Disclaimer: The following is meant to be a general guide and is in no way intended to be a substitute for professional or official advice. Please consult with the appropriate authorities as needed.

Introduction

Adulting is hard! Moving from student to working life in the Philippines entails several changes.

This transition is not just about adjusting to a new environment, but also about understanding the financial and legal responsibilities that come with gainful employment.

You’ll need to understand how the tax system works, including tax rates and deductions, to manage your finances and stay compliant with legal requirements.

Additionally, it’s crucial to get key government IDs like the Tax Identification Number (TIN), Social Security System (SSS) ID, and PhilHealth card to access important services and make full use of your legal rights as an employee.

It’s also important to know the benefits your employer offers, like health insurance, leave, and retirement plans, as these can impact your job satisfaction and financial stability.

With all these new responsibilities, how do you even begin?

Worry not! Here’s an all-in-one fresh graduate guide to taxes, benefits, and government IDs in the Philippines.

Understanding Taxes in the Philippines

Paying taxes is a key responsibility for anyone who works, does business, or engages in other lucrative activities.

In the Philippines, taxes fund important public services like education, healthcare, infrastructure, and social programs.

Understanding your tax responsibilities is key to ensuring proper compliance and avoiding penalties.

If you’re an employee, your company usually settles your taxes for you. However, you can still check this guide to understand how these taxes are computed in your pay slip.

If you decide to start your own business or become a self-employed professional, you’ll be responsible for managing and filing your taxes on your own.

This means you’ll need to track your income, calculate your tax liabilities, file your returns, and make payments directly to the Bureau of Internal Revenue (BIR).

So understanding the tax system helps you comply with the law and manage your finances better by knowing what you need to pay and what deductions you can claim.

The Basics of Philippine Taxes

First things first: you need to understand the concepts of income tax, how to file these, and payment deadlines.

Let’s get started.

Overview of the Philippine tax system: Bureau of Internal Revenue (BIR)

The Bureau of Internal Revenue (BIR) is the government agency that handles tax collection and enforcement in the Philippines.

It collects income tax, value-added tax (VAT), and estate tax, making sure individuals and businesses pay their taxes.

The BIR also sets rules and deadlines for filing returns and making payments.

Overview of the TRAIN Law and its impact on income taxes

The Tax Reform for Acceleration and Inclusion (TRAIN) Law, introduced in 2018, made significant changes to the income tax system in the Philippines.

It lowered tax rates for many people and increased the income threshold for tax exemptions, so those earning below a certain amount don’t have to pay income tax.

The law also simplified how taxes are filed and paid, making it easier for individuals and businesses to comply.

With that, here’s how you can register in the BIR.

Registering with the BIR

So how do you register in the BIR? Here’s the fresh graduate guide to navigating BIR registration.

How to Obtain a Tax Identification Number (TIN)

The first step is to get a Tax Identification Number (TIN). A TIN is a unique number assigned to every taxpayer in the Philippines, which you’ll use for all tax-related transactions.

It also serves as a secondary valid ID for opening bank accounts, applying for loans, or other official purposes.

Steps for First-Time Taxpayers

To get your TIN, look up your Revenue District Office (RDO).

Typically, you register at the RDO where you work. For remote workers, this means your home address.

You can check this link for the list of RDOs in the Philippines.

Once you’ve found your RDO, prepare the following documents:

- Completed Registration Form

- Form No.1901 – Application for Registration For Self-Employed (Single Proprietor/Professional), Mixed Income Individuals, Non-Resident Alien Engaged in Trade/Business, Estate and Trust

- Form No.1902 – Application for Registration For Individuals Earning Purely Compensation Income (Local and Alien Employee)

- Form No.1904 – Application for Registration For One-Time Taxpayer and Person Registering under E.O. 98 (Securing a TIN to be able to transact with any Government Office)

You can print these forms or get them at your RDO. Just fill out three copies as required by the BIR.

Choose the right form based on your situation:

- Fill out Form 1901 if you plan to be a remote worker or a freelancer.

- Use Form 1902 if you plan to get a traditional, office-based job.

- If you’re still unemployed, just fill out Form 1904.

- Valid ID

- PSA birth certificate

- Community Tax Certificate (cedula) – check this guide to find out how to get yours.

- 1×1 picture

- Marriage contract (for married women)

Next, submit the form and required documents to your RDO.

The RDO staff will process your application and usually issue your TIN card the same day if you submit before 1:00 PM.

After getting your TIN, just give it to your HR, and they’ll withhold and remit your taxes on your behalf.

Self-employed individuals have a few extra steps to follow. You can check this guide to register with the BIR as remote workers or freelancers.

What if you already have a TIN number but want to update your category (e.g., from employed to self-employed)?

Simply submit Form 1905 to update your registration details.

Importance of Tax Compliance

It’s crucial to register correctly and on time with the BIR. This keeps your tax records accurate, keeps you in line with legal requirements, and gives you access to government services.

Also, proper registration boosts your credibility with online clients, as foreign businesses often prefer working with tax-compliant professionals because it shows reliability.

It demonstrates that you are financially responsible and comply with legal requirements, making you a more trustworthy option, which is a critical advantage in the world of remote work.

Moreover, you avoid fines and legal issues because tax evasion carries serious penalties, including hefty fines and possible imprisonment, which can amount to a combination of:

- 25% or 50% Surcharge

- 12 to 20% Annual Interest on Unpaid Taxes

- Additional fines ranging from Php 500,000 to Php 10,000,000, with imprisonment from six to ten years, depending on the severity.

Check this link for more information on penalties and legal consequences.

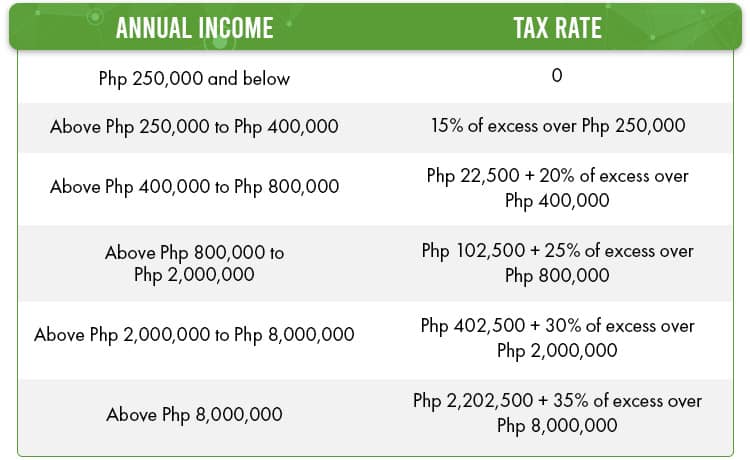

So based on the information above, here are the new tax rates and exemptions available under the TRAIN Law.

Explanation of tax brackets and income tax rates

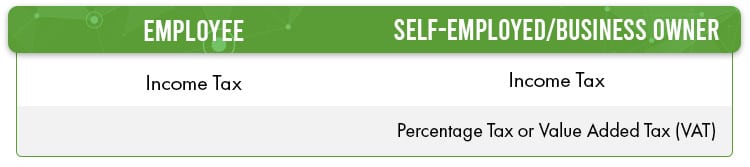

As an employee, your primary tax concern is the income tax based on your earnings.

However, if you’re self-employed (e.g., a freelancer or most remote workers), you also need to pay business taxes because you’re considered a business owner.

Here’s a comparison of what you pay as an employee versus as a business owner or self-employed individual.

With that, let’s discuss both.

Business Taxes: Percentage Tax vs. Value Added Tax

In the Philippines, self-employed individuals pay either percentage tax or value-added tax (VAT) based on their income.

The 3% percentage tax is a tax imposed on the gross sales or receipts of a business or professional practice.

This tax rate is applicable to those who are VAT-exempt under the Philippines’ tax laws.

Basically, if gross sales or receipts exceed Php 3 million, you must pay VAT. This is usually the case for VAT-registered companies.

If it’s less than Php 3 million (which is more typical among most freelancers or remote workers), you’re subject to percentage tax.

You might think the 12% VAT is much higher than the 3% percentage tax. However, with tax deductions, it can lead to a lower overall tax liability.

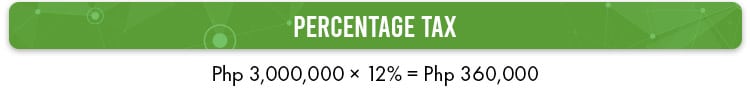

Here’s a simple calculation for both business taxes.

Computing Percentage Tax

Percentage tax is a fixed percentage of your gross sales or receipts, typically 3%, and is simpler to manage.

For example, if you have a gross income of Php 400,000, you would simply need to pay Php 12,000 for the 3% percentage tax.

Filing of the percentage tax is due on the 25th after every quarter using form 2551Q.

