One of the most important financial decisions you’ll ever make is purchasing your own home.

Besides having a roof over your head, owning a house gives you a sense of stability and peace of mind.

Additionally, owning assets like properties allows you to build equity, which helps you gain financial flexibility.

However, buying a house today is challenging due to rising property prices, limited housing supply, and comparatively low wages in the Philippines.

Fortunately, the Pag-IBIG fund provides affordable housing loans and opportunities for workers in the Philippines.

This enables you to find and purchase a proper house without getting buried in debt.

For first-time applicants of a Pag-IBIG housing loan, here’s a step-by-step guide on how to do it.

Understanding Pag-IBIG Housing Loans

Understanding Pag-IBIG Housing Loans

Before we begin, here’s a brief overview of the Pag-IBIG fund, its benefits, and its special considerations for freelancers and home-based workers:

Overview of Pag-IBIG Fund and Its Mission for Filipino Workers

The Home Development Mutual Fund (HDMF), commonly known as the Pag-IBIG fund, was established on June 11, 1978, by Presidential Decree No. 1530 to answer the need for a national savings program and affordable shelter financing for Filipino workers.

Its mission is to generate more savings for more Filipino workers, to administer a sustainable fund with integrity, sound financial principles, and social responsibility, and to provide accessible housing funds for every member.

They even have savings programs like the Pag-IBIG MP2 that are exempted from the CMEPA 20% tax.

The Importance of Housing Loans and How They Benefit Remote Workers

House loans enable individuals to purchase properties without having to pay the full price upfront, spreading the cost over more manageable monthly payments.

This enables remote workers to settle in areas better suited to their work-life balance without worrying so much about the cost.

Additionally, owning a house provides mental and financial stability as you no longer have to pay rent.

Special Considerations for Freelancers and Home-Based Employees Under Pag-IBIG

Unlike traditional employees, freelancers and home-based workers must register as voluntary members of Pag-IBIG to enjoy its benefits.

Additionally, they’re also solely responsible for setting aside and remitting their monthly contributions. (For a guide on voluntary Pag-IBIG contributions, click here.)

Besides these, freelancers and home-based employees must submit alternative proof of income like Income Tax Returns (ITRs) or bank statements showing their income flow as requirements for housing loans.

Finally, they can adjust their contributions based on their financial capacity and goals, which isn’t an option for regular employees with fixed contribution rates.

Step 1: Assess Your Eligibility

Without further ado, let’s move on to the first step of the Pag-IBIG housing loan application: determining your eligibility.

Here’s how:

Criteria for Becoming a Pag-IBIG Member

First off, you must be a Pag-IBIG member to avail of a housing loan.

You are eligible to register if you are:

- Employed (Filipinos working locally or abroad are automatically covered by the Pag-IBIG fund since employers are mandated to register their employees),

- Self-employed (freelancers, entrepreneurs, and professionals) – you can voluntarily register by providing proof of income or business, like financial statements or business permits,

- 18- 65 years old, even if you aren’t formally employed – housewives, students, or retirees can also join Pag-IBIG by registering and paying the required contributions,

- Are able to make an initial contribution of at least PHP 200 monthly for members or voluntary contributors (OFWs can opt to contribute more), and

- In possession of a valid ID and PSA birth certificate upon registration.

To register, simply visit your nearest branch or go to the official Pag-IBIG website and fill out the Member’s Data Form (MDF) here.

You can also see here any foreclosed properties Pag-IBIG acquired you may consider purchasing.

Membership Contributions: How Much and How Often?

As of February 2024, the monthly Pag-IBIG membership contributions have doubled from PHP 100 to PHP 200.

For employed members, both employee and employer each contribute PHP 200, making the total monthly contribution PHP 400.

In the case of self-employed individuals, freelancers, and voluntary members, the required minimum monthly contribution is also PHP 200, although higher contributions are allowed to increase savings and loan amounts.

Depending on their chosen payment arrangement, they can pay their contributions monthly, quarterly, semi-annually, or annually.

