As of writing, the Philippines is on the verge of recession. The GDP is falling as consumption spirals downward because of the lockdown. For ordinary citizens, this means a higher unemployment rate.

During tough times, cash flow is tight for our families. With dwindling sources of income, how can you manage your cash flow to survive? Here are 9 tips for managing your finances during tough times.

Image Credit: iStock

Don’t Panic

The bills might be piling up, but the first thing you should do is stop panicking. Your anxiety interferes with sound decision-making. According to research published by The Journal of Neuroscience, it disengages areas in your prefrontal cortex that is essential for making good decisions.

It’s okay to feel bad. Accept the situation. But the faster you recover from your panicky state, the sooner you can make clearer decisions.

Image Credit: iStock

Minimize Spending

Now is not the time to spend. Yes, we can still have lifestyle expenses. But if we’re talking about survival, you might need to curb some of this off.

- Do you have subscriptions you don’t use?

- Do you have extra expensive food items you can live without for now?

- Can you lessen utility consumption (e.g., electricity, water, etc.)?

- Do you have vices you can cut for the moment (e.g., drinking alcohol, buying virtual in-game items, etc.)?

Check what you spend on and slash off some expenses for the meantime.

Negotiate Rent and Other Expenses

In some situations, companies might provide programs to lighten the load of your budget. There is no harm in asking your landlord if they can provide you with an installment plan for the rent due in the months you have no income.

Check out the website also of some service providers if they have installment plans. For example, Globe offers a 0% installment payment program for balances due last quarantine period. Stretching the payment will help you in managing cash flow during tough times.

Image Credit: iStock

Paying Down High-Interest Debt

Recessions or economic downturns might last longer than expected. If you have high-interest debts, like credit cards, you might want to pay them off first. It allows you to free up some cash flow from the interest payments.

If you can’t pay them now, consider consolidating debt to ease up your balances. Consolidating debt means combining all your debt in one single monthly payment. Usually, credit cards (like Security bank’s 0% balance transfer) and lending corporations offer this.

Practice due diligence and find a suitable debt consolidation plan for you.

Image Credit: iStock

Emergency Fund

Most finance gurus will say that you should have around 3 – 6 months worth of emergency funds. It is the standard. But how can you build an emergency fund when you don’t even have stable cash flow now?

It’s alright. For the coming months, you can focus on survival. But if you have some extra cash, make sure at least to save up 1 month’s worth of emergency funds.

This is to stop you from using your credit card in case of emergencies. And it can balloon up plus interest, especially during times of need.

Image Credit: iStock

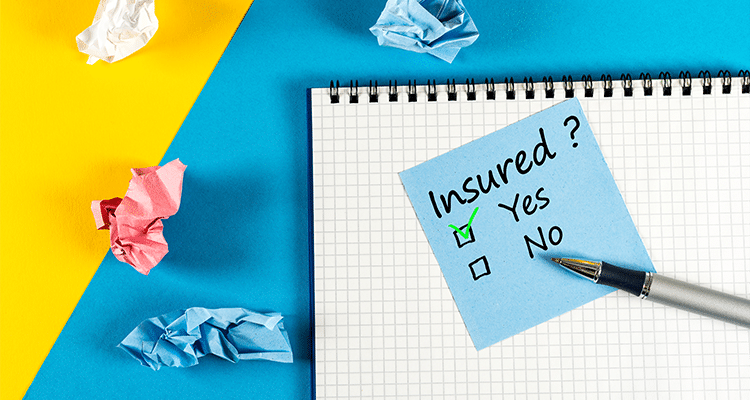

Life and Health Insurance

No one knows what will happen to us in this lifetime. As of writing, we have COVID19 that can affect our health and ability to work.

If you can manage to reallocate some expenses, you can opt to take life and health insurance for the protection of your family. There are multiple insurances out there. The one with Allcare even has a free telehealth subscription and more for freelancers.

Just choose the one that can supply your needs. And remember to ask as many questions as possible so that you can understand their insurance products.

Image Credit: iStock

Make Yourself Essential in Your Company

Ask yourself, are you essential in the operations of your company? Will it still run smoothly even without your contribution?

We have to face the facts. If there is a global economic crisis, companies are going to lay-off people. You need to be valuable to your company.

If the answer is on the negative, make sure to be more valuable by having the initiative to provide quality output. Also, you can be valuable by upskilling yourself.

Worst case scenario, you are retrenched. But with your new skills, you can easily find other options.

Image Credit: iStock

Diversify Investments

If you have the foundations like emergency funds already, you might have investments in place. During trying times, investing is quite tricky. But remember, the first adage of investments is to “not lose money.”

Now might not be the time to be aggressive. You can opt to diversify your portfolio to safer investments. It might have a slower return for now, but at least you’re not losing money.

Image Credit: iStock

Look for Additional Sources of Income

It’s not all about tightening your belts. Remember, you can also increase your income. You’ll never go wrong with having multiple streams of income.

Look for opportunities to have more income these trying times. If you have some product ideas, you can start an online business. After all, more and more people are buying online.

Also, if you have specific skills, you can market online, you can try out remote working opportunities. For me, my current remote working job provided the much-needed income when all my businesses are on a halt.

Conclusion

A financial crisis is undoubtedly daunting for every single one of us. The uncertainties that come with it may keep you restless. It’s not easy to accept something that we can’t control.

But we can all be proactive and try to ease our burdens by managing our available resources well. We’re all in this together!