 2,000 for internet bills, Php and 15,000 for accommodations:

In this example, the Optional Standard Deduction results in a smaller taxable income because you don’t have a lot of expenses.

This way, you’ll pay less taxes when you opt for the optional standard deduction.

Now, let’s apply the same computation to a Php 40,000 monthly income.

In this example, you will pay less taxes with itemized deductions.

However, note that you have to choose between an itemized deduction and an optional standard deduction at the start of the year.

You can’t change the tax scheme until the year ends.

8% Tax Rate in Lieu of Percentage Tax

Some self-employed individuals skip tax filing since they find it too complex, while others avoid it because their income is seasonal.

To increase collection, the government introduced another tax scheme, an 8% tax rate in lieu of a percentage tax to ease the burden of freelancers.

Instead of comparing income and expenses, you just need to pay a fixed 8% rate from your gross income. Moreover, you don’t need to pay percentage taxes as well.

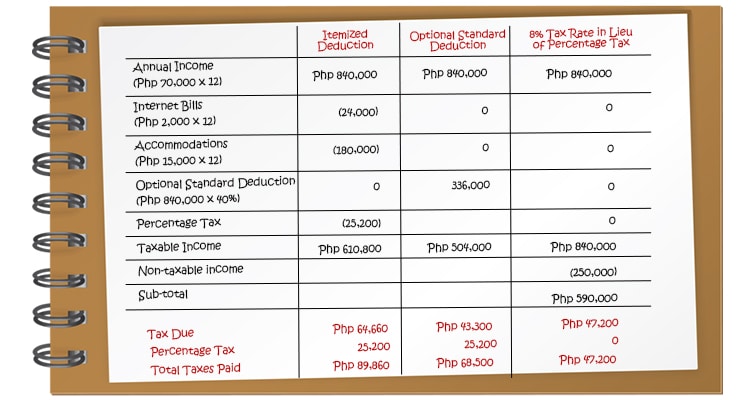

Using the same examples above, let’s compare the tax liabilities under this scheme.

Let’s say you’re earning Php 70,000 per month with the same expenses above:

As you can observe, the tax owed is lowest under the OSD tax scheme (Php 43,300 vs Php 47,200).

However, to compare the three tax schemes accurately, you need to consider the tax savings resulting from the percentage exemption.

So when we consider the total taxes paid, the lowest overall tax liability is under the 8% tax scheme (Php 89,860 vs Php 68,500 vs Php 47,200).

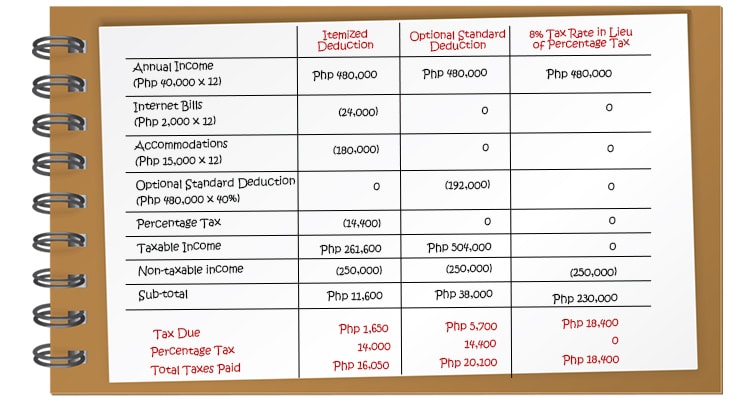

What if you earn Php 40,000 per month and incur the same expenses above? Here’s the comparison:

In this example, the lowest overall tax liability is under the Itemized Deduction tax scheme (Php 16,050 vs. Php 18,400).

However, some freelancers and digital nomads choose the 8% scheme for its simplicity. With this scheme, you don’t need to retain receipts for tax deductions.

How to Pay Digital Nomad Tax?

Now that you’re aware of the types of digital nomad tax, how can you pay them while traveling and working?

Fortunately, you can submit your tax returns via eBIR. You can refer to this guide on how to file your taxes online.

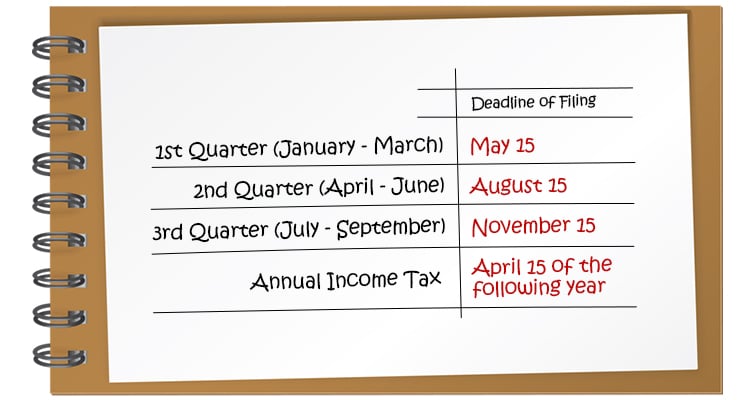

For the Income Taxes, the schedule for payment is on a quarterly and annual basis.

- 15th of the second month after the close of the quarter (1st to 3rd quarter)

- April 15 for annual income taxes

Here’s a list for your convenience.

As a digital nomad, where to pay taxes?

You can start paying taxes as a digital nomad through online channels.

As of the moment, you can course it through banks and e-wallets like DBP, Landbank, Paymaya, and Unionbank.

Why Should You Pay Digital Nomad Tax?

A lot of freelancers and remote workers aren’t paying taxes. So why should you?