Key Documents Remote Workers Need to Prove Eligibility (e.g., Payslips, Contracts, Tax Returns)

When applying for a Pag-IBIG housing loan, you’ll need the following documents and forms:

-

- Proof of Identity:

- Two government-issued IDs, like your passport or driver’s license

- Recent 1X1 ID pictures

- Proof of Income:

- Payslips for the last 3 months, if applicable

- Latest Income Tax Return (ITR) or BIR Form 1701

- Certificate of Employment and Compensation (for part-time employment or other contracts)

- Bank Statements Showing Regular Deposits

- Employment or Freelance Contracts:

- Valid contracts for freelance work or proof of engagement with clients

- Pag-IBIG Membership Details:

- Pag-IBIG MID Number

- Membership Status Verification Slip (MSVS), showing at least 24 months (2 years) of contribution

- Proof of Identity:

- Proof of Address:

-

- Recent utility bills (electricity, water, or internet) to verify residence

- Additional Documents:

- PSA Birth or Marriage Certificates, if applicable

- Authorization Forms like Power of Attorney (if you’re represented by someone else)

Step 2: Determine Your Housing Loan Needs

Step 2: Determine Your Housing Loan Needs

The next step is calculating the amount you’ll need to borrow.

Here are some factors to consider:

Calculating the Loan Amount: Factors Like Salary, Contributions, and Appraisal

The first factor to consider when determining the amount of your Pag-IBIG housing loan is your gross monthly income.

Pag-IBIG allows borrowers to allocate 35% of their gross monthly income for loan payments.

Another factor to consider is your monthly contributions to Pag-IBIG.

Contributing more than the minimum monthly amount of PHP 200 improves your chances of getting a bigger loan as Pag-IBIG considers higher contributions as a sign that you’re more likely to repay your loans on time.

Aside from this, there’s also Pag-IBIG’s appraisal of the property you’re planning on purchasing/building/renovating.

Pag-IBIG finances up to 95% of the property’s appraised value for properties within the economic housing limit and up to 90% for properties exceeding that limit.

You can use the Pag-IBIG calculator here to help you out.

Types of Housing Loans Available Under Pag-IBIG

Pag-IBIG offers two primary housing loan programs catering to members across various income brackets:

- Regular Housing Loans:

- Open to all active Pag-IBIG Fund members who meet the minimum requirements, including paying at least 24 months of contributions.

- Designed for members seeking to purchase a residential lot, house and lot, townhouse, or condominium unit; construct or complete a residential unit; improve an existing home; or refinance an existing house loan.

- Members can borrow up to PHP 6 million, depending on their capacity to pay, the loan-to-appraised value ratio, and actual needs.

- Affordable Housing Loan Program:

- This housing loan is aimed at minimum-wage and low-income members (workers who earn PHP 15,000 per month within the National Capital Region or NCR and up to PHP 12,000 per month outside the NCR) looking to acquire their own homes.

- It’s specifically designed for socialized housing, with loan amounts up to PHP 580,000 for socialized subdivision projects and up to PHP 750,000 for socialized condominium projects.

- Additionally, these offer a subsidized rate of 3% per annum for loans up to PHP 580,000, making it very affordable.

Understanding the Interest Rates and Repayment Terms

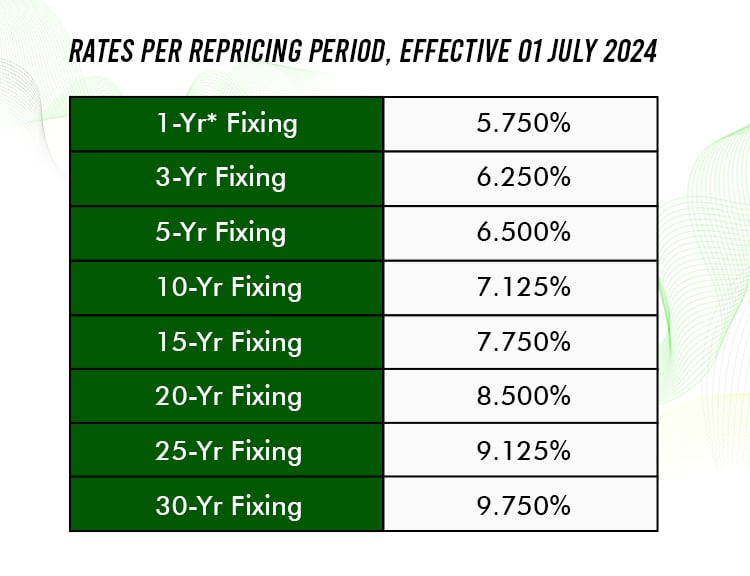

As of July 1, 2024, the interest rate for Pag-IBIG housing loans are as follows:

As seen above, your interest rate depends on the repricing period you choose.