Computing Value Added Tax

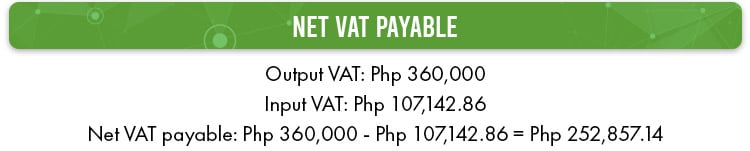

VAT, which is a 12% tax on the value added to goods and services, allows businesses to claim credits for VAT paid on their purchases. Claiming credits involves two main concepts: input tax and output tax.

Input tax is the VAT that a business pays on its purchases of goods and services needed for operations. For example, if a business buys materials, and the supplier charges VAT, this tax is the input tax.

For remote workers, you can claim VAT on office supplies (like printers and paper), equipment (such as laptops and monitors), software subscriptions, utilities (like internet and electricity), and professional services (such as fees for accountants or consultants).

Output tax, on the other hand, is the VAT that a business collects from its customers when it sells goods or services. It is charged on the sale price and passed on to the government.

By claiming input tax credits against the output tax, businesses can lower their overall tax liability.

This system requires detailed record-keeping to track both input and output taxes. For businesses with higher sales, claiming input tax credits can significantly lower the VAT they owe.

For example, let’s use gross sales of Php 3,000,000 to demonstrate how VAT works with input and output tax.

Gross Sales (Output VAT): If your business has gross sales before VAT of Php 3,000,000, the output VAT would be 12% of Php 3,000,000:

Business Purchases (Input VAT): Suppose your business spent Php 1,000,000 on purchases with PHP 107,142.86 VAT.

Business Purchases (Input VAT): Suppose your business spent Php 1,000,000 on purchases with PHP 107,142.86 VAT.

Now, you can use the input VAT of Php 107,142.86 to reduce the output VAT of Php 360,000.

Filing of the VAT is due on the 25th after every quarter using form 2550Q.

Do note that it’s best to hire an accountant to handle VAT compliance and reporting because it can be complex.

Income Taxes

Income taxes apply to both employees and businesses.

For individual employees, income tax rates are based on their salary, while for businesses, it’s based on their profits.

Given this, how do you calculate your income taxes? Let’s start with your taxable income, which is the amount the tax rates will be applied to.

Employees are taxed on their total earnings, while business owners (which includes self-employed individuals and remote workers) are taxed on their profits after expenses.

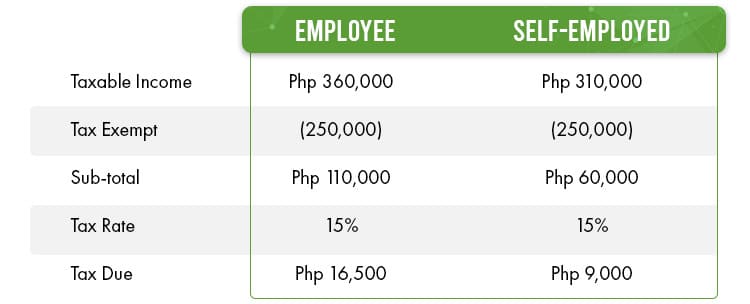

Here’s an example to illustrate.

Computing Taxable Income

Let’s say you’re an employee who earns PHP 360,000 per year. This means your taxable income is PHP 360,000.

Under the TRAIN law, the annual tax due is PHP 16,500. (We’ll explain how we arrived at this amount in the next sections.)

If you’re a remote worker with the same income, you can deduct business expenses like office supplies and internet bills from your gross income.

For example, if you have PHP 50,000 in deductible expenses, your taxable income would be PHP 360,000 – PHP 50,000 = PHP 310,000.

Your tax due would be based on this lower amount, which is PHP 9,000.

Income Tax Rates

In the Philippines, we follow a progressive rate for income tax, where higher income brackets are taxed at higher rates.

This means that the more you earn, the higher the tax percentage your taxable income will be subjected to.

Here is the updated tax table as of 2023:

This table shows a tax rate that’s about 2-5% lower (for incomes below Php 8,000,000) than in previous years.

We should also note that income amounting to Php 250,000 and below are exempt from taxes.

Given this, let’s compute the tax due from our previous example.

The example above reveals a lower income tax for self-employed individuals because they can claim tax deductions.

The example above reveals a lower income tax for self-employed individuals because they can claim tax deductions.

However, the downside is you have to track your expenses and file your own tax returns.

With a busy schedule, managing detailed records and tax filings can be time-consuming.

That’s why the government offers different tax schemes to help simplify the process.

Tax Deduction Schemes for Self-Employed Individuals

In the Philippines, there are three tax deduction options for self-employed individuals: itemized deductions, optional standard deduction, and an 8% tax rate instead of percentage taxes.

Let’s discuss the three.

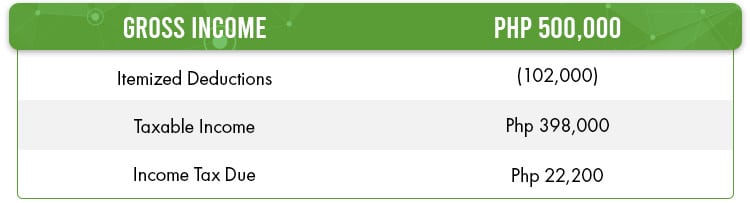

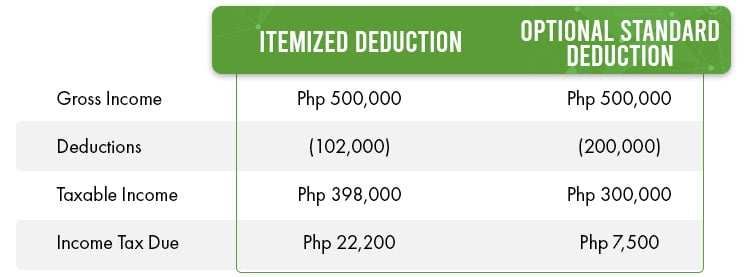

Itemized Deduction vs Optional Standard Deduction

First, let’s discuss itemized deductions and optional standard deductions.

Unlike employees, self-employed individuals can deduct various expenses to reduce their taxable income.

These deductions are called “itemized deductions.” These include home office expenses like rent, utilities, software subscriptions, and more, as long as they are necessary and par for the course in your line of work.

For example, if you have an annual salary of Php 500,000 and have the following deductible expenses:

Your taxes will be computed:

However, some people don’t have time to collect receipts. Then there are people who don’t have as many work-related expenses they can claim as tax deductions.

However, some people don’t have time to collect receipts. Then there are people who don’t have as many work-related expenses they can claim as tax deductions.

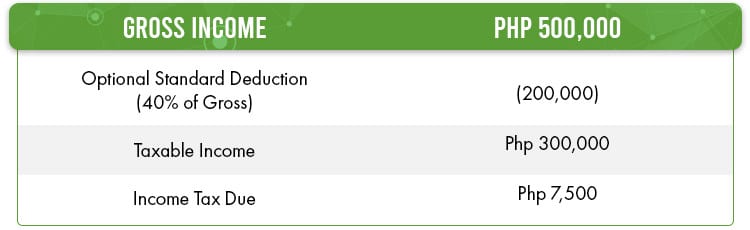

So the government introduced the optional standard deduction (OSD) scheme.

Under the Optional Standard Deduction (OSD) scheme, self-employed individuals and professionals can deduct 40% of their gross income as expenses without needing to keep or present detailed records or receipts.

For example, if your gross income for the year is ₱500,000, you can automatically deduct 40% (₱200,000) under the OSD scheme.

This would leave you with a taxable income of ₱300,000, without the need to itemize and prove any specific expenses.

In this example, the taxes are lower because the remote worker has significantly less expenses compared to the gross income.

Here’s a side by side comparison:

So, depending on your income and expenses, you should choose the tax scheme that benefits you the most.

So, depending on your income and expenses, you should choose the tax scheme that benefits you the most.

However, you must choose your tax scheme at the start of the year, and once you decide, you can’t change it for the rest of the year.

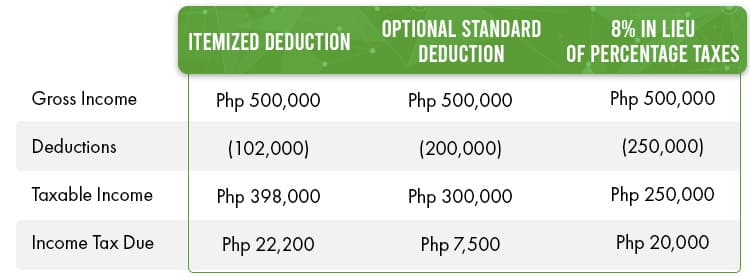

8% in Lieu of Percentage Taxes

Even with the optional standard deduction, some remote workers don’t file taxes because they still find it too complicated.