For starters, there are big advantages when you pay digital nomad tax in the Philippines

Get More Clients When You Legalize Your Profession

When you pay digital nomad tax, you legitimize yourself as a remote talent. It enhances your credibility and can open up better opportunities.

Furthermore, some clients prefer tax-registered remote workers who can provide official receipts for their services.

If you’re tax-registered, you can get more clients in the long run.

Enjoy Government Benefits

Tax money is used to fund public services such as schools, roads, healthcare, and other government projects.

As a Filipino citizen, you and your family can support nation-building by paying digital nomad tax.

Easier Visa Applications

To fully embrace being a digital nomad, providing proof of income is necessary for visa applications.

So when you pay your taxes, it’s easier to get a digital nomad visa. Tax on income like an Income Tax Return (ITR) can prove your financial capacity for travel.

Loan Applications

Are you planning to buy a house or a car? Or maybe starting a business that you can run while traveling the world?

Most digital nomads can’t finance this purely from their pockets. That’s why loans are crucial.

However, you need proof of income to get approved. When you pay your digital nomad tax, you can also use your ITR in your loan applications.

Peace of mind

You might not get caught when you don’t pay your taxes now. However, the consequences could come later. The government could eventually catch up and you will have to pay the taxes you owe.

Paying your taxes now can give you the peace of mind you deserve.

Avoiding Double Taxation

If you’re traveling with a digital nomad visa, tax implications with your income might arise.

As a digital nomad, you might be required to pay income taxes in the country you’re visiting for an extended period.

For example, let’s say you earned Php 50,000 from a US client.

The Internal Revenue Service (IRS) in the United States and the Bureau of Internal Revenue (BIR) in the Philippines may both require taxes on that income.

It’s burdensome and costly for remote workers and freelancers to pay two taxes on the same income.

This is called double taxation, and it’s when a taxpayer has to pay taxes on the same income or assets in multiple tax jurisdictions, like two different countries.

Digital nomads who stay in a country for less than a year typically encounter no issues with this.

Fortunately, there are special tax treaties against double taxation if you plan longer stays.

Special Tax Treaties and Exemptions

Special tax treaties offer reduced tax burdens to specific countries and their citizens.

These are beneficial to both the country and its citizens, as they promote trade and investment between the two nations.

Knowing these treaties might help you find the best tax residency. Digital nomad perks such as tax benefits can be enjoyed as well.

As a Filipino digital nomad, tax free countries where you can enjoy double taxation exemptions are as follows:

- United Kingdom

- Canada

- Singapore

- South Korea

- Kuwait

- Malaysia

- Netherlands

- New Zealand

- Norway

- Pakistan

- Poland

- Qatar

- Romania

- Russia

- Spain

- Sweden

- Switzerland

- Thailand

- United Arab Emirates

- Vietnam

Different countries have varying procedures for claiming double taxation exemptions. So even offer tax free digital nomad visa perks.

It’s best to consult tax professionals to get all the details.

Local Tax Considerations

Aside from national taxes, digital nomad tax also includes local taxes as well.

Depending on your municipality, local taxes may cover property taxes, community taxes, and occupational taxes.

Occupational Tax

Many digital nomads fall under the category of non-licensed professionals and typically pay approximately Php 200 for an occupational tax receipt (OTR).

Most local governments treat it similar to professional tax receipt (PTR) for licensed professions, which is renewable annually.

Tax rates can differ, so consult your local authorities for taxes applicable to your profession.

Importance of keeping records and receipts

Now that you’re aware of the digital nomad taxes, you should also diligently track your income and expenses.

This allows you to claim your expenses as tax deductions from your gross income.

It also helps keep track of any income you receive to accurately report your earnings.

Having accurate records also provides a clear paper trail in case of an audit.

FAQs on Digital Nomad Tax in the Philippines

Got inquiries about digital nomad tax in the Philippines? Here are answers to some frequently asked questions.

Can I qualify for any tax breaks as a digital nomad in the Philippines?

Digital nomads are taxed the same way as self-employed individuals, so you can also qualify for tax breaks available in this tax class.

You can avail of tax schemes such as the 8% flat rate in lieu of percentage tax for lower tax liabilities, for instance.

If you choose the itemized deductions tax scheme, you can also claim normal and necessary expenses such as flight tickets, accommodations, and phone bills to reduce your tax liability.

How do I handle online income from multiple sources?

Some digital nomads might have multiple online sources of income such as income from employment and business.

With this, you should report mixed income tax returns that include your other income sources as well.

Check this guide on how to file taxes as mixed income earners.

What are the penalties for non-compliance with tax regulations?

Can a digital nomad avoid tax? Not really.

Failure to pay taxes carries a civil and/or criminal liability. The civil liability encompasses penalties in the form of surcharge, interest, and compromise fees.

The surcharge varies from 25% to 50%, depending on the reason for non-payment.

On the other hand, interest rates range from 12% (if it was due after the TRAIN law was passed) to 20% (if it was due prior to the passing of the TRAIN law) per year.

Lastly, there’s a compromise fee of Php 1,000 to Php 50,000, depending on the amount of tax unpaid.

You can check this link to learn more about the penalties for not paying your taxes.

Conclusion

Complying with taxes is crucial for a digital nomad. It ensures that you can enjoy traveling the world without worrying about legal implications in the future.

With the tips above, you can comply with your tax requirements. Still, it’s best to work with a tax professional to ensure you’re paying the right digital nomad tax for your career.

So if you’re still looking for online careers as a digital nomad, you can sign up through Remote Staff for the best remote working opportunities for Filipinos.

Register today!