This means that the interest rate remains constant during this time. Afterwards, the rate is subject to adjustment depending on the prevailing market rates.

For those applying for affordable housing loans, the interest rates are subsidized at 3% per annum for loans up to PHP 580,000.

In terms of payment, Pag-IBIG offers flexible payment terms of up to 30 years; this depends on your desired monthly amortization and age (the loan term must not exceed the borrower’s 70th birthday).

Step 3: Prepare Necessary Documents

Step 3: Prepare Necessary Documents

After determining the amount you’re loaning from Pag-IBIG, the next step is acquiring the necessary documents for your application.

Here’s a quick rundown of these documents – and some tips for getting them:

A Complete Checklist of Required of Required Documents for Remote Workers

When applying for a Pag-IBIG housing loan, you’ll need the following:

- Your completed Housing Loan Application Form,

- Certificate of Employment with Compensation,

- Latest Income Tax Return (BIR Form 2316),

- One Month Payslip,

- Valid ID of Principal Borrower/Spouse and Co-Borrower/Spouse (e.g., TIN ID, passport, driver’s license),

- Valid ID of Seller/s and Spouse/s,

- The latest certified true copy of original certificate of title/transfer certificate of title/condominium certificate of title,

- Updated Tax Declaration (House and Lot),

- Updated Real Estate Tax Receipt (House and Lot),

- Contract to Sell, and

- Vicinity Map.

Tips for Obtaining Essential Papers Like Proof of Income and Certificates of Employment

Proof of Income:

- You can ask your employer or HR department for official copies of your payslips covering the required period (typically the last 3-6 months).

- If your company uses payroll software, you can download digital copies of your payslips and print them.

- For freelancers, keep a folder of your invoices, billing statements, or a client-by-client earnings summary.

Certificate of Employment (COE):

- Follow your company’s internal guidelines for requesting one and do so well in advance.

- When requesting one from your employer, indicate that you need a COE for a housing loan application and have them include details like job title, employment duration, and salary.

- If you’re a freelancer, you can ask your clients to provide a letter verifying their ongoing work, project duration, and payment terms and present signed contracts or agreements to support your application.

Income Tax Returns (ITR):

- Visit your nearest Bureau of Internal Revenue (BIR) branch or authorized service center to request a copy.

- Before doing so, make sure your taxes are filed and updated to prevent delays.

- If you’re exempt from filing ITRs, you can submit a Notarized Affidavit of Income instead. Aside from this, you can also use audited financial statements as proof of income.

Organizing and Storing These Documents:

- Scan and save all essential documents so you’ll have a digital and physical copy of each.

- Keep all original documents in an organized file or folder.

- Keep all documents regularly updated for your convenience.

The Role of an Affidavit of Income (If Formal Employment Records are Unavailable)

An Affidavit of Income is crucial for freelancers, gig workers, or other informal earners who lack traditional employment records like payslips or certificates of employment.

Having one serves as an alternative proof of earnings and certifies your ability to make regular loan payments based on your declared source of income.

Step 4: Submit Your Application

Step 4: Submit Your Application

Once you’ve finished gathering and organizing all the necessary documents for your application, it’s time to submit these to Pag-IBIG:

How to File Your Pag-IBIG Housing Loan Application In Person

The first step to filing your housing loan application is having all the necessary documents at hand and filing out the housing loan application form.

Next, submit all your documents and photocopies to your nearest Pag-IBIG branch.

Once there, go to the housing loan counter and present all the necessary documents you have. The Pag-IBIG staff will then review your application for completeness and eligibility.

Finally, expect to pay a minimal processing fee (usually around PHP 1,000 or as specified) and obtain a receipt as proof of payment.

Online Application: A Step-by-Step Walkthrough of Pag-IBIG’s Portal

If you’d rather submit your application online, here’s what you need to do:

- Scan and save all required documents in the required formats (PDF or JPEG).

