We all want to secure our future.

We may be strong enough to work in our current online jobs, but we don’t know what tomorrow may bring. Thus, you should consider applying for voluntary contributions for your SSS, PhilHealth, and Pag-IBIG.

Unlike their in-office counterparts, independent contractors, freelancers, and self-employed individuals don’t have automatic access to the same benefits.

That said, you can still opt to set up voluntary contributions. This means you’ll be the one deducting the contributions for your SSS, Pag-IBIG, and PhilHealth accounts. Signing up for these lets you enjoy the benefits of paying your voluntary contributions, particularly access to a retirement fund, housing loans, and health insurance.

But how do you start applying for voluntary contributions? Here’s a guide to help you get started.

Update Your SSS, Pag-IBIG, and PhilHealth Status to Self-employed.

The first step in applying for voluntary contributions is changing your status in SSS, Pag-IBIG, and PhilHealth from employed to self-employed.

If it’s your first time to register with these three agencies, here’s a guide on what you need to do.

If you’re just updating your current account, here’s a step-by-step guide on what to do.

(Note that this involves going to your nearby branch to fill out forms, so you may want to allot an entire day for these.)

Updating Your SSS to Self-Employed.

To change your status in SSS to self-employed:

- Download and complete two copies of the Member’s Data Change Request form (SSS form E4).

- Under the Change Membership Type, choose: To Self-employed. Under that field, indicate your profession/business, the year it started, and your monthly income.

- Submit the accomplished forms with a photocopy of your Unified Multi-purpose ID (UMID) card. You also need to present your physical UMID card as well.

Updating Your PhilHealth to Self-employed.

Updating Your PhilHealth to Self-employed.

Here’s how to update your PhilHealth membership to self-employed:

- Download the PhilHealth Member Registration Form (PMRF).

- On the PMRF’s upper-right corner, check Updating/Ammendment.

- Finish filling out the form: under the IV. Member Type, select Self-earning Individual and state your estimated monthly income.

- Submit your filled-out PMRF to your nearest PhilHealth branch.

- Wait for the printed copy or email of your updated PMRF.

Updating Your Pag-IBIG to Self-employed.

To change your Pag-IBIG membership status, here’s what you need to do:

- Download and fill out the Pag-IBIG Member’s Data Form (MDF).

- Under the Membership category, mark your appropriate status (in your case, Self-employed).

- Submit the filled-out MDF with your supporting documents to your nearest Pag-IBIG branch.

- Get a payment order form and proceed to the cash division to pay your Pag-IBIG contribution.

Pag-IBIG Requirements for Changing Your Membership.

Besides your MDF, you also need to bring the following when changing your Pag-IBIG membership:

- Two valid IDs (Passport, Driver’s License, PRC License, etc.).

- Your latest Income Tax Return (ITR) with last year’s CPA-certified financial statement.

- Employee Statement of Accumulated Value (ESAV).

- Business Permit or Mayor’s Permit (If you also have a business).

- DTI or SEC registration under your name (If you also have a business).

How Much is My Voluntary Contribution?

Once you’ve updated your membership status, you should determine your required voluntary contributions.

One way to ensure you don’t miss making these payments is to include them in your monthly budget.

