We are all working on our goals. It might be for that house you’re buying, that travel with your family, or just some cash for a comfortable retirement. If you are looking for a reliable bank to save up your hard-earned money? Look no further; Security Bank got you covered.

Security Bank Corporation (SBC) is one of the largest banks in the Philippines. It was established on June 18, 1951, and was listed on the Philippine Stock Exchange in 1995 under ticker “SECB.”

They offer competitive financial products, and they have some unique accounts you can take advantage of. Here are 3 unique Security Bank financial products you can take advantage of.

All-Access Account

Over other types of bank accounts, the most unique is Security Bank’s All Access Account. The All-access account is a 3-in-1 product where you get a passbook, ATM account, and checkbook.

But that’s not all. By having this, you can get free life insurance for 3x your average daily balance (3M maximum). Where can you get free life insurance for just maintaining your balance?

Probably, nowhere else. So if you want free life insurance plus the perks above, you have the All Access Account.

Moneybuilder Savings Account

Saving money is a habit. It doesn’t come naturally for most of us because most want to spend instantly. After all, it feels good to splurge money. But if you want to be rich, you need to save and budget.

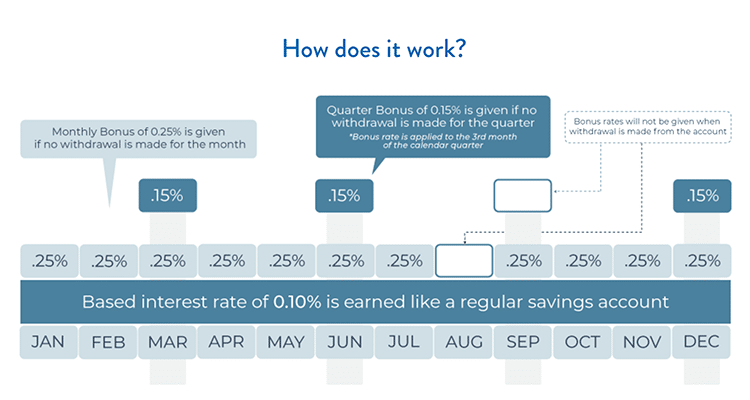

That’s why the Security Bank’s Money Builder Savings account builds your wealth and your savings habit for you. It does this by incentivizing you with an additional interest percentage when you don’t withdraw money. The rates are as follows:

Image Credit:

Security Bank

With this, you have that extra push to keep your money at bay.

eSecure Online Saving Account

Finally, if you already have the All Access account above or their Basic Easy Account, you can take advantage of their eSecure Online Saving Account. What’s good about this account is that you can have a higher-tiered interest rate from 0.50% to 1.2% per annum, depending on the balance.

Also, you can have 10 accounts under this. If you’re the type who wants to separate their money for certain amounts or savings goals, this can be really useful. You can also utilize this feature when you practice the Jars method for budgeting.

Bonus: Connect to Gcash

We all know Gcash is a powerful financial tool for bills payment, transfer of money, and more. Luckily, you can pair your Gcash with your Security Bank account. You just need to connect it/ There are two ways.

You can either link your account on your Gcash, or use Instapay to transfer money directly to your Gcash.

Requirements

If you like what you see, you can open an account with ease. The requirements are just easy for all types of accounts:

For Resident Citizen, Non-resident Citizen, and Resident Alien:

- 1 primary valid ID or 2 secondary valid IDs

For Non-resident Alien:

- Passport or Alien Certification of Registration (ACR) I – Card

That’s it! And you can have your own Security Bank account.

Conclusion

There you have it! I hope these unique bank accounts can help you achieve your financial goals! Good luck!