To address this, the TRAIN law introduced the 8% income tax rate in lieu of percentage taxes.

This simpler option lets them pay a flat 8% tax on their gross income, making filing easier. Moreover, they are exempted from filing the percentage tax, resulting in less tax liabilities overall.

Using the example above of a Php 500,000 annual income, here’s the income tax due:

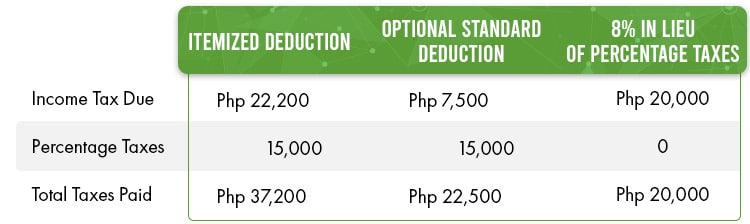

Here are some computations to compare the outcomes from the other tax schemes:

So, the optional standard deduction resulted in the lowest income tax due. However, to see the full tax impact, we should also factor in the percentage taxes paid.

Since the 8% option exempts you from paying percentage taxes, it results in lower total taxes paid.

Like other deductions, you can choose the 8% tax rate at the start of the year, but you can’t change it until the next year.

Filing Your First Income Tax Return

Now that we’ve tackled the basics of taxes, how do you file your income tax return?

Here’s a fresh graduate guide to help you navigate the process:

When and How to File Your Taxes

Filing your income tax is different when you’re an employee versus self-employed.

As an employee, your taxes are automatically deducted from your salary and remitted by HR.

You can use this tax calculator to estimate your monthly deductions, but you don’t need to worry about the deadlines.

As for self-employed individuals, you need to file your taxes in a timely manner because there will be penalties for late and incorrect filing, which can amount to:

- 25% or 50% Surcharge

- 12-20% Annual Interest on Unpaid Taxes

You can check this link for more information about the penalties.

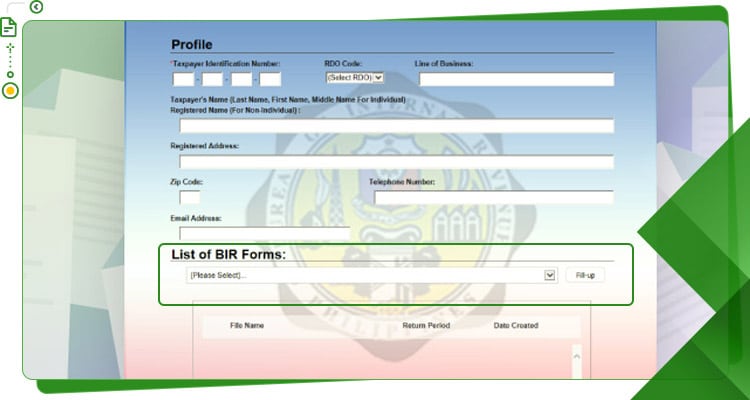

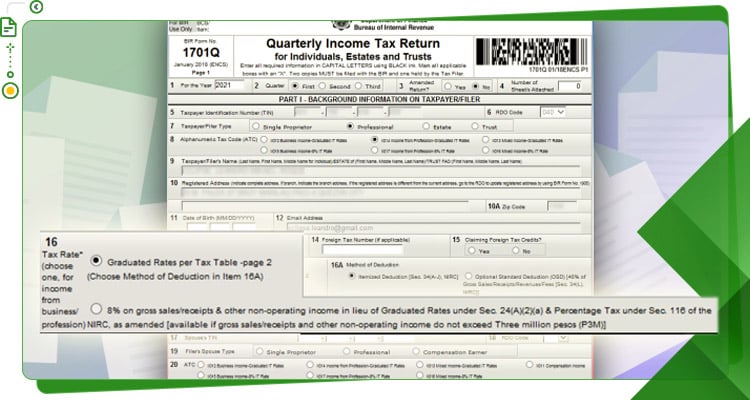

You can also file your taxes online using the eBIR form software. (Note that you can only install this on a Windows OS.)

When you open the file, you will see this form. Just fill out the information and choose the BIR form you will file in the dropdown menu.

When you open the file, you will see this form. Just fill out the information and choose the BIR form you will file in the dropdown menu.

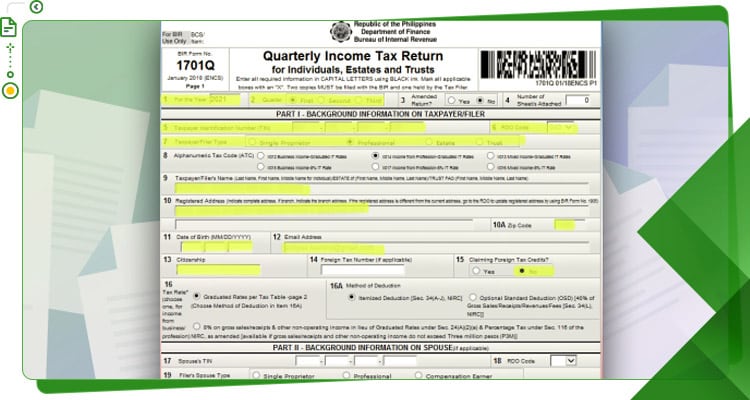

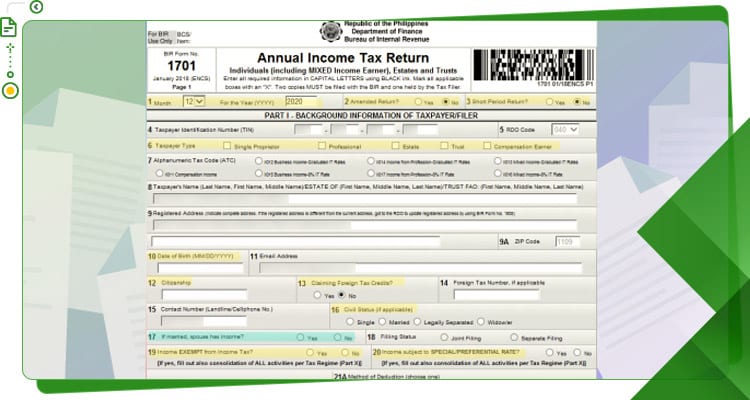

In a year, you will use 2 forms to file your income tax return:

- BIR Form No. 1701Q – Quarterly Income Tax Return For Individuals, Estates and Trusts

- BIR Form No. 1701 – Annual Income Tax Return For Individuals (including MIXED Income Earner), Estates and Trusts

You file BIR form 1701Q every quarter and BIR form 1701 annually.

The schedule for filing is:

- 1st Quarter – On or before May 15 of the current taxable year

- 2nd Quarter – On or before August 15 of the current taxable year

- 3rd Quarter – On or before November 15 of the current taxable year

- Annual Income Tax Return – On or before April 15 covering the income of the preceding year

Overview of BIR Form 1701

BIR Form 1701 is the annual income tax return used by self-employed individuals, professionals, and mixed-income earners in the Philippines to report their income and taxes for the year.

Remember, you need to file the BIR form 1701Q for three quarters.

Here’s the BIR Form 1701 for the annual income tax:

You can follow this step-by-step guide on filing BIR Form 1701Q and BIR Form 1701.

You can follow this step-by-step guide on filing BIR Form 1701Q and BIR Form 1701.

However, be extra careful with this section if it’s your first time filing.

The tax deduction scheme you choose in the first-quarter form will be set for the entire year, and you can’t change it if you make a mistake.

So choose wisely among the three:

- Itemized Deduction

- Optional Standard Deduction

- 8% in Lieu of Percentage Tax

Common Deductions and Tax Credits

Among the three, professionals and businesses use itemized deductions to maximize their tax savings when they have many expenses.

However, avoid using unrelated expenses. The ones you claim should be necessary and normal for your practice. The BIR may require supporting documents like contracts and receipts, so keep those as well.

For example, remote workers can deduct home office renovation expenses, supplies, app subscriptions, and other expenses directly related to their work.

On the other hand, you can’t deduct your spa and relaxation expenses from your taxable income.

If you opt for the optional standard deduction or 8% tax rate in lieu of percentage tax, you don’t need to keep receipts since a fixed percentage will be deducted from your gross income.

It’s easier for remote workers and often results in a lower tax liability. You can find sample computations in earlier sections of this article.