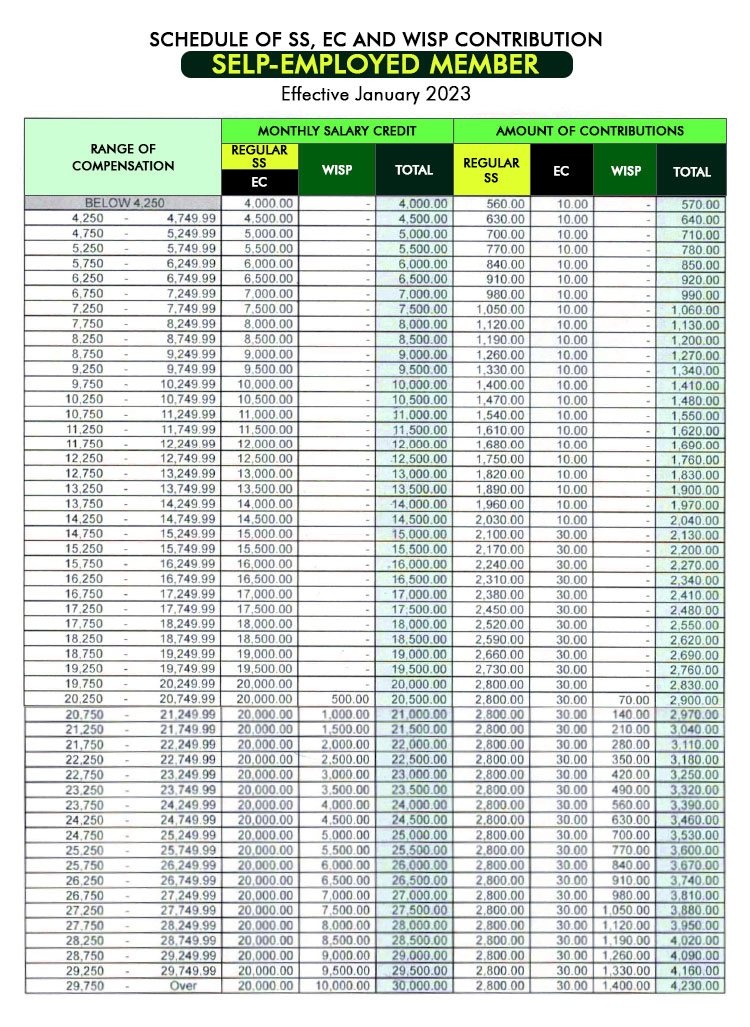

SSS Voluntary Contribution Rates.

Based on the Social Security Act of 2018, the SSS monthly contribution rate for self-employed members is 14% multiplied by your monthly salary credit (MSC).

To determine your MSC, refer to the table for the updated contribution schedule below:

In the contribution table’s leftmost column (range of compensation), look at the range where your monthly declared income falls.

For example, a salary of PHP 25,000 would fall between PHP 24,750 – PHP 25,249.99. You’ll find the corresponding MSC in the rightmost column of the Monthly Salary Credit section.

Using the previous example, let’s say your MSC is PHP 25,000.

To calculate your monthly contribution, you can use this formula:

SSS Monthly Contribution = MSC x Contribution Rate.

Using the above example again: PHP 25,000 x 0.14 = PHP 3,500.

But wait, if you’ve registered to the employee’s compensation program (EC), you’ll have to pay an additional monthly EC contribution of PHP 10 if your MSC is below PHP 15,000 and PHP 30 if your MSC is above PHP 15,000. This program aims to assist workers who suffered sickness or injury resulting in disability while on the job.

Thus, if your contribution is PHP 3,500, it’ll become PHP 3,530.

PhilHealth Voluntary Contribution Rates.

The premium contribution rate for Voluntary/Self-employed workers is 4%, with a PHP 80,000 income ceiling.

Thus, if your salary is PHP 10,000, which serves as the income floor for PhilHealth contributions, you would have to pay PHP 400. And if you’re earning above PHP 80,000, you’ll still only pay PHP 3,200.

To calculate your monthly premium contribution, use this formula:

Monthly Premium Contribution = Declared Monthly Income x 0.04

For example:

PHP 25,000 x 0.04 = PHP 1,000

Thus, if you’re earning PHP 25,000 a month, your PhilHealth premium contribution will be PHP 1,000.

Pag-IBIG Voluntary Contribution Rates.

Pag-IBIG’s monthly contribution rate for self-employed individuals is 1% for individuals whose monthly income is at least PHP 1,000 to PHP 1,500 and 2% for individuals whose monthly income is above PHP 1,500.

Using the contribution rate above, the formula for calculating your Pag-IBIG monthly contribution is:

Pag-IBIG contribution = Monthly Income x Contribution Rate.

Thus, if your monthly income is PHP 25,000, for example:

PHP 25,000 x 0.02 = PHP 500.