- Visit the virtual Pag-IBIG website and log in with your credentials. If you’re not a registered member, register for an account by providing your Pag-IBIG MID number, email, and personal details.

- Go over to the “Apply for and Manage Loans” section. Once there, you’ll see a list of required documents and forms you’ll need to complete the application. Once you have all of them, click “Proceed.”

- Select the loan type you need and provide your Pag-IBIG Membership ID no. (MID).

- Carefully review your application before submitting it. Afterwards, you’ll receive a confirmation email regarding your submission.

- Finally, wait for Pag-IBIG to process your application.

Step 5: Undergo Loan Evaluation

Step 5: Undergo Loan Evaluation

After submitting your application, Pag-IBIG will first assess your financial profile, creditworthiness, and eligibility for a loan.

What to Expect During the Pag-IBIG Loan Evaluation Process

Pag-IBIG will check if all required documents are complete and properly filled out – and whether you meet the minimum 24 months of Pag-IBIG contributions.

Additionally, Pag-IBIG will evaluate your income and Debt-to-Income Ratio to see if you can pay off your loan.

If you’re financing a property, Pag-IBIG will conduct an appraisal to determine its market value and condition for a small fee.

Afterwards, you’ll receive an email detailing the loan amount, repayment terms, and conditions.

How Can Remote Workers Prepare for Potential Follow-Ups or Additional Requirements?

Typically, if you’ve complied with all the requirements above, all you have to do is wait for your housing loan to be approved.

However, Pag-IBIG may still message you to request additional information or requirements. Keep additional physical and digital copies of all your documents on hand so you can respond promptly.

Regularly check your emails and SMS messages so you don’t miss any updates or requests from Pag-IBIG.

Timeline for Loan Approval

The entire loan application process usually takes 17-20 working days, provided all your requirements are complete and accurate.

Once your loan application is approved, you’ll receive a notice of approval (NOA) containing loan details like the amount, interest rate, and repayment terms.

Afterwards, visit the same Pag-IBIG branch you applied to and sign the loan agreement.

Step 6: Loan Approval and Fund Release

Step 6: Loan Approval and Fund Release

Once your loan is approved, there are a few more things you need to do before it’s released:

Understanding the Conditions for Loan Approval

After going over your NOA, you must sign it to confirm you agree to its terms and conditions.

Before returning the NOA, you must also complete the transfer of property title to your name. This involves going to the Bureau of Internal Revenue (BIR) and the Registry of Deeds for the final transfer of title.

Once these are done, return the signed documents to Pag-IBIG and coordinate with them to release the loan proceeds.

You must accomplish all these within 90 days or else your loan approval could be revoked. Fortunately, it’s possible to ask for an extension if you need it.

Options for Receiving the Loan Funds

Here are some ways you can receive your Pag-IBIG housing loan:

- Direct Disbursement to Your Bank Account:

- The funds are directly transferred to the bank account you provided during the loan application.

- Check Issuance:

- A manager’s check is issued in your name or directly to the property seller or developer.

- Direct Payment to the Seller/Developer:

- The loan amount is directly credited to the property developer or seller as payment for the property.

- Staggered Release for Construction Loans:

- Funds are released in installments based on the construction’s progress.

- Disbursement via Partner Financial Institutions:

- Some funds may be processed through Pag-IBIG’s partner banks or financial institutions for added convenience.

Next Steps: Property Purchase or Home Improvement Process

After securing your Pag-IBIG housing loan, you can now coordinate with your seller or property developer to complete the transfer of ownership.

Once that’s done, provide the updated Transfer Certificate of Title (TCT) and tax declaration to Pag-IBIG.

If you plan to use the loan for renovations, you can proceed with hiring reputable contractors to handle the renovations. Make sure you request detailed contracts and timelines from them.

Pro Tips for Remote Workers Applying for a Housing Loan

Pro Tips for Remote Workers Applying for a Housing Loan

Doing all these steps can be a daunting experience for many first-time applicants.

Fortunately, there are some ways you can streamline your housing loan application in Pag-IBIG:

The Importance of Maintaining Consistent Pag-IBIG Contributions

One of the key qualifications for a Pag-IBIG housing loan is at least 24 monthly contributions (or a lump sum payment).