Understanding Withholding Tax

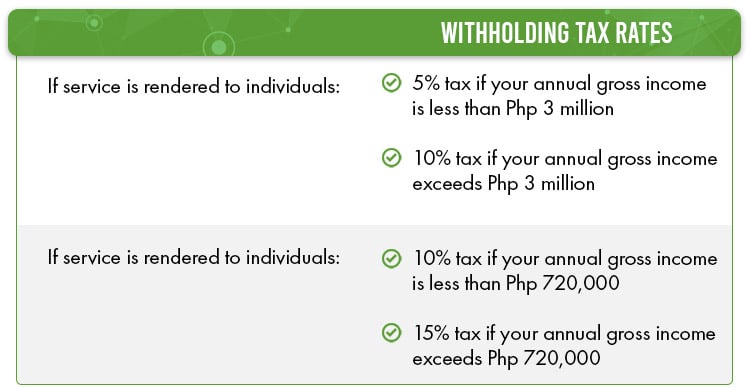

When you get paid by an employer or receive a professional fee from a local client, you’re subject to withholding tax. Here’s a fresh graduate guide to withholding taxes.

What is Withholding Tax?

Withholding tax is a preemptive tax deducted from an individual’s income or a company’s earnings before it is paid out.

There are 2 types of withholding tax: Creditable Withholding Tax (CWT) and Final Withholding tax.

Creditable Withholding Tax (CWT) is the tax that individuals and corporations pay annually based on their income. Here are two types that are most relevant for fresh graduates:

- Withholding tax on compensation – the tax deducted from an employee’s income by their employer.

- Expanded withholding tax – applies to certain types of income payments (e.g professional fees and commissions). You can use it as tax credits to reduce your total income tax liability when you file your annual tax return.

On the other hand, final withholding tax applies to specific incomes like interest payments, lottery winnings, and stock dividends.

Unlike creditable withholding tax, you can’t use it as a tax credit.

Creditable Withholding Taxes

In this article, we will focus on creditable withholding taxes on your income.

Think about it like an advance payment to the BIR, collected by your client or employer on your behalf.

So when you receive your salary or professional fees, the tax is already deducted.

This ensures taxes are paid gradually during the year, sparing you from having to make a large lump-sum payment when you file your annual tax return.

It also helps the government maintain a steady flow of revenue. Later on, you can use the tax withheld as credits for your income tax liability.

Ensuring Correct Withholding Tax

Computing your withholding tax is different for self-employed individuals and employees.

For self-employed individuals, here are the tax rates.

For example, let’s say you have a contract with a corporation for Php 70,000 to create a website. The corporation will usually withhold Php 7,000 from your professional fee.

You can then request BIR form 2307: Certificate of Creditable Tax Withheld at Source from your client and then apply it to your tax liabilities as supporting documents.

So in the same example, if you computed a total income tax liability of Php 100,000 for the year. You will only pay Php 93,000 if you include the BIR form 2307 from your client.

For employees, your company calculates your withholding tax. However, you can use this formula to verify if it’s correct:

Taxable Income = Gross Taxable Income minus Non-Taxable Deductions

Gross Taxable Income includes Monthly Basic Salary, Holiday Pay, Overtime Pay, Night Differential, and Other Taxable Allowances.

Non-Taxable Income includes PHIC (Philhealth) Contributions, SSS Contributions, Pag-IBIG (HDMF) Contributions, Unpaid Leaves/Absences, and Tardiness Deductions.

Not that you only include the “employee’s part” you paid for SSS, Philhealth, and PAG-IBIG.

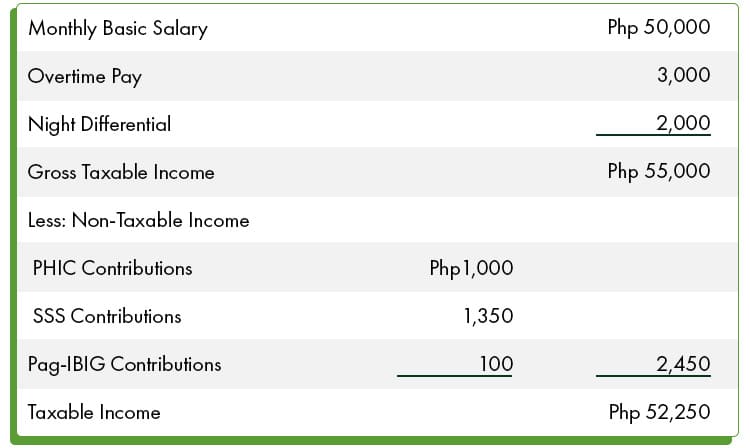

For example, let’s say your gross taxable income is Php 55,000 per month, with non-taxable income which includes:

To calculate your taxable income, subtract the non-taxable deductions from the gross taxable income. In this case, that’s Php 55,000 minus 2,450 which totals to Php 52,250.

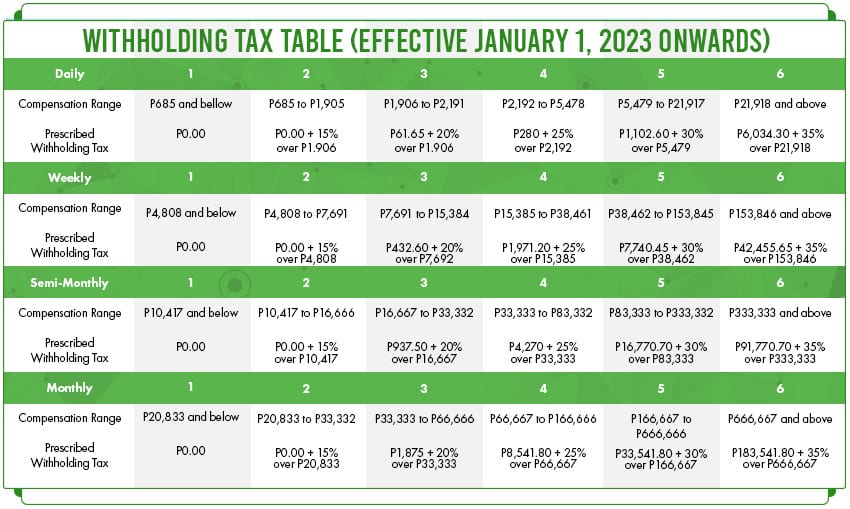

Afterwards, you can check the tax table by the BIR.

Thus, you can use the withholding tax amount from the 3rd column of the monthly row.

The withholding tax for the month is calculated as Php 1,875 plus Php 3,783.40 (20% of Php 18,918), totaling Php 5,658.40.

Honestly, it can feel like a really complicated process. That’s why the BIR created a tax calculator to help you determine your withholding tax and ensure accuracy.

Understanding BIR Form 2316

Now that you understand withholding tax, how do you know if your company is paying it?

BIR Form 2316 is proof of your total income and taxes withheld by your employer, confirming that taxes are paid.

This document also serves as proof of tax compliance and provides eligibility for loans or government services.

Also, some employees are mixed-income earners, which means they earn from both a job and a business or profession.

So, as with BIR form 2307, you need the BIR form 2316 to claim tax credits as well.

You can check this guide on filing taxes for mixed income earners.

Navigating Employee Benefits in the Philippines

Understanding employee benefits is essential for fresh graduates as it helps them make the most of their compensation, know their rights to health insurance and retirement contributions, and make informed decisions when accepting job offers.

Here’s a fresh graduate guide to know more about employee benefits available in the Philippines.

Overview of Mandatory Benefits

The Philippine government requires employers to provide mandatory benefits for all working Filipinos, namely SSS, PhilHealth, and Pag-IBIG benefits.

The SSS (social security system) provides financial assistance for retirement, disability, death, and sickness. It also offers maternity benefits and salary loans to help its members in times of need.

On the other hand, PhilHealth offers health insurance coverage to help with medical expenses. It provides financial aid for hospital stays, surgeries, and other healthcare services.

Lastly, Pag-IBIG Focuses on housing and savings. It offers affordable housing loans, as well as a savings program with dividends that employees can use for future financial needs.

Together, these benefits support financial security, health, and housing, helping Filipinos achieve a more stable and secure future when they retire.

If you haven’t already, check this guide to register for SSS, PhilHealth, and PAG-IBIG.

Computing Your SSS, Philhealth, and PAG-IBIG contributions.

Your employer typically computes your mandatory benefits, but here’s a guide to help you calculate them yourself.