Your monthly contribution is PHP 500.

How Do You Pay Your Voluntary Contributions?

Now that you’ve established monthly voluntary contributions, it’s time to determine where you can pay them. You can do so over-the-counter by visiting your nearest SSS, Pag-IBIG, and PhilHealth branches.

However, the more convenient option is paying your contributions via accredited bill payment centers or collecting agents. Note that if you pay through these channels, it may take up to three business days to complete the transaction.

You can also submit your payments through all Bayad Center outlets, SM Bills Payment Centers, and Robinsons Business Centers. Another popular payment method you can use is GCash.

Where Can You Pay Your SSS Voluntary Contributions?

Besides paying over-the-counter, you can also settle your SSS voluntary contributions via partner banks. You can see the complete list here.

If you want to pay over-the-counter, you can do so at the following banks:

- Asia United Bank

- Bank of Commerce

- Bank One Savings Bank

- First Isabela Cooperative Bank

- Partner Rural Bank

- Philippine Business Bank

- PNB Savings Bank

- Rural Bank of Lanuza

- Union Bank of the Philippines

- United Coconut Planters Bank

- Wealth Bank

Other over-the-counter options include:

- Bayad Center

- ECPay

- SM Bills Payment

For online payments, you can use the following sites:

- Bayad Center

- GCash

Before paying your voluntary contributions, you will need a Payment Reference Number (PRN) generated on My.SSS. It’s a unique number that ensures your payment is posted in real-time.

To get your PRN, log in to the SSS portal and click PRN. Select ‘Generate PRN’ and then choose “voluntary” under membership type. Once there, select the applicable period and contribution amount.

After acquiring your PRN, you can log in to your preferred online payment channel to make your SSS payment.

Where Can You Pay Your PhilHealth Voluntary Contributions?

Today, you can pay your voluntary contributions via the PhilHealth Member Portal:

- Go to the PhilHealth Website and click ‘Online Services.’

- Under ‘Member Portal,’ click ‘Register/Login,’ Note that you need a PhilHealth online account to access the payment service. Click ‘Create Account’ to register or continue logging in if you already have one.

- Click ‘Payment Management’ and choose ‘Generate SPA.’ Input the period you’ll be paying for, then the member portal will automatically compute the amount you need to pay.

- Select ‘Generate Statement of Premium Account (SPA).’

- Choose MYEG Philippines as the accredited collecting agent. Follow the ensuing instructions, then click ‘Proceed.’

- You can now settle your PhilHealth contributions via GCash or Credit/Debit card.

- You will then receive a confirmation message after finishing the transaction. To view your official receipt or Electronic Acknowledgement Receipt (ePAR), click ‘View SPA History’ under the ‘Payment Management’ module.

Over-the-counter Partners.

You can also settle your voluntary contributions through these banks:

- Asia United Bank Corporation

- Bank of Commerce

- Bank One Savings Corporation

- BDO Network Bank, Inc.

- Camalig Bank Inc. (A Rural Bank)

- Century Rural Bank, Inc.

- Century Savings Bank Corporation

- China Banking Corporation

- China Bank Savings, Inc.

- CIS Bayad Center, Inc.

- Citystate Savings Bank, Inc.

- Development Bank of the Philippines.

- East West Rural Bank, Inc.

- Land Bank of the Philippines

- Local Government Units (selected LGUs only)

- Money Mall Rural Bank, Inc.

- Penbank, Inc. (A Private Development Bank)

- Philippine Business Bank, Inc.

- Philippine Veterans Bank

- Rizal Commercial Banking Corporation

- Robinsons Bank Corporation

- Rural Bank of Bambang (N.V.), Inc.

- Rural Bank of Jose Panganiban (CN), Inc.

- Rural Bank of Sta. Catalina (NO), Inc.

- Saviour Rural Bank, Inc.

- SM Mart, Inc.

- UCPB Savings Bank

- Union Bank of the Philippines

- United Coconut Planters Bank

Online Payment Methods.

You can also pay online via the following payment channels:

- Bank of the Philippine Islands

- Citibank N.A.