Additionally, maintaining consistent Pag-IBIG contributions demonstrates your financial reliability, making it more likely for your housing loan to be approved.

Aside from this, regular contributions help build up your Total Accumulated Value (TAV), a factor that Pag-IBIG considers when determining your loan amount.

Furthermore, members with consistent contributions gain access to other Pag-IBIG fund benefits like Short-term loans (e.g., calamity loans) and dividends from their savings.

How to Strengthen Your Application With Supplementary Documents

Aside from submitting the required documents mentioned above, having the following increases your loan application’s chances of being approved:

- Credit/Bank History:

- Submitting your credit card statements or certificates of loan payments demonstrates your reliability in paying off debts.

- Co-Maker or Guarantor Information:

- Presenting your co-maker or guarantor’s valid ID can add another layer of security to your loan.

- Proof of Other Assets:

- Listing other land titles or property deeds under your name shows additional sources of collateral or financial backing.

Common Mistakes to Avoid During the Application Process

Here are some things you should avoid so your housing loan application goes smoothly:

- Submitting Incomplete or Incorrect Documents:

- Missing or erroneous documents can lead to application delays (if not outright rejections).

- Thus, always double-check if you have obtained and properly filled out all the necessary documents in Pag-IBIG’s official checklist.

- Not Meeting the Minimum Monthly Contributions:

- Verify your contribution on Pag-IBIG’s website or through their branches, and prepare to make a lump sum payment if needed.

- Delaying Submission of Additional Requirements:

- Delayed submissions can hold up your application; thus, respond promptly to any requests by Pag-IBIG and prepare supplementary documents.

- Not Budgeting for Upfront Costs:

- Prepare a budget for appraisal fees, documentary stamps, and other initial payments in addition to your loan down payment.

FAQ: Frequently Asked Questions

FAQ: Frequently Asked Questions

Here are some of the most common questions workers ask when applying for a Pag-IBIG housing loan for the first time:

Can Freelancers Apply for a Pag-IBIG Housing Loan?

Yes, they can.

That said, because freelancers don’t have traditional employment records, they must provide alternative documentation to demonstrate their eligibility and financial capacity.

These include:

- Latest Income Tax Return (ITR),

- Bank Statements for the past 3-6 months showing regular deposits,

- Invoices and payment receipts from clients, and

- Affidavit of Income if formal records aren’t available.

What is the Minimum Contribution Period to Qualify for a Housing Loan?

To qualify for a Pag-IBIG housing loan, you must have paid at least 24 monthly contributions.

Alternatively, if you haven’t completed 24 monthly contributions, you can opt to pay a lump sum payment instead to meet the criteria.

Are Remote Workers Eligible for Online Application?

Everyone can apply for a Pag-IBIG housing loan online if it’s more convenient for them.

Simply follow the steps above to apply for a housing loan online.

For many workers, securing a Pag-IBIG housing loan is a crucial step towards owning their own home- or improving their current one.

However, the whole process can be daunting, especially if you’re doing it for the first time.

Fortunately, by following the step-by-step loan guide outlined above, you can streamline the application process and be one step closer to your dream home.

Aside from a new home, are you also looking for work from home jobs?

If so, Remote Staff is the place to go.

Our jobs list contains plenty of jobs to choose from. These range from virtual assistant jobs and online transcription jobs to online writing jobs and online design jobs.

Ready to start your online career? If so, sign up here. Good luck!

Understanding Pag-IBIG Housing Loans

Understanding Pag-IBIG Housing Loans Step 2: Determine Your Housing Loan Needs

Step 2: Determine Your Housing Loan Needs Step 3: Prepare Necessary Documents

Step 3: Prepare Necessary Documents Step 4: Submit Your Application

Step 4: Submit Your Application Step 5: Undergo Loan Evaluation

Step 5: Undergo Loan Evaluation Step 6: Loan Approval and Fund Release

Step 6: Loan Approval and Fund Release Pro Tips for Remote Workers Applying for a Housing Loan

Pro Tips for Remote Workers Applying for a Housing Loan FAQ: Frequently Asked Questions

FAQ: Frequently Asked Questions