SSS Contributions

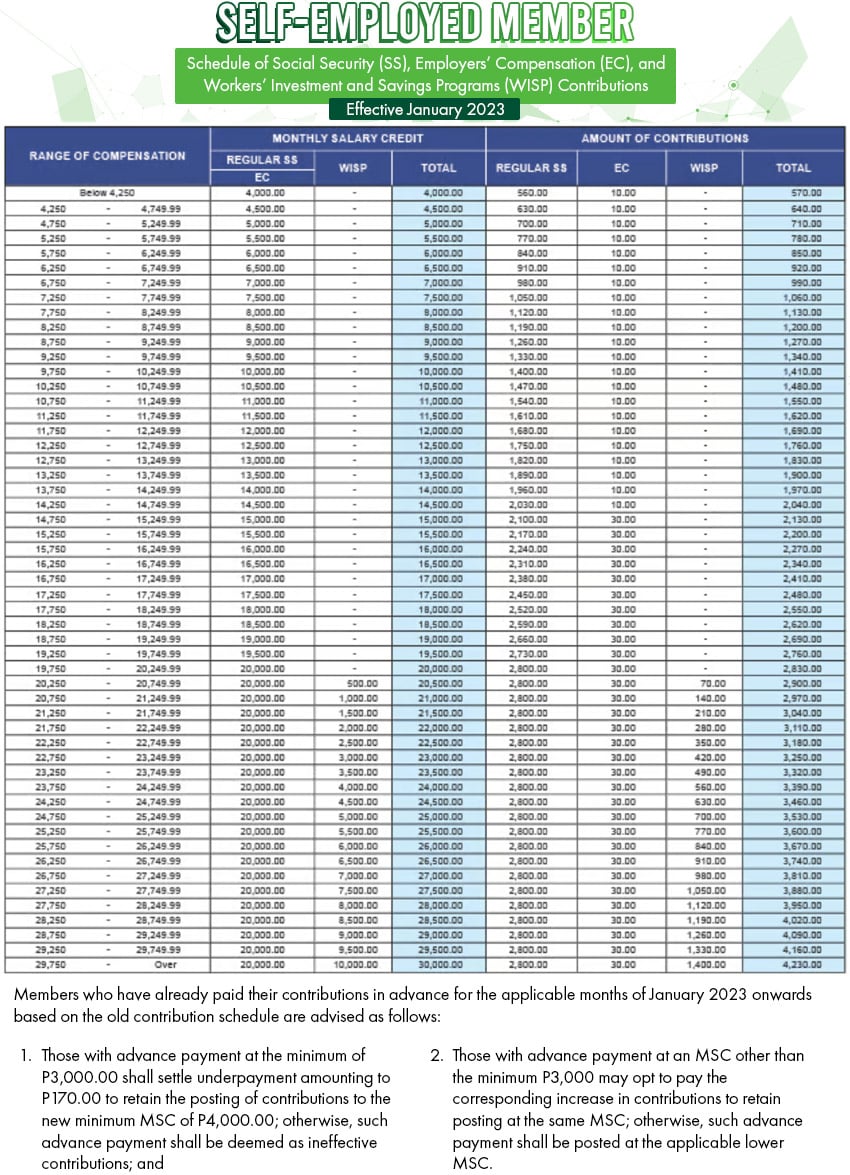

After your SSS registration, paying your contributions depends on your gross income, and you can find the amounts in the table below.

For employees, there will be an ER (employer’s share) and EE (employee’s share) column, because your employer will deduct your share from your salary and contribute their portion separately.

Also, there’s a column for EC (Employee’s Compensation), which helps workers who suffer from work-related sickness, injury, disability, or death. These benefits can be received alongside those from the social security program.

Moreover, incomes above Php 20,250 will have an extra contribution under the Worker’s Investment and Savings Program (WISP) for additional long-term savings and investment.

So for example, you’re earning Php 30,000 per month. Your SSS contribution will amount to:

Only the Php 1,350 will be deducted from your pay and be remitted to the SSS.

Only the Php 1,350 will be deducted from your pay and be remitted to the SSS.

For self-employed individuals, the process is the same, but you will pay the full amount yourself, unlike employees who share the cost with their employer.

You can check this table for the contribution amounts.

PhilHealth Contributions

PhilHealth is a key part of the mandatory benefits system in the Philippines, offering important health insurance coverage for all workers.

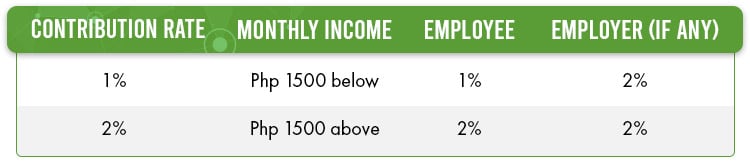

After your Philhealth registration, you can refer to the table below to compute your contributions.

The contribution ranges from Php 500 to a maximum of Php 5,000, split equally between the employer and employee.

For example, if you earn Php 25,000 a month, your PhilHealth premium will be Php 1,250. However, only Php 625 will be deducted from your pay – with your employer providing the other half.

If you’re self-employed, you’ll pay the full amount.

PAG-IBIG Contributions

PAG-IBIG contributions offer savings and affordable housing loans to Filipino workers.

The name stands for “Pagtutulungan sa Kinabukasan: Ikaw, Bangko, Industriya at Gobyerno,” reflecting its goal of providing financial security and housing opportunities for Filipinos.

Here’s how much you’ll need contribute based on your monthly income:

The maximum salary used for computation is Php 10,000.

For example, let’s say your monthly salary is Php 25,000. Only Php 200 (Php 10,000 x 2%) will be deducted from your pay. The other half will be provided by your employer.

So, in total, you should have a total of Php 400 in contributions to your PAG-IBIG fund.

As for self-employed individuals, you will only pay Php 200 (Php 10,000 x 2%) since you have no employer.

You can also choose to contribute more if you want to build up a more substantial fund for the future.

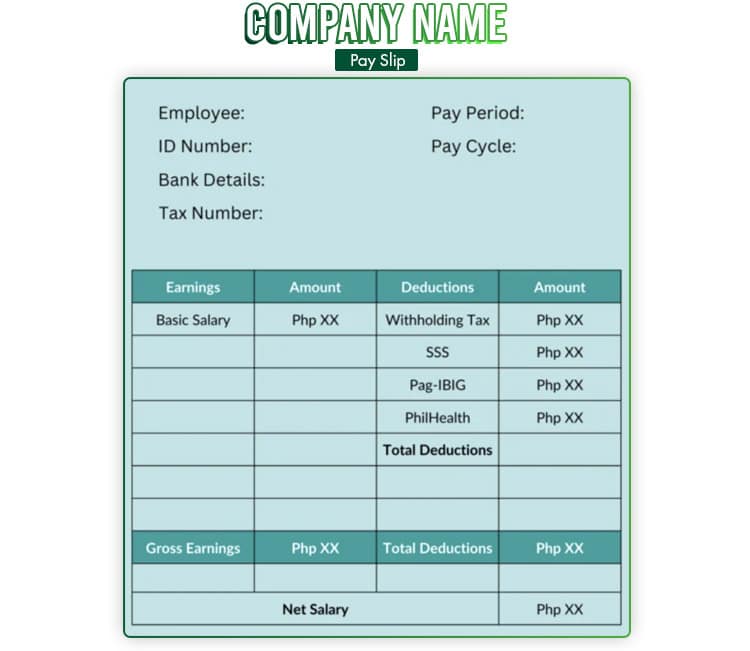

Understanding Your Payslip

Along with your salary, you’ll receive a payslip that details your earnings and the deductions made.

Your payslip understanding is key to ensuring you’re paid correctly, tracking your benefits and contributions, and confirming that all deductions are accurate and follow company and legal guidelines.

Let’s break down what you’ll find on your payslip:

Breakdown of a Typical Filipino Payslip

Earnings can include basic salary, overtime pay, night differential, and bonuses. The total of these is your gross pay or gross earnings.

Earnings can include basic salary, overtime pay, night differential, and bonuses. The total of these is your gross pay or gross earnings.

On the other hand, common deductions include withholding taxes, SSS, PAG-IBIG, and Philhealth premiums.

It can also include payroll deductions such as loan payments or union dues.

Subtracting your total deductions from your gross pay gives you your net salary, which is the amount you receive on payday.

Importance of Payslip Accuracy

Unfortunately, your HR can make mistakes with your pay. So it’s important to check your payslip every time.

You can check the previous sections for the computation of your taxes, SSS, Philhealth, and PAG-IBIG deductions.

If you spot errors on your payslip, report them to your HR right away and provide any proof to resolve the issue faster.

Usually, payroll adjustments will be credited at the next pay cycle.

Other Common Benefits

Aside from the basic pay, employees are also entitled to monetary benefits throughout the year. The most common ones are overtime pay, holiday pay, and a 13th-month bonus.

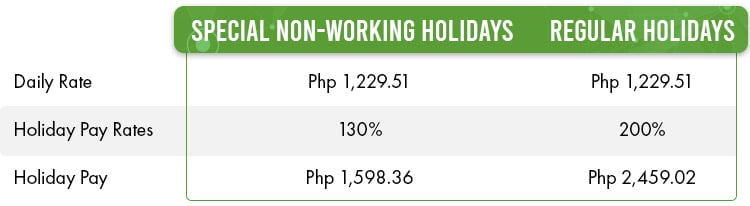

Holiday Pay

Holiday pay is additional compensation given to employees who work on official holidays, calculated based on their regular daily rate.