- IPAY-MYEG Philippines, Inc.

- Land Bank of the Philippines

- Security Bank Corporation

- Union Bank of the Philippines

- BancNet e-Gov

Where Can You Pay Your Pag-IBIG Voluntary Contributions?

To settle your Pag-IBIG voluntary contributions online, you must have a virtual Pag-IBIG account. If you already have one, click the ‘Pay Online’ button and select: ‘MP2 Savings (voluntary contributions).’

Under the membership category, select ‘local’ from the drop down menu. Afterwards, type in your Pag-IBIG MID number and name. Input the amount for member savings amount and the period covered.

If you’re paying MP2 contributions, you will be asked to type in your MP2 savings account number.

Regarding payment options, you can pay using your PayMaya e-wallet or Visa/Mastercard/JCB credit card.

Tick the box if you want to receive your payment confirmation via SMS or email, enter your verification code, and then tick the ‘terms and conditions’ box to proceed.

You can also pay your contribution through the following:

- SM Business Service Centers

- SM Hypermarket

- Savemore

- Bayad Center and its Authorized Partners

- LANDBANK

- Metrobank

- ECPay through 7/11 and merchant stores

- M Lhuillier

- CashPinas Moneygment App (Credit to account, DragonPay, ECPay, Paypal, and 7/11 stores)

When Should You Pay Your Voluntary Contributions?

When Should You Pay Your Voluntary Contributions?

To avoid getting fined, you should settle your contributions on or before their due dates:

PhilHealth Contribution Deadlines.

For voluntary contributions, your deadline depends on which payment frequency you choose:

- Monthly: Last working day of the applicable month (for example, if you’re settling premiums for June, your deadline then would be on June 30).

- Quarterly: Last working day of the applicable quarter (for example, if you’re settling your January-March contributions, your deadline is March 31).

- Semi-Annually: Last working day of the first quarter of the applicable semester (for example, for January-June contributions, the deadline is March 31).

- Annually: Last working day of the first quarter of the year. (for example, if you’re paying for January-December’s contributions, your deadline is March 31).

SSS Contribution Deadlines.

You can pay your SSS voluntary contributions either every month or quarter. The due dates are based on the last number of your SSS number:

- 1-2: The tenth(10th) day of the month following the applicable month or quarter.

- 3-4: The fifteenth (15th) day of the month following the applicable month or quarter.

- 5-6: The twentieth (20th) day of the month following the applicable month or quarter.

- 7-8: The twenty-fifth (25th) day of the month following the applicable month or quarter.

- 9-0: The last day of the month following the applicable month or quarter.

For example, if your SSS number ends in 5, your January payment is due on February 20 if you settle monthly. However, if you’re paying for the first quarter (January-March), your deadline would be on March 20.

Pag-IBIG Contribution Deadlines.

You can opt to pay your Pag-IBIG voluntary contributions either monthly or quarterly. The deadline for monthly contributions is on the tenth (10th) day of the following month. So if you’re paying for August’s contributions, your deadline is September 10.

On the other hand, the deadline for quarterly contributions is on the tenth (10th) day of the first month of the next quarter. So, if you’re paying for the first quarter (January-March), your deadline will be in April.

Securing Your Future, Today.

As the Filipino saying goes: “Kapag my isinuksok, may madudukot.” (If you save up, you’ll have something to pull from.)

By applying for voluntary contributions as early as possible, you can rest easy knowing that you have money set aside for a housing loan, health insurance, or pension. Yes, these will make a dent in your monthly salary. But better safe than sorry, right?

Or… you can skip all these steps and work alongside an outsourcing company, like Remote Staff.

With us, you won’t have to worry about your government contributions since we’ll take care of them for you. In addition, our jobs list has a wide range of available positions to choose from and is regularly updated, so you’ll have an easier time job hunting.

Good luck!

Updating Your PhilHealth to Self-employed.

Updating Your PhilHealth to Self-employed. When Should You Pay Your Voluntary Contributions?

When Should You Pay Your Voluntary Contributions?