For most Filipinos, we are one emergency away from being bankrupt, especially during these trying times. That’s why health insurance is crucial for our protection. After all, health is wealth.

By virtue of Republic Act No. 7875, Philippine Health Insurance Corporation (Philhealth) was established to provide equitable health insurance coverage for our populace. And remote workers and freelancers can get them as well.

Eligibility

After registering, you should pay at least 9 months’ worth of premiums in the twelve months preceding the confinement. If you want to get insured during the first month of registration, you should pay off the last 9 months worth (including the period of confinement).

Here are the deadlines and payment schemes you can avail

- Monthly – Last working day of the month you’ll pay for. (Example: Paying for January. Deadline is January 31.)

- Quarterly – Last working day of the quarter you’ll pay for. (Example: Paying for 1st Quarter, January to March. Deadline is March 31.)

- Semi-Annually – Last working day of the first quarter. (Example: Paying for 1st Semester, January to June. Deadline is March 31.)

- Annually – Last working day of the first quarter. (Example: Paying for January to December. Deadline is March 31.)

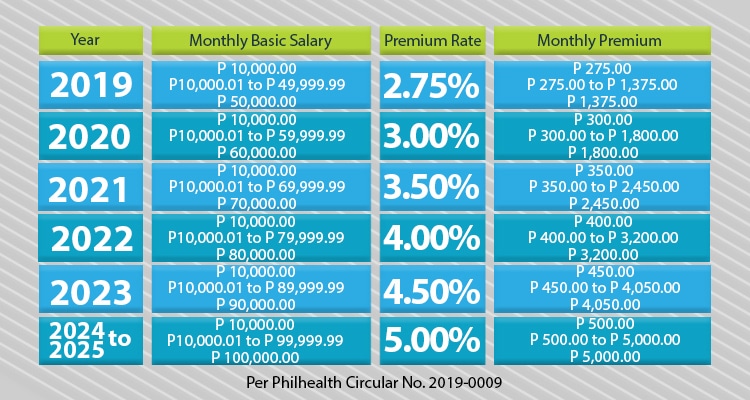

There is no difference in the amount whether you pay monthly or annually. The payment premiums are:

But what exactly can you get from it? Here are 6 benefits when you avail Philhealth as a remote worker or freelancer.

Health Benefits for Different Medical Cases and Procedures

Not all diseases are created equal. Some are more deadly. And procedures vary for every medical case. The good thing is that Philhealth covers almost all diseases with equitable prices. Here are the medical and procedure coverages and case rates.

- Medical Case Rate

- Procedure Case Rate

- Medical Conditions and Procedures Allowed as a Second Case Rate

- Medical Case Rates for Primary Care/Facilities Infirmaries/Dispensaries

- Procedure Case Rates for Primary Care/Facilities Infirmaries/Dispensaries

As long as you get these procedures from accredited institutions and professionals, you can get coverage. You can also search through their database for the specific disease.

Your Dependents Are Still Covered

It’s not enough that you’re covered. Your dependents should also be. After all, you want a healthy family. With that, your dependents are also covered with your Philhealth membership. Dependents that are eligible are:

- Legitimate spouse who is not a member;

- Child or children – legitimate, legitimated, acknowledged and illegitimate (as appearing in birth certificate) adopted or stepchild or stepchildren below 21 years of age, unmarried and unemployed.

- Children who are twenty-one (21) years old or above but suffering from congenital disability, either physical or mental, or any disability acquired that renders them totally dependent on the member for support, as determined by the Corporation;

- Foster child as defined in Republic Act 10165 otherwise known as the Foster Care Act of 2012;

- Parents who are sixty (60) years old or above, not otherwise an enrolled member, whose monthly income is below an amount to be determined by PhilHealth in accordance with the guiding principles set forth in the NHI Act of 2013; and,

- Parents with permanent disability regardless of age as determined by PhilHealth, that renders them totally dependent on the member for subsistence.

45 Days Hospitalization Per Year

Most private health insurance and HMOs don’t offer hospitalization benefits unless it’s an emergency. But Philhealth gives that to you as well.

Philhealth insures you for 45 days of hospitalization per year. It covers allowances for hospital room and board fees. On top of that, your dependents are also protected with the same 45 days benefit. But if you have 2 or more dependents, the 45 days are shared among them.

Philhealth Konsulta

Prevention is better than cure. That’s why early detection might lead to better chances of a healthy life. That’s why Philhealth launched Philhealth Konsulta. Watch the video below for an overview.

Philhealth Konsulta provides free consultation, diagnostics, and some medicines for specific cases. Here are the accredited Konsulta Package Providers as of March 31, 2021.

COVID Subsidies

COVID is the greatest threat to our health today. According to a study, the average hospital expense for COVID is 51,000 PHP to 200,000 PHP. But when you contract severe complications, it can go into hundreds of thousands.

A subsidy for COVID-related expenses is surely welcome. And Philhealth offers:

- COVID Testing (2,710 to 8,150 PHP)

- Community Isolation Benefit Package (22,449 PHP)

- Admission to Hospitals

- Mild pneumonia- P43,997

- Moderate pneumonia- P143,267

- Severe pneumonia- P333,519

- Critical pneumonia- P786,384

You can also check this link for things you should do when you have COVID.

Lifetime Membership on Retirement

There will be a time when you can’t work anymore during retirement. How do you pay for your Philhealth membership?

Good news! When you’re 60 years old or above with 120 contributions, you can be a lifetime member. Just register again with the following requirements.

How to Avail Your Claims

What to do now if we need to use our Philhealth benefits? You have to meet the following conditions.

- At least 9 Months paid premium preceding confinement (including the period of confinement).

- Confined for 24 hours in an accredited hospital.

- Disease requiring hospitalization.

- Attending physicians should also be Philhealth accredited to be covered.

- It’s covered within the 45 days limit.

Required Documents

- Your Member Data Record. If your dependents are using it, they should also reflect on the sheet.

- Philhealth Claim Form 1

- Certificate of Premium Payments showing 9 months of payments.

- Philhealth ID

- Valid ID

Depending on the hospital, you might need to provide an authorization letter and valid ID if you can’t submit it personally.

Pass the following to the hospital itself before discharge. And you will have a deduction from your bill — no need to file on a Philhealth office.

Conclusion

You’ll never know when diseases will strike you or your family. By having a Philhealth membership, you are protected from the impact of the disease. Have peace of mind with this healthcare insurance.