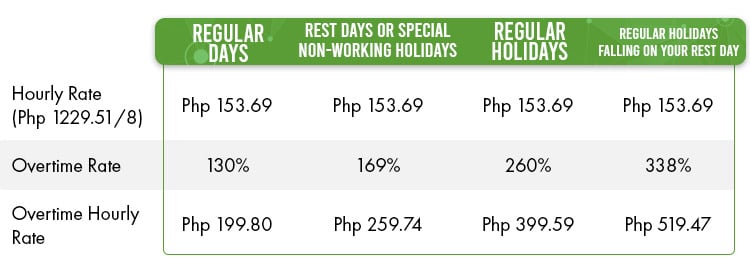

The rates are as follows:

Rest days aren’t considered holidays, but if you work on your rest day, you earn 130% of your daily rate, similar to special non-working holidays.

This will come in handy for computations in further sections of this article.

So what’s the difference between non-working holidays and regular holidays?

On regular holidays, you still get paid 100% of your daily rate even if you don’t work. For special non-working holidays, you don’t get paid if you don’t work.

Regular Public Holidays

Regular public holidays are established by the labor code and include major celebrations such as:

- New Year’s Day – January 1

- Maundy Thursday – date varies per year

- Good Friday – date varies per year

- Araw ng Kagitingan – April 9

- Labor Day – May 1

- Independence Day – June 12

- National Heroes Day – Last Monday of August

- Bonifacio Day – November 30

- Christmas Day – December 25

- Rizal Day – December 30

Take note that these national holidays can be moved or adjusted by the President of the Philippines through official proclamations.

Special non-working holidays

In contrast, special non-working holidays are declared by the President through annual proclamations. For the past years, these included:

- Day after New Year’s Day – January 2

- EDSA People Power Revolution – February 25

- Eid’l Fitr – date varies per year

- Black Saturday – date varies per year

- Eid’l Adha – date varies per year

- Ninoy Aquino Day – August 21

- Barangay and Sangguniang Kabataan elections – October 30

- All Saints’ Day – November 1

- All Souls’ Day – November 2

- Feast of the Immaculate Conception of Mary – December 8

- Last Day of the Year – December 31

The dates of special non-working holidays can be adjusted or may not be declared as holidays at all each year, depending on the government’s decisions.

Let’s proceed to calculating salary differentials.

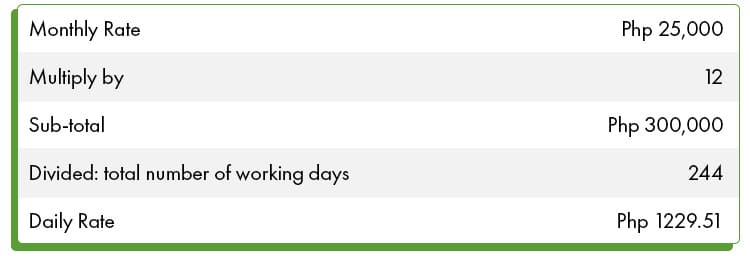

For example, your salary is Php 25,000 per month and you worked on a holiday during the year.

You can calculate your your daily rate with this formula:

Daily rate = (Monthly rate x 12) / total working days in a year.

So for this year, that will amount to:

The number of working days changes each year, so you’ll need to wait for the government’s yearly announcement to know the exact count.

Your holiday pay will be:

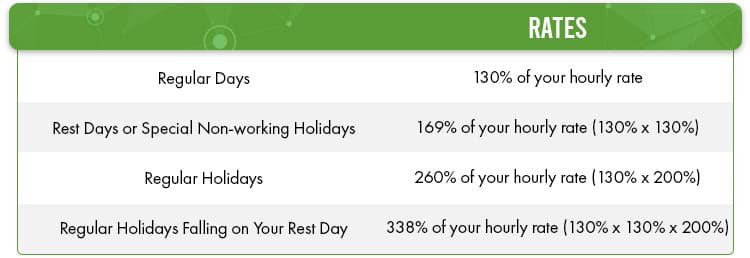

Overtime Pay

Employees are also entitled to overtime pay for hours worked beyond the standard work hours.

Generally, overtime pay is 130% of your hourly rate (your daily rate divided by 8 hours). The rate increases if the overtime falls on a holiday or your rest day.

So using the example in the previous section, here’s how your overtime pay will vary depending on the date it was worked.

You can then multiply these hourly rates with the number of hours you worked overtime.

13th-month Pay

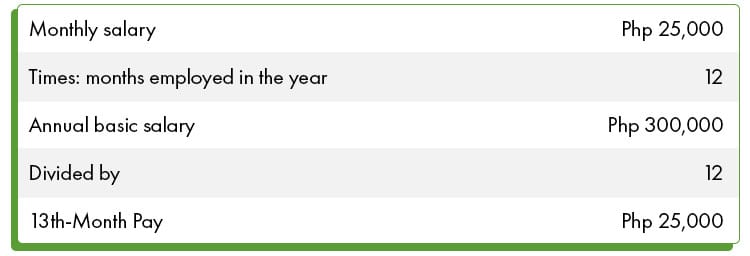

As required by Presidential Decree No. 851, employees will receive 1/12th of their annual basic salary as 13th-month pay, typically given before December 24 to help with holiday expenses.

Here’s how you can compute your 13th-month pay:

13th-month pay = Total annual basic salary / 12

Do note that your basic salary doesn’t include overtime pay, holiday pay, night differential, bonuses, incentives, commissions, and allowances.

So for most people, it’s just dividing your annual salary by 12.

For example, if you earn Php 25,000 per month, you can compute your bonus as:

Do note that you’ll only receive the full Php 25,000 if you worked for the company for the entire year (January to December).

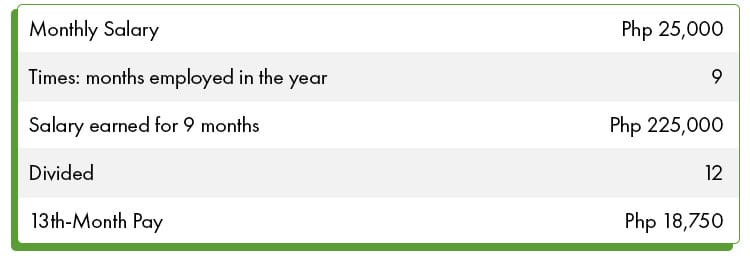

What if you were hired at the beginning of April this year? Will you still get a bonus?

Yes! You’d still receive a bonus, but it will be prorated based on how many months you worked.

Using the same figures on the previous example, your bonus will be:

Note that your 13th-month pay plus other qualified benefits (e.g. de minimis fringe benefits) are non-taxable up to Php 90,000 for the calendar year.

So if you earn Php 100,000 a month and get a Php 100,000 13th-month pay, the Php 10,000 excess will be part of your taxable income.

Maximizing Your SSS, PhilHealth, and PAG-IBIG Benefits

Understanding your SSS, PhilHealth, and PAG-IBIG benefits is essential for financial security and healthcare support.

Here’s how to maximize these government-mandated benefits.

Claiming SSS Benefits

The Social Security System (SSS) helps members during times of need. Here are the benefits you can claim.

- Retirement Benefit – Financial support during retirement through monthly pensions or lump sums.

- Disability Benefit – Monthly pensions or lump sums for partial or total disabilities.

- Sickness Benefit – Daily cash allowance for up to 120 days if you’re unable to work due to illness or injury.

- Maternity Benefit – Cash benefit for female members for up to 105 days for childbirth or miscarriage.

- Death Benefit – Monthly pension or lump sum for a deceased member’s beneficiaries.

- Funeral Benefit – Financial help for funeral costs.

- Salary Loan – Short-term loan for financial emergencies.

Note: If you’re employed, you can file some claims and request benefits through your HR.

For self-employed individuals, you can file at the nearest SSS branch or through your My.SSS account. Click the link on the benefit above for the steps and requirements.

Overview of PhilHealth Benefits

PhilHealth provides affordable healthcare coverage, helping members with medical expenses such as hospital stays, surgeries, and other healthcare services.

Currently, here are the illnesses currently covered.

To claim your benefits, just follow these simple steps.

- Complete PhilHealth Claim Form 1 and submit it along with supporting documents like a valid ID and medical records. Usually the hospital has a dedicated counter for Philhealth submissions.

- The hospital will deduct your PhilHealth benefits from your bill.

If the benefit wasn’t deducted, you can file your claim directly at a PhilHealth branch.

PAG-IBIG Benefits:

Pag-IBIG provides savings programs and housing loans for employees and members. You can enjoy the following:

PAG-IBIG Regular Savings Program

A mandatory savings program where members contribute monthly, earning tax-free dividends for long-term savings. This is where your monthly Pag-IBIG contributions go.

PAG-IBIG MP2 Savings Program

A voluntary, high-dividend and tax-free savings option for members with a five-year maturity period. For the past years, dividends ranged from 6-8% per annum.

Refer to this link for the requirements.

PAG-IBIG Housing Loans

A loan program that helps members buy, build, or improve their homes with affordable rates.

Follow this link for the requirements.

PAG-IBIG Multi Purpose Loan

A short-term loan for personal use, allowing members to borrow up to 80% of their Pag-IBIG savings. You can use this loan for your emergency purchases or even start your own business!

Here’s the link with the requirements.

PAG-IBIG Calamity Loan

A low-interest loan for members affected by natural disasters, repayable over 24 months.

Check out this link to see the requirements.

PAG-IBIG Home Equity Appreciation Loan (HEAL)

A loan that lets members borrow against the increased value of their property.

Check this link for the requirements.

Importance of Updating Records

Updating your records is crucial. Without it, you might face issues with SSS, PhilHealth, or Pag-IBIG, such as delays in benefits, loans, or coverage.

- SSS (Social Security System): Incorrect records can affect your contributions, leading to reduced or delayed benefits like loans, pensions, or sickness benefits.

- PhilHealth: Outdated information may block your access to health benefits when you need medical services.

- Pag-IBIG: Wrong records can delay housing loans, multi-purpose loans, or savings withdrawals and impact your contributions and dividends.

With this, keep your records updated to prevent problems. Be sure to check these important details.

Personal Information:

- Change of name (due to marriage or other legal reasons)

- Change in civil status (single, married, widowed, etc.)

Contact Information:

- Updated home address

- New phone number or email address

Beneficiaries:

- Adding or changing beneficiaries (spouse, children, parents, etc.)

Employment Details:

- Change of employer

- Shift from employment to self-employment or voluntary contributions

Dependents:

- Adding or removing qualified dependents (e.g., children, parents)

Bank Account Details:

- For receiving benefits or loan proceeds

So how do you update your information with SSS, PAG-IBIG, and PhilHealth? Here are a few steps.

SSS (Social Security System)

- Online:

- Log in to your My.SSS account on the SSS website.

- Navigate to “Member Info” to update your details.

- Upload the necessary documents for verification (e.g., marriage certificate for name changes).

- In-person:

- Visit an SSS branch with a completed Member Data Change Request Form (SSS Form E-4) and supporting documents.

- Submit the form and documents for processing.

PhilHealth

- Online:

- Download the PhilHealth Member Registration Form (PMRF) and fill out the items needed to be updated.

- Scan two Valid IDs.

- Send to actioncenter@philhealth.gov.ph or ofp@philhealth.gov.ph

- In-person:

- Go to a PhilHealth office with a filled-out PhilHealth Member Registration Form (PMRF) and required documents (e.g., birth certificate for dependents).

- Bring 2 Valid IDs.

- Submit the form and documents to update your records.

Pag-IBIG

- In-person:

- Visit a Pag-IBIG branch and submit a Member’s Change of Information Form (MCIF) with supporting documents (e.g., valid ID for address changes).

- Bring a valid ID and a photocopy.

- The staff will process the updates.

Voluntary Contributions for Freelancers and Self-Employed Individuals

Self-employed individuals may avail SSS, Philhealth, and PAG-IBIG by voluntary contributions.

The difference is you’ll pay the full amount since you don’t have an employer to share the cost.

You can check the previous sections for the schedule of premiums for SSS, Philhealth, and PAG-IBIG applicable to your income.

How to Continue Contributing to SSS, PhilHealth, and Pag-IBIG

What if you’re a previous employee who decided to become self-employed?

Yes, you can still continue your contributions. Just follow this complete guide to voluntary SSS, Philhealth, and PAG-IBIG contributions.

Benefits of Voluntary Contributions

Voluntary contributions to SSS, PhilHealth, and Pag-IBIG allow freelancers and self-employed individuals to maintain safety nets for financial security.

Here’s a deeper look:

Retirement Security

Voluntary contributions to the SSS allow freelancers and self-employed individuals to secure a pension for their future.

Upon reaching the required number of contributions and retirement age, members will be entitled to monthly pension payments or lump sum benefits, which contribute to financial stability in old age.

Additionally, voluntary SSS members are still eligible for other benefits like sickness, disability, and death benefits, which provide a cushion for unforeseen circumstances.

Health Coverage

By making PhilHealth contributions, self-employed individuals maintain access to healthcare services that significantly reduce medical expenses.

PhilHealth coverage includes hospitalization, outpatient care, maternity benefits, and emergency services, providing you with affordable healthcare options.

It is especially important for freelancers who don’t have health insurance from their employers.

Housing and Savings

Pag-IBIG contributions enable you to access various financial services such as low-interest housing loans, multi-purpose loans, and calamity loans.

By maintaining voluntary contributions, you accumulate savings over time, which can later be used for housing investments or other financial needs.

Pag-IBIG also offers a savings program that grows your contributions, allowing you to plan for future large purchases or even allocate for emergency funds.

Maintaining these voluntary contributions gives freelancers and self-employed individuals access to the same benefits that regular employees have.

Voluntary contributions can provide financial support and peace of mind during retirement, illness, or emergencies.

Steps to Switch to Voluntary Contributions

Switching to voluntary contributions is straightforward but requires updating your membership status to “Self-Employed.”

Voluntary contributions allow freelancers, self-employed individuals, and those without formal employment to continue accessing essential benefits like retirement pensions, healthcare coverage, and housing loans -even without a traditional employer.

Here are the steps that you have to follow if you want to pay for your own monthly contributions to SSS, PhilHealth, and Pag-IBIG:

SSS:

- Download and complete two copies of the Member’s Data Change Request form (SSS Form E4).

- Under Change Membership Type, select “To Self-employed” and indicate your profession or business, the year it started, and your monthly income.

- Submit the completed forms along with a photocopy of your Unified Multi-Purpose ID (UMID) card to the nearest SSS branch. Bring your actual UMID card as well for validation.

PhilHealth:

- Download the PhilHealth Member Registration Form (PMRF).

- In the upper-right corner, check the box for Updating/Amendment.

- Complete the form, selecting Self-earning Individual under Member Type and indicating your estimated monthly income.

- Submit the filled-out PMRF at your nearest PhilHealth branch.

- Wait for the printed copy or email with your updated membership information.

Pag-IBIG:

- Download and complete the Pag-IBIG Member’s Data Form (MDF).

- Under Membership category, select “Self-employed.”

- Submit the completed MDF along with supporting documents to your nearest Pag-IBIG branch.

- Obtain a payment order form, then proceed to the cash division to pay your Pag-IBIG contribution.

You can monitor your voluntary contributions through the following:

- SSS. Register for an account on the SSS website to track your payments and benefits.

- PhilHealth. Use the PhilHealth Member Portal to view your contribution history and check your coverage status.

- Pag-IBIG. Access the Pag-IBIG Virtual Portal to track your savings, loans, and contributions.

By regularly monitoring your contributions, you guarantee that your benefits are updated and accessible.

Essential Government IDs for Fresh Graduates in the Philippines

Aside from securing your first job, obtaining the essential government IDs is key to participating in the formal workforce.

These IDs allow you to enjoy employee benefits, manage your taxes, and stay compliant with legal requirements, among other things.

Let’s break down the important documents and processes, starting with the Tax Identification Number (TIN).

Tax Identification Number (TIN)

One of the most essential government IDs you’ll need is the Tax Identification Number (TIN) issued by the Bureau of Internal Revenue (BIR).

This unique number is used to monitor your tax obligations as a working individual in the Philippines.

Importance of Obtaining a TIN

Getting your TIN enables you to:

- pay taxes and comply with national tax laws.

- open a bank account, get a job, or apply for loans.

- claim tax exemptions or benefits as an employee.

How to Apply for a TIN

Applying for a TIN is relatively straightforward.

There are two ways to do it: manual registration and online application.

- Manual Application:

-

- Visit your local BIR Revenue District Office (RDO).

-

- Fill out BIR Form 1902 for employee registration.

- Submit your completed form along with valid IDs (e.g., Birth Certificate, Passport).

- Wait for your TIN to be issued.

- Online Application:

- Go to the Online Registration and Update System (ORUS).

-

- Create an account and complete the required fields.

- Follow the instructions to verify and submit documents.

Currently, an online TIN application is primarily available for self-employed individuals and online sellers, while employees typically need to register in person through their employer.

Uses of a TIN in Daily Life

Your TIN plays a key role in several everyday scenarios:

- Employment. You need a TIN to receive your salary, compute taxes, and track your SSS and PhilHealth contributions.

- Banking. You can use a TIN to open accounts, apply for loans, or use financial services.

- Government Transactions. Essential for SSS registration, PhilHealth benefits, and Pag-IBIG savings.

- Business. Required for business registration and paying taxes.

Here are the best ways to protect your TIN from misuse:

- Keep your TIN confidential to avoid identity theft.

- Only provide your TIN to legitimate institutions, and monitor its use to ensure it isn’t used in fraudulent transactions.

SSS, PhilHealth, and Pag-IBIG IDs

After securing your TIN, the next step is obtaining your SSS, PhilHealth, and Pag-IBIG IDs.

These IDs are essential for accessing social security, healthcare, and housing benefits, helping you protect your future and maximize your employment benefits.

Let’s walk through the process of registering for these essential IDs.

Registration and Application Process

Here is the step-by-step process for registering and applying for each of these essential government IDs.

Whether you’re doing it manually or online, we’ve got you covered with the necessary documents and where to apply.

Manual Application:

- SSS (Social Security System). To register, visit the nearest SSS branch and fill out SSS Form E-1. You will need to submit this form along with a valid ID (such as your passport, driver’s license, or birth certificate) as proof of identification.

- PhilHealth. Fill out the PhilHealth Member Registration Form (PMRF) and submit it to the nearest PhilHealth branch or send it via mail. Attach a valid government ID with the form to complete the process.

- Pag-IBIG. For your Pag-IBIG membership, you need to complete the Membership Registration/Remittance Form (MRF) and submit it to the nearest Pag-IBIG branch. Ensure you bring your TIN and a valid ID.

Online Application:

- SSS. Register online by going to the official SSS website. Create an account using your email address, follow the instructions to fill out the necessary details, and complete the e-registration process. Once registered, you will be assigned an SSS number which will serve as your permanent SSS ID.

- PhilHealth. You can register through the PhilHealth website or by downloading the PhilHealth mobile app. Fill out the PMRF and upload a scanned copy of your valid ID to complete the online registration.

- Pag-IBIG. Visit the Pag-IBIG online portal, create an account, and follow the on-screen instructions to fill out your registration details. Once completed, you’ll receive a Pag-IBIG number, which can be used for all future transactions with the agency.

By following either manual or online processes, you can secure your SSS, PhilHealth, and Pag-IBIG IDs quickly and efficiently.

Benefits of Having These IDs

Having your SSS, PhilHealth, and Pag-IBIG IDs unlocks numerous benefits as you enter the workforce.

These IDs can provide crucial support in areas like healthcare, retirement, housing, and emergency assistance.

Understanding the value of these benefits early on can help you make the most of what each institution offers, and better equip you for any challenges that may come your way.

- SSS Benefits. As a member of the Social Security System (SSS), you are entitled to a range of benefits, including:

- Disability benefits. Financial support in case of a partial or total permanent disability.

- Maternity benefits. Cash benefits for female members who go on maternity leave.

- Retirement benefits. Pension payments or lump sums upon retirement.

- Death benefits. Support for beneficiaries in case of the member’s death, including funeral grants.

- PhilHealth. This agency provides access to affordable healthcare services, covering both in-patient and out-patient treatments.

Members can also benefit from hospitalization coverage, medical consultations, and surgical procedures, among others.

This guarantees financial assistance for both health emergencies or scheduled medical procedures.

- Pag-IBIG. Your contributions towards this institution go towards housing loan programs, short-term loans, and calamity assistance.

The savings plan also allows members to invest in their future by accumulating funds for major life events, such as purchasing a home or dealing with an unexpected crisis.

Having these IDs provides you with more security and helps you access benefits that can support your personal and financial well-being throughout your working life- and beyond.

How to Replace Lost IDs

Losing your SSS, PhilHealth, or Pag-IBIG IDs can be stressful, but replacing them can be pretty straightforward:

- SSS. Visit your nearest SSS branch and fill out a replacement request form. Bring a valid ID for verification.

- PhilHealth. Go to a local PhilHealth office, submit the replacement request form, and provide a valid ID.

- Pag-IBIG. Head to a Pag-IBIG branch, submit a replacement request form, and present identification.

Remember to keep copies of your ID numbers to simplify the replacement process.

Philippine Postal ID and UMID

Once you’ve secured your essential IDs, like the TIN, SSS, PhilHealth, and Pag-IBIG, you’ll want to explore getting a Philippine Postal ID and Unified Multi-Purpose ID (UMID).

These IDs serve also as valid government-issued identification and make transactions smoother across various government services.

Applying for a Philippine Postal ID

The Philippine Postal ID is one of the most accessible and widely accepted forms of identification in the country.

Here’s how to get one:

- Requirements. A completed application form, two copies of government-issued ID, and proof of address.

- Process. Visit any post office, submit the documents, and have your biometrics captured. Processing takes 10 to 15 working days.

- Cost. The fee for a Postal ID is PHP 504, but it’s PHP 650 if you want to get it faster.

- Uses. This ID comes in handy for bank transactions, passport application, and various government services.

Overview of the Unified Multi-Purpose ID (UMID)

The UMID consolidates your SSS, GSIS, PhilHealth, and Pag-IBIG information into one card. Here’s what you need to know about your UMID application:

- Benefits:

- Unified access to government services.

- Can be used to verify your identity throughout the country.

- How to apply:

- Requirements: Submit a filled-out application form, valid ID, and a recent 1×1 photo.

-

- Process: Visit your nearest SSS or GSIS branch, submit the documents, and have your biometrics taken.

How to Use UMID for Government Services

The UMID streamlines access to essential government services by consolidating your information for SSS, GSIS, PhilHealth, and Pag-IBIG.

Here’s how you can use it:

- SSS and GSIS Benefits. Present your UMID for quick access to retirement benefits, loans, and claims.

- PhilHealth and Pag-IBIG. Use it to track contributions, apply for healthcare benefits, and access housing loans.

If you want to update your UMID information, visit your SSS or GSIS branch with valid supporting documents for any updates (e.g., name or address changes) and submit an update request form.

Voter’s ID and Passport

After securing your primary government IDs, it is time to register to vote and obtain a passport. Both of these are essential for exercising your rights as a citizen and for travel purposes.

Here’s a quick guide to getting these important documents.

Registering to Vote in the Philippines

For fresh graduates, voter registration is a critical step in participating in national and local elections.

Did you know that Filipinos can begin voting as early as 15 years old for the Sangguniang Kabataan (SK) elections?

So, if you haven’t registered yet, now is the time to practice your rights as a young professional and contribute to shaping the Philippines’ future through your right to suffrage.

Here’s how you can register:

- Visit the nearest COMELEC office.

- Submit a completed application form and provide two valid IDs and proof of residence.

- Undergo biometrics capture.

Note that applying for a voter’s ID is free and the processing can take several months to a year.

If your ID is not yet available, you will be given a voter’s registration receipt, which contains your voter’s number.

This receipt is important, as it allows you to vote in upcoming elections even without the physical ID.

Applying for a Philippine Passport

A passport is an important document for both travel and identification. If you are applying for a passport for the first time, here’s what you need to know:

- Schedule an appointment through the Department of Foreign Affairs (DFA) website.

- Prepare necessary documents, including a valid ID, birth certificate, and printed application form.

- Appear at your appointment for document verification and biometrics capture.

- Pay the application fee (around PHP 950 for regular processing or PHP 1,200 for expedited processing).

A passport is essential for international travel and also as a reliable form of identification within the Philippines.

Tips for Maintaining and Renewing Your IDs

To guarantee you are always ready for important transactions, follow these tips for keeping your IDs safe and up to date:

- Keep digital copies of your IDs as backups in case of loss.

- Store your physical IDs in a safe place where they won’t be damaged.

- Renew your IDs early to avoid processing delays, especially for passports and government IDs that expire after a set period.

For the renewal process, keep this information in mind:

- SSS, PhilHealth, Pag-IBIG, and UMID. Visit the relevant branch and submit updated personal information as needed.

- Passport Renewal. For passport renewal, follow the same steps as the first-time application, with additional documents like your expiring passport.

An online reservation is needed to secure an appointment with the Department of Foreign Affairs (DFA), as walk-ins are typically not accommodated.

Make sure to book your slot through the DFA website to avoid delays.

FAQS

Need more help? Here are some answers to some frequently asked questions.

How do I register with the Bureau of Internal Revenue (BIR) if I’m working remotely for a foreign company?

It depends on the setup. If you’re an employee and the company operates in the Philippines, you’ll likely register as an employee, even for remote work.

If you’re an independent contractor, you’ll need to register as self-employed.

Refer to the earlier sections for BIR’s registration steps.

How does being an independent contractor or freelancer affect my SSS, PhilHealth, and Pag-IBIG contributions?

You’ll still get the same benefits, but you’ll have to pay the full amount yourself since you can’t split the costs with your employer.

What should I know about the Pag-IBIG MP2 Savings Program as a fresh graduate?

Pag-IBIG MP2 is a voluntary savings program with higher interest rates. You can start with as little as ₱500, and it has a 5-year term.

It’s open to all active Pag-IBIG members and has no income requirement.

So with the extensive guide provided above, you can start adulting more confidently as a fresh graduate.

Whether it’s understanding taxes, maximizing benefits, or getting valid IDs, these steps will help you build a strong financial foundation.

Enjoy your journey to financial independence on the road ahead!